Shares of Reliance Industries extended its losing streak to the third session in a row on July 10, falling around 3% during the tenure as investor sentiment dampened amid reports of a delay in the public listing of its telecom arm, Jio Platforms.

According to a Reuters report, the much-anticipated initial public offering (IPO) of Jio is unlikely to take place in 2024, with the company yet to appoint investment bankers to kick off the process. Citing individuals familiar with the matter, the report said that Jio intends to further strengthen its business fundamentals, focusing on revenue growth, expanding its user base, and building out digital services, before taking the company public.

“It’s just not possible this year,” a source told Reuters. “The company wants the business to be more mature before the IPO.”

The news follows earlier delays in the listing of Reliance Retail, which had similarly been viewed as a key monetisation event for the conglomerate. Both moves suggest a strategic recalibration by Reliance Industries as it looks to optimise business readiness and valuation before approaching capital markets.

Jio Platforms, backed by investors including Google and Meta, is widely considered one of India’s most valuable private firms, with analyst valuations ranging between $111 billion (IIFL) and $136 billion (Jefferies). Roughly 80% of its ₹1.47 lakh crore annual revenue stems from its telecom business, while its newer digital and AI-driven ventures are being steadily scaled up. Jio is also working with Nvidia to build AI infrastructure within India, as part of a broader push into next-generation technologies.

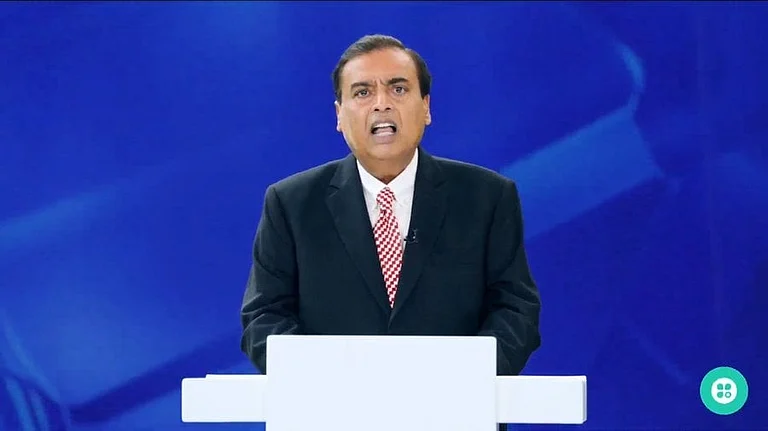

Back in 2019, Ambani had signalled that Jio would move towards a listing within five years, a timeframe that fuelled expectations for a blockbuster IPO in 2025. However, with the core telecom business facing headwinds such as subscriber churn following recent tariff hikes, the company appears to be taking a more cautious approach.

Separately, the listing of Reliance Retail, India’s largest retail operator is also understood to be postponed until at least 2027 or 2028. As reported by The Economic Times, internal operational challenges such as lower-than-expected earnings per square foot have prompted the group to push the retail IPO timeline.

To streamline operations ahead of any public listing, Reliance is undertaking a major restructuring of its FMCG play. According to The Economic Times, it has carved out all its consumer brands under a new direct subsidiary named New Reliance Consumer Products (New RCPL). This new entity will house products priced 20–40% lower than incumbent rivals and offer higher trade margins to attract retailers and scale up the business nationally by March 2027.

So far, over 60% of FY25 FMCG sales have come through traditional kirana stores, with RCPL’s products now available in over a million outlets via a network of 3,200 distributors.

Despite raising over $25 billion in recent years from marquee global investors including KKR, ADIA and Silver Lake, Reliance appears in no rush to float either of its flagship consumer units. While the IPO ambitions remain intact, the group is recalibrating its strategy to ensure stronger fundamentals and sustained performance before seeking public listings.