Demand for AI-skilled talent in India is soaring, with companies willing to pay top salaries.

A TeamLease Digital report shows senior AI/GenAI, cloud, data, and cybersecurity roles can fetch up to ₹60 lakh per annum.

But there is a huge skill gap that persists for in-demand roles.

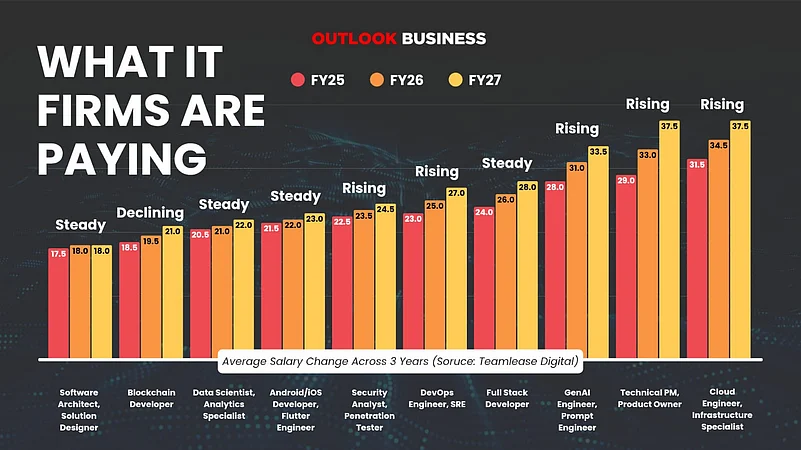

Salary growth is also strongest in innovation-linked roles (AI, MLOps, Cloud) with over 18% CAGR in 3 years.

Demand for employees highly skilled in artificial intelligence has surged among Indian companies. They are ready to hire and pay more for specific roles like GenAI Engineer, Natural Language Processing (NLP) Specialist, Machine Learning Operations (MLOps), Cloud Architect, Infrastructure Engineer and Cybersecurity Analyst. But there is a huge skill gap that persists for in-demand roles.

A new report by staffing firm TeamLease Digital claims that enterprises are ready to pay as much as ₹60 lakh per annum for senior roles related to fields like AI/GenAI, cloud, data engineering, and cybersecurity. But there is a 40% to 53% talent gap.

"AI, cybersecurity, data engineering, and devOps are now sector-agnostic capabilities, with BFSI, healthcare, retail, and manufacturing driving demand. In contrast, roles in IT support, legacy Systems, and low-code are facing stagnation, prompting re-skilling and portfolio realignment," the report says, adding that tech hiring in BFSI, manufacturing, and retail is growing faster than in IT Services.

Meanwhile, the report titled Digital Skills & Salary Primer also notes that high growth in salaries is concentrated around innovation-aligned roles—AI, MLOps, Cloud—where the 3-year compounding annual growth rate exceeds 18%. Meanwhile, operational roles like full stack, devOps, and API are maturing, showing slower hikes and signalling a shift in enterprise investment priorities.

AI Skill Mismatch

This comes as the Indian AI market is projected to reach $28.8 billion by 2025, with a 45% CAGR. However, this growth comes with a severe talent shortage: for every 10 open GenAI roles, only one qualified engineer is available. By 2026, the AI talent gap is expected to reach 53%, while cloud computing is projected to face a 55–60% demand-supply mismatch. Without scaled-upskilling initiatives, enterprise ambitions risk being constrained.

The TeamLease report is based on an analysis of 30,000 tech and digital roles.

Post the first quarter earnings, several IT industry leaders talked about skill mismatch they have been facing in their workforce. Even TCS CEO K Krithivasan, while announcing layoff of 2% of its workforce, said, "This is driven by where there is a skill mismatch or where we think we have not been able to deploy someone.”

Talking to a media portal, he noted that AI productivity gains, which are just 20%, are not to blame for the cutting of over 12,000 employees.

Meanwhile, HCL Tech, the Noida-based top-tier IT giant, also announced that it would be hiring specialised workforce with "niche capabilities in data, AI, cyber and enterprise technology."

Talking to reporters during the Q1 press brief, HCL's Chief People Officer Ramachandran Sundararajan said that about 15%–20% of this year's fresher intake is expected to fall into the premium skill category and will be subject to candidates meeting company standards.

Meanwhile, traditional jobs like IT Service ManagementSpecialist, IT Operations Analyst, Mobile App Developer, Web Developer, Enterprise Resource Planning (ERP) Consultant, and Customer Relationship Management (CRM) Specialist have seen a decline in demand, as per the new TeamLease report.

"India’s digital economy is projected to grow twice as fast as the country’s overall economy and contribute one-fifth of GDP by 2029-2030, representing a global leadership opportunity, provided we address the 60% talent gap in AI domains and the 55–60% demand-supply mismatch in cloud computing, which remain critical constraints,” says Neeti Sharma, CEO of TeamLease Digital.

Saurabh Gupta from HFS Research, in his newsletter on July 29, wrote that recent IT layoffs are not just short-term adjustments.

"This is structural demand compression for commoditised skills. And while entry-level hiring remains stable—the bar is rising. Today’s freshers are expected to come AI-ready, GenAI-fluent, and hungry to build—not just maintain," he said.

He added that an analysis of over 200 IT services companies (including GCCs) confirms a decisive talent shift across the global services ecosystem, with AI specialists, product managers, and design thinkers in demand, while roles such as generalist developers, middle-tier engineers, and transactional jobs like app maintenance, L1 support, and back-office processing are declining.

Where Are the AI Jobs

The report says, while the IT sector, the nation’s largest private sector employer, would hire over 150,000 freshers during FY26, the new breed of outsourcing sub-sector, Global Capability Centres (GCCs), are expected to be at par with them soon.

GCCs are expected to contribute over 22–25% of net new white-collar tech jobs in 2025. This means over 1.2 million of the 4.7 million new tech jobs by 2027 will be generated by GCCs across domains like GenAI and ER&D.

And they are projected to onboard over 400,000 freshers by 2030 as they expand into Tier-2 and Tier-3 engineering campuses.

Last financial year alone, they hired 130,000 to 140,000 fresh hires.

As of now, India is home to over 1,760 GCCs employing 2.16 million people, but by 2027 this number is expected to reach 3 million with over 2,100 GCCs.

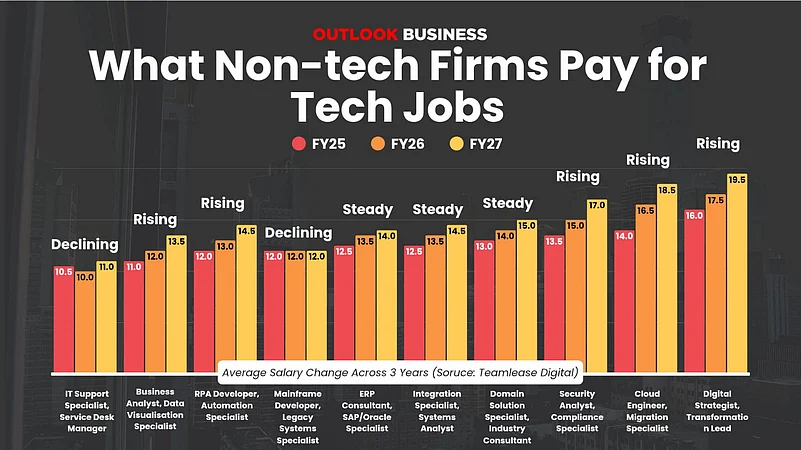

Meanwhile, the TeamLease Digital report also says that technology roles in non-tech sectors are expected to grow at a 12% CAGR between 2025 and 2028, fuelled by ERP modernisation, RPA, cloud migration, and cybersecurity. BFSI, retail, healthcare, manufacturing, logistics, and telecom are emerging as key recruiters for AI, cloud, cybersecurity, and full-stack development talent. Sector-wise, automotive and manufacturing are set to see rising demand for AI, sensors, and automotive software as ADAS adoption expands, even as only 30% of vehicles in India are projected to have self-driving features by 2030.

India’s semiconductor industry is expected to double from $54 billion in 2025 to $108 billion by 2030, backed by AI, data centres, and PLI schemes. BFSI’s digital transformation is projected to grow from $108.5 billion in 2025 to $419.45 billion by 2034, while retail and e-commerce could expand from $165 billion in FY26 to $345 billion by FY30. The health-tech sector is forecast to grow at 26% CAGR, reaching $50 billion by 2033.

How Much Do New Roles Pay

Among the fastest-growing roles, Product Management stands out, with senior professionals likely to command salaries of up to ₹42 LPA by FY27, as organisations shift towards product ownership and customer-centric innovation.

Cloud Computing roles remain critical, with salaries forecast to rise from ₹31.5 LPA in FY25 to ₹37.5 LPA by FY27, a growth of 19%, underscoring the sector’s pivot towards scalable cloud-native delivery models. Meanwhile, Generative AI roles are gaining strong traction, with senior-level salaries increasing from ₹28 LPA to ₹33.5 LPA between FY25 and FY27.

"While DevOps and Software Architecture continue to earn respectable senior salaries (₹33–45 LPA), YoY growth is showing signs of plateauing — with about 3% annual hikes by FY27. This suggests that while still critical for hybrid infrastructure and delivery ops, these roles are no longer the fastest-growing as AI-led roles take precedence," the report says.

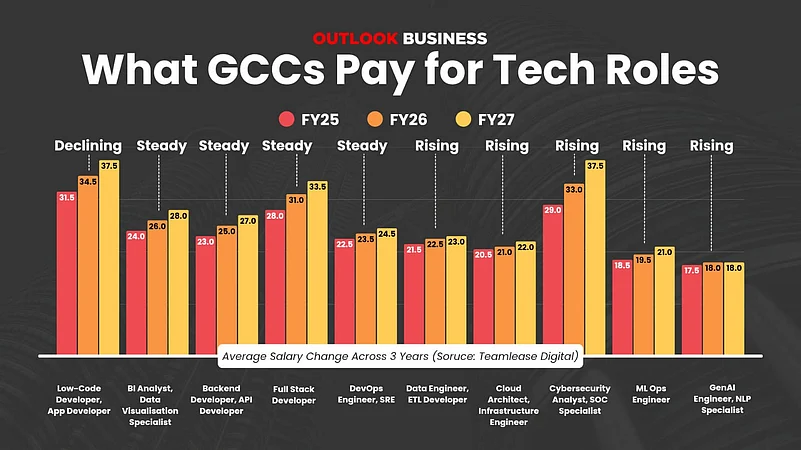

Over at GCCs, Generative AI Engineering and MLOps are setting new salary benchmarks, with senior talent earning ₹58–60 LPA and YoY increases exceeding 18% annually. Salaries in Cybersecurity (₹28 to ₹33.5 LPA) and Data Engineering (₹23 to ₹27 LPA) are also expected to grow steadily over FY25 to FY27. Skills like Full Stack, API & Microservices, and DevOps continue to offer stable mid-career salaries (about ₹22–26 LPA), but YoY salary growth is now tapering off to 2–3%.

"These roles are transitioning from high-premium innovation anchors to operational mainstays, as GCCs prioritise scalable and modular AI-first architectures over legacy-heavy delivery stacks," the report says.

In the non-tech sector, roles in digital transformation are projected to grow from ₹16 LPA to ₹19.5 LPA from FY25 to FY27, while Data Analytics is forecast to increase from ₹11 LPA to ₹13.5 LPA over the same period. Cloud Solutions and Cybersecurity remain the highest-paid functions at senior levels, with professionals having over 8 years of experience earning ₹30 LPA and ₹28 LPA, respectively.

Conversely, legacy systems maintenance exhibits complete salary stagnation, remaining flat at ₹12 LPA from FY25 to FY27, while IT Support demonstrates minimal growth, increasing from ₹10.5 LPA to ₹11 LPA over the three years, reflecting a shift towards cloud-native and outsourced service models.