BoJ raised its benchmark rate by 25 basis points to 0.75%, marking the highest level in three decades.

BoJ Governor Kazuo Ueda said the hike reflects confidence that moderate wage and price growth will be sustained.

The move could have global spillover effects, including yen carry-trade unwinds, currency volatility, and potential foreign fund outflows.

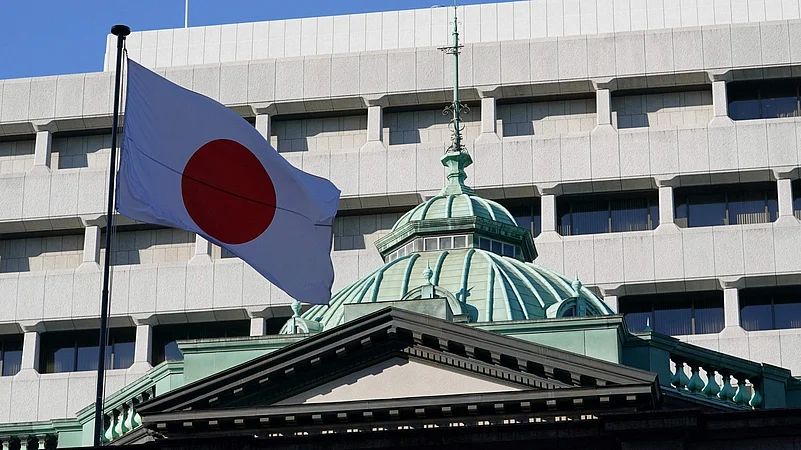

The Bank of Japan (BoJ) raised the benchmark lending rate by 25 basis points, to 0.75%, its highest level in three decades. The move takes the key policy rate to the highest level since 1995, ending an era of interest rates near-or-below-zero to combat deflation. Rising inflationary pressures and improved business sentiment have prompted the Japanese central bank to shift its stance though the Japanese economy shrank 2.3% year-on-year in the previous quarter.

The Japanese central bank decided the rate hike in a unanimous vote, a statement said. The latest monetary policy decision marks the fourth rate hike since Kazuo Ueda took charge as the BoJ governor in 2023. In a statement following the policy announcement, Ueda justified the decision because it was “highly likely that the mechanism in which both wages and prices rise moderately will be maintained.”

The Yen Factor

As per reports, one of the major triggers for BoJ’s policy shift is the persistent weakness of the yen against dollar. The Japanese yen slumped against the greenback amongst major global currencies, making imports including food, fuel, and essential goods expensive. Higher interest rates are expected to strengthen the Japanese currency by attracting more foreign investment into Japanese financial markets. Global investors are keen for better returns on yen-denominated assets.

As per media reports, any further hike in policy rate could influence global markets as Japan served as a source of low-cost capital for investors. A currency strengthens if the key lending rate is raised. A stronger yen would affect currency trends, bond markets, and investor sentiment across global markets.

"Given that real interest rates are at significantly low levels, the BoJ will continue to raise interest rates" if its economic and price forecasts materialise, BoJ said in its statement.