Steel Secretary Sandeep Poundrik said the EU’s Carbon Border Adjustment Mechanism (CBAM) will impact Indian exports.

CBAM will impose a carbon price on imports from countries with weaker environmental rules, fully operational by 2026.

It initially covers iron and steel, aluminium, cement, fertilisers, electricity and hydrogen.

The tariff is linked to EU-ETS carbon prices, estimated at ₹5,200 per tonne of CO2 in 2026, rising 5% annually.

Indian steel industry relies heavily on the high-emission blast furnace route, making exports vulnerable.

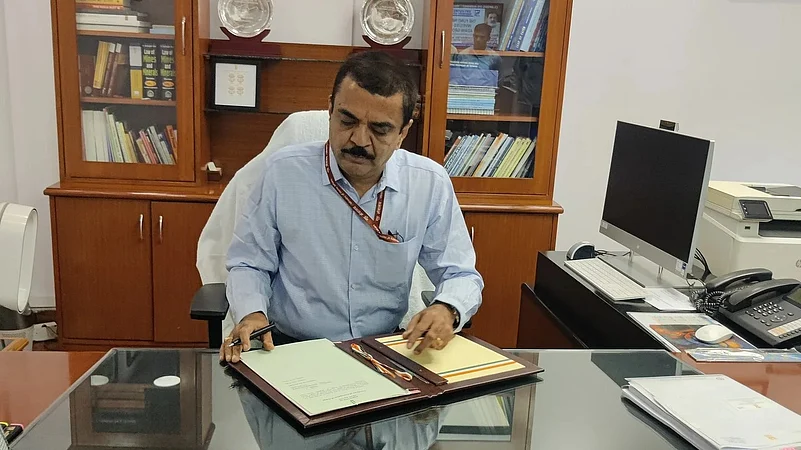

The EU's Carbon Border Adjustment Mechanism (CBAM) will impact Indian exports to the region, and the industry has to take measures to address this "concern", Steel Secretary Sandeep Poundrik said on Wednesday.

The CBAM is designed to impose a carbon price on imports from countries with lower environmental regulations, initially covering iron and steel, aluminium, cement, fertilisers, electricity and hydrogen. This is expected to be fully in place in 2026.

The tariff is pegged to the carbon price in the EU Emissions Trading System (EU-ETS), which in 2026 is assumed at ₹5,200 per tonne of CO2 equivalent, with a five per cent annual rise as free allowances in the EU are phased out.

The limits of carbon emission, which are proposed in the CBAM, will definitely affect the exports, the senior ministry official said in a session at 'FT Live Energy Transition Summit India' in the national capital.

He said the Indian steel industry is still predominantly using the blast furnace (BF-BOF) route, where the pollution or emission is higher. In fact, the new capacities which are being added are still in the BF-BOF route.

"So, that's an area of concern for the industry. There is capacity being added or existing in the electric blast furnace route, which is less carbon intensive. But, CBAM will impact Indian exports to Europe, and Indian industry will have to take measures to address that," Poundrik noted.

Later speaking to PTI, the official said out of the total exports of around 4.5 million tonne, two-thirds is exported to Europe.

His comments assume significance as the government is pushing the industry to take measures to boost steel production and its exports.

In the present scenarios, various countries across the world are protecting their markets in the form of tariffs or regulations.

According to official data, the domestic steel sector accounts for 12% of India's greenhouse gas emissions with an emission intensity of 2.55 tonne CO2 per tonne of crude steel, higher than the global average of 1.9 tonne CO2.

Last year, the steel ministry introduced the definition of green steel with an aim to encourage the industry to bring down carbon emissions.

As per the ministry's taxonomy, green steel shall be defined in terms of percentage greenness of steel, which is produced from the steel plant with CO2 equivalent emission intensity of less than 2.2 tonne of CO2 per tonne of finished steel.

If 1.6 tonne of CO2 or less is emitted in the production of 1 tonne of finished steel, it will be considered 5-star green-rated steel.

On emissions in the range of 1.6-2 tonne, the product will be given a 4-star rating, while those with 2-2.2 tonne of emissions will be rated 3-star.