National Telecom Policy 2025 aims to double telecom’s GDP contribution by 2030 with ₹1 lakh crore in annual investment

It calls for a boost in exports, telecom start-ups, and R&D, and seeks to create 1 million new jobs

While the industry welcomes the growth vision, it warns that the new rules may increase compliance burdens

The Centre’s Department of Telecommunications on July 23 released the draft of the National Telecom Policy (NTP) 2025 for public consultation. The 21-page policy document, which aims to double the sector’s GDP contribution by 2030, calls for ₹1 lakh crore ($12bn) in annual infrastructure investment. It targets a twofold increase in telecom exports, start-ups and R&D spending—particularly in emerging technologies. The plan also seeks to generate one million new jobs, upskill another million workers, enhance telecom infrastructure security through quantum-resistant cryptography and reduce the sector’s carbon footprint by 30%.

While experts and industry participants have praised the intent of the policy document, some are already flagging additional layers of compliance burden the policy might impose on smaller telecom firms.

“The draft NTP 2025 is an ambitious blueprint that seeks to dismantle outdated regulatory scaffolding that has been slowing India’s telecom sector. It addresses long-standing issues like fragmented licensing, spectrum bottlenecks and infrastructural roadblocks,” said Rishi Agrawal, chief executive and co-founder of Teamlease Regtech, a cloud-based compliance management software provider.

He added that while the policy expands compliance to telecommunication identifier user entities (TIUEs) like fintechs and OTT players, “while well-intentioned, these add a compliance layer that smaller players may struggle to meet”.

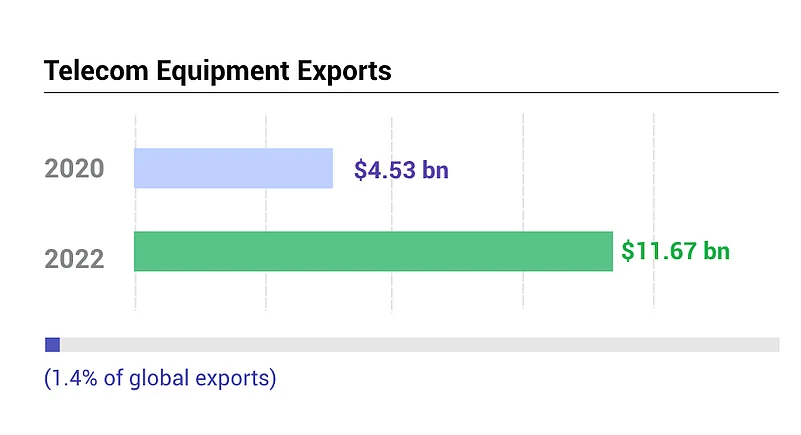

Before getting into the nitty-gritty of these new compliance norms, it is worth examining where India's telecom sector stands. While the exact estimate of the telecom sector's contribution to Indian GDP is not public, data shows its share in India's trade has grown over the years. According to the Economic Survey 2024–25, India exported $11.67bn worth of telecommunication and sound recording and reproducing apparatus and equipment in 2022 (latest available data); this was about 1.4% of total global exports in this category—a sharp surge compared to 2020, when India exported just $4.53bn worth of such equipment.

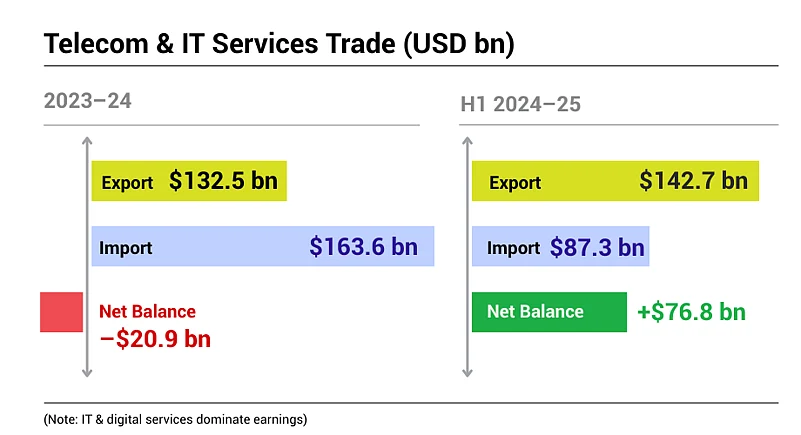

Further, data shows that in 2023–24, India’s telecommunications, computer and information services earned about $132.5bn from overseas clients, while spending about $163.6bn on similar services, leading to a net outflow of $20.9bn for the year. In the first half of 2024–25 (April to September), earnings surged to $142.7bn, with spending at just $87.3bn, giving the country a net surplus of $76.8bn from these services. Though IT services and digital services make up a large part of these exports.

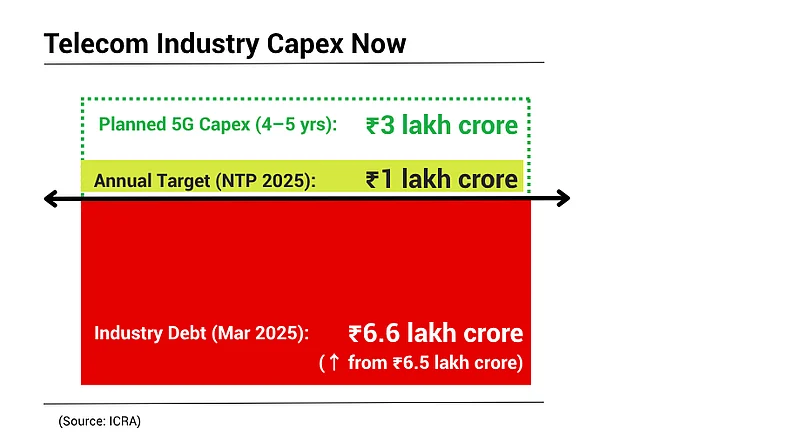

The Indian telecom industry, dominated by a few large players like Bharti Airtel, Reliance Jio and Vodafone Idea, grew by 12–14% to ₹3.2–3.3 lakh crore in 2024–25, according to ICRA. Over the next four to five years, the credit agency expects industry players to spend three lakh rupees crore on expanding their 5G network as capital expenditure. It appears the industry is already geared up to meet NTP 2025’s one lakh crore rupees annual investment target.

But there is a caveat. ICRA noted that this vast capex will add to the total debt of the sector. As of March 2025, the industry’s debt had reached a massive ₹6.6 lakh crore, up from ₹6.5 lakh crore a year ago.

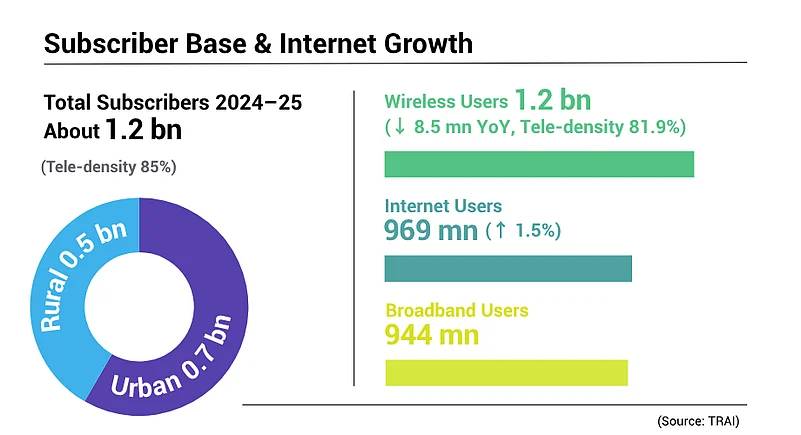

According to the latest report by the Telecom Regulatory Authority of India, the nation’s telephone subscribers rose slightly from 1.2bn in 2023–24 to just over 1.2bn in 2024–25, while overall tele density fell to 85%. Urban subscriptions edged up to 0.7bn and rural to 0.5bn, though both saw density declines as companies hiked subscription prices last year.

Wireless (mobile) users dropped to 1.2bn, with 8.5mn subscribers lost over the year, and wireless tele density fell to 81.9%. In contrast, internet subscriptions increased 1.5% to 969mn, with 944mn broadband users forming the bulk.

What New Telecom Policy Aims to Achieve?

Among the six goals outlined in the NTP 2025, the first one aims to provide universal high-quality connectivity by covering the entire population with 4G and 90% with 5G by 2030, connecting all gram panchayats and government institutions with fibre and raising tower fibreisation to 80%. The plan targets 10 crore households with fixed broadband, 1mn public Wi-Fi hotspots and a supportive framework for satellite and non-terrestrial networks to reach underserved areas. It also focuses on improving indoor and outdoor network quality, setting stringent quality standards, ensuring network resilience through submarine cables and achieving a top 20 global ICT ranking.

To achieve this, the DoT plans to focus on using the Digital Bharat Nidhi (DBN) scheme to connect underserved rural, remote and urban areas, boosting fixed-line broadband and public Wi-Fi and leveraging BharatNet, optical fibre and GIS mapping to improve last mile connectivity. It also promotes hybrid access via mobile, satellite, Wi-Fi and fixed lines.

The DBN scheme was part of the Telecommunications Act 2023, essentially replacing the earlier Universal Service Obligation Fund, to bridge the digital divide across India. A Lok Sabha reply shows that from 2020–21 to 2024–25, DBN-funded projects in the Northeast have connected over 90% of border villages, covering more than 4,696 habitations with mobile network using ₹1,775.5 crore.

The second mission of the policy on innovation aims to position India among the top 10 global hubs for telecom innovation and research in emerging areas like 5G, 6G, AI, IoT and quantum communication. It targets achieving 10% of global 6G intellectual property rights, creating a Section 8 innovation company and transforming C-DOT into a world-class R&D institution. The plan also includes supporting 500 tech start-ups and MSMEs, establishing 10 centres of excellence, co-creating use cases such as digital twins and collaborating with global standards bodies. India also seeks to deploy indigenous advanced telecom technologies to at least 10 countries to strengthen its global presence.

“By aligning telecom infrastructure with innovation, cybersecurity and domestic manufacturing, the policy not only targets universal connectivity but also aims to make India a net exporter of telecom technology and IP. It is a strategic leap toward digital sovereignty and global competitiveness,” said Shailesh Sapale, co-founder and chief revenue officer of Trezix, a trade-tech start-up.

Push for Domestic Telecom Equipment

Another goal of the NTP 2025 is to increase India’s telecom manufacturing output by 150% and achieve 50% import substitution through design-led and localised production. It includes creating a telecom manufacturing zone, building a complete supply chain and setting up 30 advanced research labs in top institutions.

Point to note: under the Production-Linked Incentive (PLI) scheme, the telecom sector clocked ₹80,927 crore in PLI-driven domestic sales by March 2025, with ₹14,915 crore worth of exports.

“That shows India is already moving from importing gear to making and exporting it,” says Chitranjan Singh, founder and chief executive, Ananant Systems, which makes chips and secure wireless communication systems.

At the same time, India has deployed nearly 4.7 lakh 5G base transceiver stations (BTS) in just 22 months, covering 99.6% of districts. This network now supports a mobile subscriber base of 116 crore as of early 2025. At such a scale, the demand for local semiconductors and telecom hardware is not just rising—it is exploding. “What this really means is that a ₹1trn push will fuel domestic manufacturing of core systems,” he added.

In 2023, electronics and IT minister Ashwini Vaishnaw said that almost 80% of the equipment used in the 5G rollout was made in India.

Now to further incentivise manufacturing, NTP 2025 suggests providing capex and opex support for telecom software development and encouraging operators to adopt indigenously designed and manufactured equipment. The plan also aims to promote “Made in India” telecom products globally through branding and quality assurance, attract investments in partner countries using lines of credit and improve export competitiveness by simplifying regulations and certification processes.

According to experts, the move would boost local gear makers such as Tejas Networks, HFCL, STL and level the playing field with global manufacturers like Nokia, Ericsson, Samsung and Cisco.

“The newly introduced policy also creates significant opportunities for infrastructure investors, start-ups, equipment manufacturers and service providers. Its success, however, will hinge on effective and collaborative implementation,” said Akhilesh Tuteja, partner and national leader – technology, media and telecommunications (TMT), KPMG India.

Skilling the Gap

The push to create one million direct and indirect jobs in the telecom sector under the policy is a “bold and welcome move”, as per Nipun Sharma, chief executive of TeamLease Degree Apprenticeship; however, it demands an equally bold response in talent readiness, she says.

“While the telecom sector gears up for expansion, the pressing question is: who will fill these jobs? Only 54% of Indian graduates are employable, largely due to a mismatch between academic learning and industry needs. Add to that, the impact of AI is fundamentally reshaping job roles—requiring a blend of technical, soft and digital skills,” Sharma says.

NTP also calls to set up an Indian Institute of Telecom Technology to develop industry-ready talent and the Telecom Sectoral Skill Council to enhance workforce capabilities.

Spectrum, Security, Scrutiny

The Telecom Policy 2025 also calls for making spectrum management faster, more efficient and better aligned with industry needs. It plans to cut the time for spectrum authorisation and allocation by 50%, increase the use of spare optical fibre backhaul by 40% and re-farm underutilised spectrum for telecom services.

The policy encourages spectrum sharing, leasing, trading and secondary usage to maximise efficiency. It also proposes regular spectrum audits of central and state government entities and PSUs, delegation of frequency assignments to regional levels for faster approvals and the creation of a dynamic National Spectrum Roadmap updated every two years in line with global International Telecommunication Union standards and market requirements.

“Processes for spectrum assignment and right of way (RoW) approvals have been earmarked for streamlining with stated goals like halving grievance redressal timelines and improving ease of deployment. Additionally, the policy introduces experimental authorisations for emerging technologies such as 5G, 6G and IoT, enabling innovation with minimal red tape and proposes a flexible framework for non-terrestrial networks (NTNs) to support satellite communications. These are clear wins for compliance rationalisation,” says Agrawal from Teamlease Regtech.

However, he points to goals outlined in the Secure and Trusted Network mission.

“The policy veers into a space where new complexities emerge. It introduces new procedural obligations, especially around cybersecurity. The rules expand compliance to Telecommunication Identifier User Entities (TIUEs) like fintechs and OTT players, mandating uniform data security standards, incident reporting, IMEI validation and Mobile Number Verification (MNV) protocols,” he said.

The policy calls for strengthening telecom security and preventing misuse of network resources. It aims to create strict regulatory frameworks to stop the misuse of telecom identifiers like IMEIs (a unique 15-digit number assigned to every mobile device with a cellular connection) and curb unsolicited commercial communication or spam. It also includes analysing telecom equipment to identify and segregate non-trusted sources, engaging with telecom operators, law enforcement and financial institutions to prevent cybercrime and introducing mobile number validation services to protect sectors like banking, insurance, social media and e-governance from telecom-based frauds.

The moves aim to reduce response times for telecom cybersecurity incidents by 50%, conduct regular network audits and closely monitor both border and satellite communications to prevent unauthorised access or interference.

However, according to Amitraj Kaushal, advocate at Supreme Court of India, the policy faces criticism for its executional ambiguity and over-reliance on private operators without proportionate public safeguards.

“The lack of granular implementation frameworks, especially around rural inclusion and data privacy, may dilute its transformative promise. Moreover, high spectrum pricing and delayed rollout incentives deter smaller players, risking monopolistic trends,” he notes.

He notes the success of NTP 2025 would depend not just on vision but also on enforcement, equity and agility.