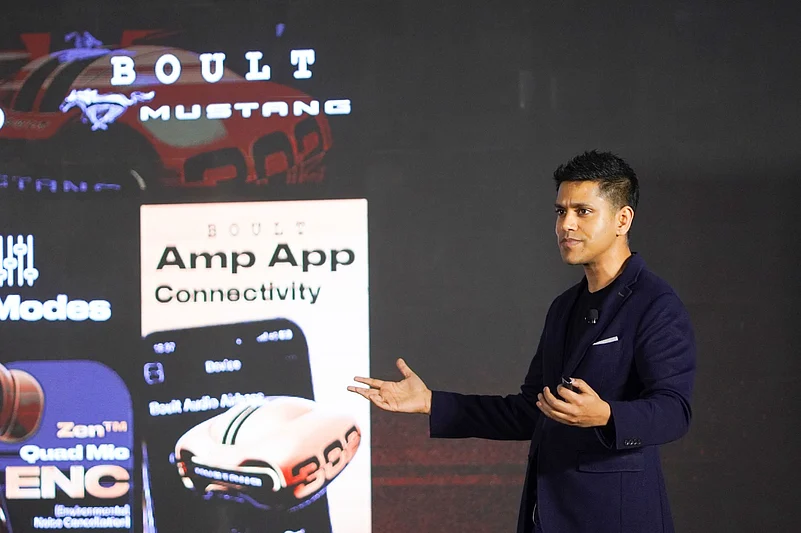

Wearables brand Boult Audio on Wednesday launched three limited edition audio products in collaboration with Ford Mustang. The second largest audio company and third largest wearable player in India recorded a 36% year on year growth in its TWS (true wireless stereo) segment in third quarter.

On the sidelines of the launch, Boult Cofounder and CEO Varun Gupta talked to Outlook Business about the company’s IPO plans, competition from Chinese firms and a need for the government to support Indian wearables brands. Edited excerpts:

You have launched these products in India only. What are your plans for the international markets?

We are focusing on the US and the UK. India is (currently) known for its IT and services companies, but not for consumer hardware brands. We want India to be known as a manufacturer, not just Make in India, but make for India and make from India.

Government is pushing for localization in manufacturing. How does Boult is ensuring domestic value addition in its products?

The biggest (local) value additions come before the manufacturing process. Number one is the product design. We design all the products by ourselves, in house. We have an enormous product and industrial design team. We have 3D printers. We build up and own our own molds, the molds from which the plastics and the products are produced.

Second is the technology that we work on. The technology and the IP is our own.

We do 20 to 25% of manufacturing by ourselves, in our own factories. So we take all of that learnings and give it to our contact manufacturing partners, where they manufacture these products for us.

And lastly is the raw material sourcing. About 30 to 35% of the raw materials are sourced in India, which is rubbers, silicons, plastics, some part of batteries and some products. We also do SMT (semiconductor mounting technologies) through our partners.

And lastly, through packaging, charging cables and all other paper materials, etc.

Having said that, some technical components like PCBs, semiconductors and audio drivers are still sourced from international geographies.

So the idea is to increase local purchase of raw materials as a percentage. Already we are assembling and manufacturing more than 99% of the products in India. So we want to reduce the dependence of sourcing raw materials from international geographies, or increasing the raw material sourcing from India.

What are the geographies that dominate your imports?

Most of our imports right now come from China, the biggest supplier of semiconductors and PCBs and drivers. We do not purchase finished goods and complete ready made goods from China.

Last year, you were planning to achieve a revenue of Rs 1000 crore in FY25, a threshold for the IPO. But now you have reduced the revenue estimate to about Rs 800 crore. How will it impact the IPO plan?

So this year (FY25), we will close at over Rs 800 crore business in our books. Having said that, in terms of gross merchandise value, we're already Rs 1000 crore plus. We are looking at our book value next year at over Rs 1000 crores.

Right now, we are doing the prep work for an IPO. When we will get ready in terms of the top line, revenue and financially, and when all of the other prep work is ready, we will be going for an IPO.

Also, we do see some one of our competitors (BoAt) also going for an IPO. So we'd love to wait and watch how the market responds to that. If it is seen and received well, then it also paves the way for us.

A lot of Chinese brands are coming into the Indian wearables market. So how do you see that competition?

As per an IDC report, we were the fastest growing brand, both in terms of audio and smartwatch. We do see players like Realme, as per IDC, have grown but it's from the same BBK group as the Oppo, OnePlus and Realme. However, the Oppo and OnePlus family have degrown, while the Realme family has grown. So their entire pie has not grown so much.

Having said that, all of these Chinese firms are smartphone first players. So their focus on audio and accessories as a category is very less. They do have one or two launches in every sub-category. Their product launch times are very slow. They do not understand the Indian market as much, so they're just trying to play out two key factors. One is cost, and second is the brand positioning, or the relatability with the smartphone brands.

Some loyalists from their own smartphone consumer base do end up buying their products. But all the other new consumers, who a have pride in Indian brands and their trust in them, do not. They want an audio first company, not a smartphone first company. They still hold a lot of trust in people like us.

Are you seeking any support from the government for local manufacturing?

There is PLI for smartphones. We're pushing the government to start introducing the PLI scheme in the wearables category. We also want to push the government to discourage Chinese companies dumping in India of their unsold or bad inventory. So once we're able to iron out these two small issues, we will see the Indian manufacturing ecosystem growing and overall domestic consumption and domestic raw material sources also increasing.

How has the government responded to your concerns?

Overall, we've seen a huge push for domestic manufacturing, but PLI has not been approved yet. We're hopeful that a PLI scheme, and possibly anti-dumping duties (on Chinese imports), might come in. But PLI is a bigger game changer for us as a wearables company.

How is quick commerce playing out for you in raising sales?

Quick commerce is a big upcoming challenge for us, and a huge focus area for us. It has increased the overall (sales) pie. It is not cannibalizing on the ecommerce sales marketplaces. So we do see a huge amount of value in being unlocked in terms of fast 10 minute deliveries, in which players like Amazon and Flipkart have also stepped in.

Flipkart has stepped in with its Flipkart minutes. It's not just Blinkit and Big Baskets and

Consumer demand is also increasing because of the faster delivery time. So that is giving us a lot of growth. But right now, it (sales through quick commerce) is focused in tier one geographies, and soon we will see that moving to tier two and three cities.

What is the share of quick commerce in terms of total sales? And what are you targeting ahead?

So right now, it is about 10% but we see that moving to about 20% in the next 18 months. And if Amazon and Flipkart really start betting big, then we will see that to move to about 30 to 35% as well.