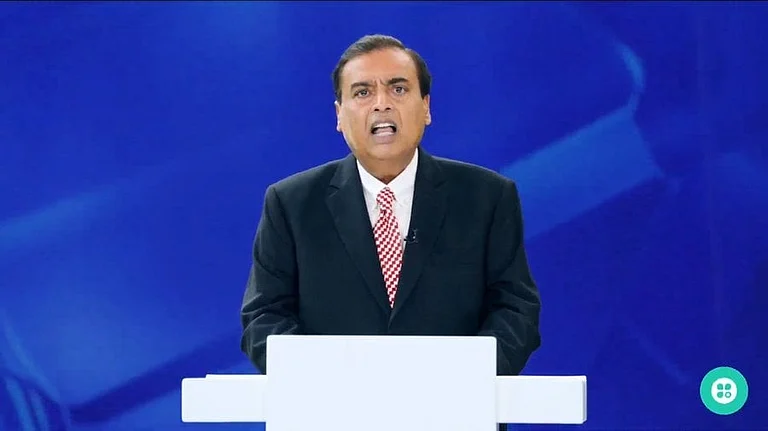

Mukesh Ambani’s Reliance Industries is considering listing its telecom arm, Jio Infocomm, by selling just a 5% stake in a move that could raise over $6-bn (roughly Rs 52,000 crore) and set the stage for one of India’s largest-ever public offerings, Bloomberg reported.

The conglomerate has initiated informal talks with the Securities and Exchange Board of India (Sebi) to seek approval for a lower-than-usual public float, the report said. India’s listing norms typically mandate a minimum 25% public shareholding, but Reliance is arguing that the local market lacks the depth to absorb such a large offering.

If approved, the IPO could hit the markets as early as next year. Even a modest 5% float would eclipse many other listings to make it the biggest IPO in India’s history, leaving Hyundai India’s ₹28,000 crore public offer far behind.

Reliance has long toyed with the idea of taking Jio public. Earlier this month, Reuters had reported that the IPO was off the table for 2025, with RIL said to be waiting for stronger revenue growth, a larger subscriber base, and an expanded digital footprint to justify a higher valuation for Jio, currently pegged by analysts at over $100 billion.

For now, all eyes are now on RIL’s annual general meeting, likely to be held in August, for cues on the listing roadmap. "At the AGM, we expect markets to be tuned in for updates on Jio’s IPO plans, especially in light of a possible delay and ongoing discussions around more flexible listing norms," Citi wrote in a recent report.

Jio Infocomm disrupted India’s telecom market back in 2016 with its ultra cheap data pricing and now commands a customer base of nearly 500 million subscribers, giving it one of the largest user pools globally. The proposed IPO would offer an exit route to major global investors including Meta Platforms and Alphabet’s Google, who together invested over $20 billion into Jio Platforms in 2020, when it was valued at around $58 billion.

However, a 5% float may not sit well with some of these early investors. Bloomberg said the limited offering has already led to frustration among a few stakeholders hoping for a more substantial exit.