Honasa Consumer returned to profit in Q2 FY26 with ₹39.2 crore, driven by 17% volume growth and margin discipline

Analysts remain divided on the stock, with targets ranging from ₹250 to ₹450

The company’s next challenge is proving that its turnaround is sustainable amid evolving competition and expansion into new premium segments

Honasa Consumer, the parent company of beauty brands like Mamaearth, Acqualogica, and The Derma Co, delivered a sharp rebound in the second quarter ended on September 30, 2025. The company posted a consolidated net profit of ₹39.2 crore in Q2 FY26, reversing a loss of ₹18.6 crore a year ago.

Its revenue from operations rose 16.5% year-on-year to ₹538.1 crore in Q2 FY26, compared to ₹461.8 crore in the same quarter previous year. However, the number declined 10% QoQ from ₹595.3 crore. The company’s total income, include other income of ₹20.1 crore, stood at ₹558.2 crore.

The company’s total expenses remained flat at ₹505.5 crore year-on-year. And its tax expenses for the quarter stood at ₹13.5 crore as against a tax credit of ₹5.8 crore in the year-ago quarter. Honasa, meanwhile, reported an EBITDA of ₹48 crore during the quarter against an EBITDA loss of ₹31 crore in the year-ago quarter. Its EBITDA margin improved to 8.9% during the same period.

The company’s stock price surged up to 9% on Thursday after it swung back to profitability in the September quarter. The shares opened 6.36% higher and went on to hit an intraday peak of ₹308.20 on the NSE before trimming some gains to around ₹295 apiece by 10.15 am.

The pivot from losses to profitability came at a time when the broader beauty and personal care (BPC) sector is navigating sluggish demand, rising input costs, and margin pressures. But this raises a question on whether this rebound is a momentary uptick or sustained structural shift.

Drivers Behind the Profit Turnaround

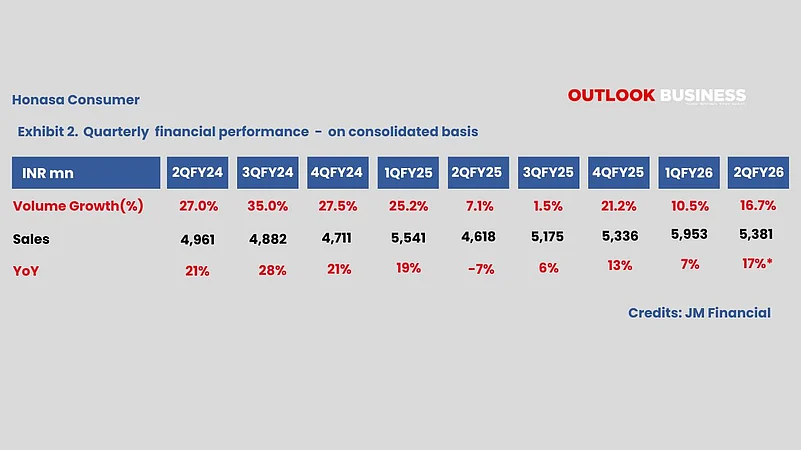

The improvement in Honasa’s financial results looks multi-faceted. The company’s underlying volume growth in Q2 remains strong at 16.7%, which shows the resilience and volume-led growth of the core business.

It also credits double-digit growth in its “younger brands” (BBlunt, Aqualogica, Dr Sheth’s & Staze) which grew 20% YoY. In addition, Mamaearth’s primary sales returned to growth (low-single digits) after inventory and base affect were adjusted.

"Our focus categories continued to contribute over 75% of total revenues, reaffirming the success of our category-first strategy. Deeper distribution and brand-building efforts have enhanced consumer engagement across India," said Varun Alagh, chairman and CEO & cofounder of Honasa Consumer.

In addition, Honasa’s cost and margin discipline also show up in the numbers as the company maintained consistency in expenses, which allowed operating leverage to kick in. The shift in settlement terms by major ecommerce marketplace Flipkart was also disclosed by the company, but it claims no corresponding hit to profitability.

The company’s top line saw ₹28 crore revenue recognition impact due to change in settlement by Flipkart. It has recently altered its settlement structure for marketplace sellers. Instead of recording fulfilment and logistics costs expenses on the seller’s books, the ecommerce giant now deducts these directly from the revenue payable to them.

Since a significant portion of Honasa’s sales come from ecommerce marketplaces like Flipkart, the company was directly affected by this accounting change. On a comparable basis, Honasa said its revenue grew over 22% during the quarter, adding that the adjustment had “no impact on absolute profitability”.

The beauty and personal care firm also noted that its e-commerce and modern trade channels delivered strong double-digit growth, while general trade performance remained relatively subdued.

Analysts Split on Honasa Consumer Stocks

Brokerage firms gave mixed views on the stock, with some maintaining ‘buy’ rating while others are giving it ‘sell’ rating. On the bullish side, Jefferies has reiterated a “Buy” rating with a target price of ₹450, while noting that “business momentum is strengthening with a 17% volume-led growth and notable margin improvement”.

On the other hand, HSBC retained a ‘Reduce’ rating with a target price of ₹264 apiece. “Mamaearth’s growth turned positive and emerging brands continued to grow at 20% year-on-year. Revenue growth is similar after adjusting for reporting changes, while higher margins led to minor upward revisions in profit estimates,” said the brokerage firm in its latest report.

Emkay Global has retained ‘Sell’ rating on Honasa, with a September 2026 target price of ₹250, valuing the company at 3x sales (implying a P/E of 35x and EV/EBITDA of 30x).

“Honasa’s performance in Q2 was better than expected, wherein topline growth at 16.5% was in-line, while EBITDA margin at 8.9% surprised positively, driving the 18% EBITDA beat. Changes in settlement by Flipkart (mid-teen revenue mix) drove the change in logistic cost recognition (now adjusted with revenue), which led to a 140bps negative impact on gross margin (reported at 70.5%)…,” it said.

It has cut topline by 3% for FY26 and by 1% for FY27 to factor in the changes, while the brokerage firm upgraded earnings by 6-15% over FY26-28E, given better margin delivery in Q2 and factoring in the accounting adjustments.

JM Financial has upgraded Honasa Consumer to a ‘Buy’ rating from ‘Add’, citing a stronger outlook and consistent improvement in profitability. The brokerage noted that the company delivered a solid performance in Q2 FY26, with revenue slightly ahead of expectations and profitability once again exceeding forecasts.

It highlighted that Honasa’s initiatives to revive growth in Mamaearth are yielding results, with management expressing confidence in achieving double-digit growth by Q4 FY26. The brokerage attributed the sustained margin expansion to an improved product mix, operating leverage, and marketing efficiencies, noting that profitability has consistently surpassed expectations in recent quarters.

Momentum and The Road Ahead for Honasa

This quarterly result is more than a one-off bounce for several reasons. First, the BPC brand signals to investors that the new-age “D2C + premium brand” model in India’s consumer space can swing or profitability. Second, its move from online to hybrid is significant as scaling via digital alone gets tougher in a saturated marketplace.

Third, given the competitive intensity in personal care, achieving operational leverage and margin improvement is perhaps the more important test than topline growth. Going forward, JM Financial has raised its FY26-28E for Honasa Consumer by 2-5%.

“Management expects to sustain EBITDA margin trajectory at current levels of 1H aided by better mix and operating leverage (especially on marketing spends). We are building in EBITDA margin of c.8% for FY26E,” it added.

The company has gradually enhanced its innovation funnel across focus categories. It has picked up a 25% stake in Couch Commerce Pvt Ltd, the parent company of premium oral-care brand Fang Oral, for ₹10 crore. Fang Oral operates in the oral-care segment, which offers products aimed at teeth whitening and daily oral wellness. It has also entered the prestige skin care segment with organic brand Luminéve.

“The management views oral care as a decadal opportunity, backed by multi-levers like clean-label positioning, Q-commerce acceleration, and right to increase stake over time,” Emkay Global added.

Honasa’s story mirrors the broader evolution of India’s new-age consumer start-ups in many ways. This quarter may have cemented its turnaround narrative, but the company’s challenge now lies in proving that this profitability isn’t a one-time cosmetic fix, it’s the foundation for the next chapter.