Bank Q4 Results: Major banking stocks, including ICICI, HDFC and Yes Bank, will remain under watch tomorrow as investors react to the Q4 earnings. While all three domestic lenders have reported a rise in net profit levels, asset quality remained a mixed play.

Yes Bank stood out with a strong year-on-year net profit surge of around 63% for the quarter ending March. However, its net interest margin witnessed only a minor surge to 2.5%, up from 2.4% reported in the corresponding quarter of the previous fiscal year. Meanwhile, HDFC Bank witnessed a 6.9% rise in its consolidated profit levels on YoY basis.

As for the second largest private lender, ICICI Bank witnessed an 18% YoY surge in net profit levels, which stood at Rs 12,630 crore. The banking firm also witnessed a marginal rise in NIM at 4.41% in Q4, compared to 4.25% in the previous quarter.

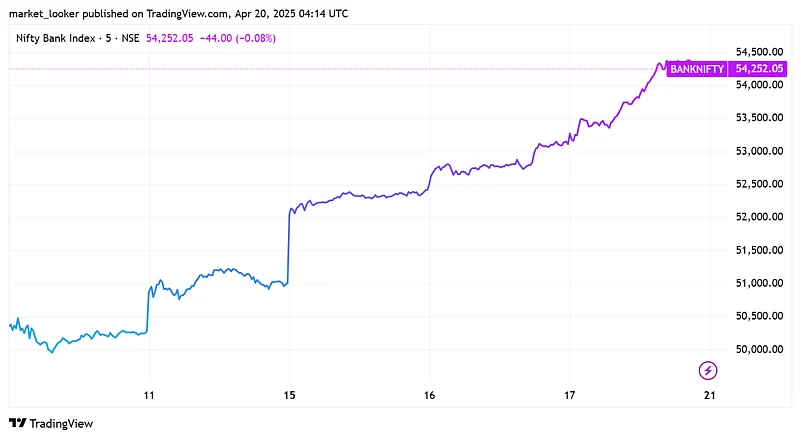

Last week, Nifty bank was among the best-performing sectoral indices, surging by more than 4% in just 3 trading sessions. Nifty50, on the other hand, increased by over 2% amidst a broader market rally. On year-to-date basis, the banking index has surged over 3,229 points or 6.3%, trading above the 54k level mark.

Major banking stocks will remain in focus across D-street on April 21. While profits remained relatively healthy, the asset quality of major lenders remained mixed.

Asset quality of Major Banks

Yes Bank showed a slight improvement in asset quality, with its gross NPA ratio easing to 1.6% as of March'25 compared to 1.7% a year ago. The net NPA ratio came down to 0.3%, compared to 0.6% recorded in the corresponding period of the previous fiscal.

HDFC Bank, on the other hand, experienced a mild uptick in stress. The bank's gross NPAs stood at 1.33% of total advances as of March 31, 2025, slightly higher than 1.24% a year earlier.

Meanwhile, ICICI Bank reported a steady improvement, with its gross NPA ratio declining to 1.67% in Q4FY25 from 1.96% reported in the previous quarter. Net NPAs also improved to 0.39%, down from 0.42% sequentially.