The IBC Amendment Bill 2025 was introduced on July 12 by Finance Minister Nirmala Sitharaman.

The bill aims to reduce delays, maximise value for stakeholders, and improve governance in insolvency processes.

Key reforms in the bill include group insolvency, cross-border insolvency frameworks, and a creditor-led resolution process.

The Insolvency and Bankruptcy Code (IBC) Amendment Bill, 2025, which is being seen as the most comprehensive overhaul of India’s insolvency regime since its introduction in 2016, has been sent to a select committee for further deliberations. The bill, which aims to reduce delays, maximise value for all stakeholders, and improve governance of all processes under the Code, was introduced in the Lok Sabha on Tuesday by Finance Minister Nirmala Sitharaman.

She told the lower house that it had become necessary to amend certain provisions of the IBC and to insert certain new provisions for its effective implementation.

"They seek to modify existing provisions to better align with the overall objectives of the Code and to introduce new provisions that follow global best practices for resolving insolvency," the statement noted.

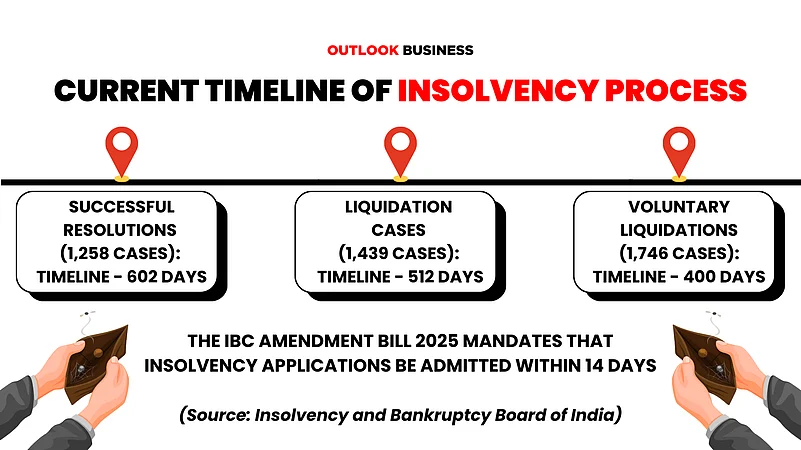

While most legal experts welcome the amendment, which mandates that insolvency applications be admitted within 14 days, some say that without increasing the bandwidth of the National Company Law Tribunal (NCLT), implementation will remain a challenge. Notably, at present, an insolvency application is processed in an average of over 400 days.

The IBC Amendment Bill 2025 also brings in key reforms, including the group insolvency and cross-border insolvency frameworks, as well as the creditor-led resolution process. Before these, let’s try to understand why an amendment to the 2016 Bankruptcy Code had become important.

Why Amend the IBC 2016?

As per the Insolvency and Bankruptcy Board of India’s (IBBI) latest quarterly update on corporate insolvency cases (CIRPs), by the end of June 2025, a total of 8,492 companies had entered the CIRP process. Of these, 1,258 companies were successfully revived through resolution plans, 1,314 cases were closed after appeals, reviews, or settlements, and 1,191 were withdrawn before completion. However, 2,824 companies had to be sent for liquidation.

Since the Code came into effect, 3,763 companies have been rescued in total, while 2,824 were liquidated. On average, companies resolved under CIRP recovered about 32.57% of the money claimed by creditors. On average, resolution plans returned nearly 95% of the fair market value of these companies, as per IBBI.

Looking at timelines of these resolutions, though, tells a different story. The 1,258 successful resolutions took an average of 602 days to complete (excluding certain delays) and cost about 1.11% of the liquidation value, or 0.63% of the resolution value. Liquidation cases took less time, around 512 days on average, while completed liquidation processes (final reports submitted) took around 651 days. Voluntary liquidations were faster, taking about 400 days on average.

"The new Bill has been introduced to modernise IBC, inter alia to address delays in the process with the intent to maximise value for stakeholders by improving the governance mechanism of the processes in India. Especially, the introduction of the Creditor-Initiated Insolvency Resolution Process for faster and more cost-effective resolution aims to minimise business disruption," said Manmeet Kaur, Partner at Karanjawala & Co.

Shorter Resolution Timeline

Amit Tungare, Managing Partner, Asahi Legal, says the Insolvency and Bankruptcy Code (Amendment) Bill, 2025 is aimed at cutting delays, improving creditor recoveries, and aligning India’s framework with international best practices.

"The Bill hardwires a no-discretion principle for admission of financial creditor applications once default is proven and procedural compliance met, curbing prolonged pre-admission litigation," he said.

This amendment to Section 7 of the IBC clarifies key definitions and tightens the process for starting corporate insolvency cases. It says that the Adjudicating Authority must decide within 14 days whether to admit or reject, based only on whether a default has occurred, the application is complete, and there’s no disciplinary action against the proposed resolution professional. If these conditions are met, “no other ground shall be considered to reject an application”. Importantly, if a record of default from an information utility is filed by a financial institution, it will be treated as sufficient proof of default.

"While the proposed bill sounds good, in order to maximise the benefits, NCLT’s bandwidth should be increased, without which implementation will remain a challenge (especially for complying with the 14-day deadline for admission of an insolvency petition by a financial creditor),” said Zeeshan Khan, Partner, Krishnamurthy & Co. (Klaw),

An Information Utility is a regulated platform that securely collects, verifies, and stores financial information to quickly confirm debt and defaults during insolvency proceedings.

"The elevation of Information Utility (IU) records to near-conclusive proof of default under Section 7… This reform will sharply reduce the time and friction at the admission stage, as the NCLT will no longer entertain unnecessary disputes once an uncontested IU record confirms the debt and default. It will push creditors to maintain precise, up-to-date filings with IUs, while leaving debtors with very limited scope to resist admission once the data stands. In essence, IU compliance now becomes a critical strategic tool," said Rahul Hingmire, Managing Partner, Vis Legis Law Practice.

Under the amendment to Section 7, if multiple insolvency applications are pending against the same company, the initiation date will be the date the first application was filed. Also, restructuring now explicitly covers the “sale of one or more assets” of the corporate debtor.

One-Time Revival of Insolvency Cases

The new Bill proposes adding sub-sections (1A) and (1B) to Section 33 of the Insolvency and Bankruptcy Code (IBC). These changes would allow the corporate insolvency resolution process to be restarted in exceptional situations, but only if the committee of creditors formally requests it through an application.

Reports suggest this amendment is aimed at preventing a repeat of the JSW Steel–Bhushan Power and Steel Ltd. (BPSL) case. On May 2, the Supreme Court had cancelled JSW Steel’s acquisition of BPSL. That decision was later withdrawn, and the case was heard again. The Supreme Court finished the re-hearing on Monday and has now reserved its verdict.

As per the new additions, if “the Adjudicating Authority is satisfied” that certain grounds exist, it can consider an application from the committee of creditors (CoC) — backed by at least 66% of voting share — to restore the insolvency process.

But this provision will also apply to ongoing insolvency cases started before the new law comes into effect, as long as a liquidation order hasn’t yet been passed. However, the restoration can only be done once for any company.

If no resolution plan is received or approved within the allowed time, the court “shall pass a liquidation order”.

The amendment also updates the law to allow not just liquidation but also dissolution of the company in certain cases, with the CoC required to meet specific conditions before deciding to dissolve.

Tungare says the amendment now provides stronger governance and value protection.

"CoC oversight in liquidation, strict withdrawal rules, recalibrated payouts for dissenters, extended moratorium coverage (including surety claims), and earlier “look-back” triggers for suspect transactions collectively aim to plug value leakage. Importantly, the Bill clarifies priority of government dues (two-year cap, no automatic secured status), expands IBBI’s regulatory ambit to all service providers, and introduces penalties for frivolous proceedings and wrongful trading even in liquidation," he said.

Section 3(31) of the Amendment Bill overturns the Supreme Court’s 2022 State Tax Officer vs Rainbow Papers Ltd ruling, which had allowed government authorities to be treated as “secured creditors” under the IBC. Under the Code’s priority rules, secured creditors — mainly banks — are paid first from the sale of a debtor’s assets, while government dues rank lower. The amendment clarifies that even if government dues are technically “secured” under other laws, they will not get priority or be treated as secured for IBC purposes, restoring banks’ higher claim in the liquidation process.

Creditor-Initiated Insolvency Resolution

Another key introduction in the bill is the creditor-initiated insolvency resolution process, as per legal experts. The new Section 58B allows certain types of financial institutions (as notified by the government) to start a creditor-initiated insolvency resolution process if a company has defaulted on its payments.

Before they can start, these creditors must get the approval of other creditors in the same category who together hold at least 51% of the debt value. They must also inform the company about their intention and give it at least 30 days to respond.

If, after considering the company’s response, the creditors still want to proceed, they must again secure the 51% approval within the next 30 days. If they fail to do so, they must restart the approval process from scratch.

Once approvals are in place, the creditor can appoint an insolvency professional (with no pending disciplinary action) to act as the resolution professional.

“With the introduction of the ‘creditor-initiated insolvency resolution process’, the creditors will have the power to initiate an out-of-court insolvency process within the debtor-in-possession model, with a further ability to convert the same into a full-fledged CIRP on occurrence of certain events. This model not only empowers the creditors to control the process but also ensures business continuity. On the other hand, the group insolvency and cross-border insolvency will unlock access to a wider asset pool and ensure value maximisation for all stakeholders,” said Abhishek Mukherjee, Partner, Cyril Amarchand Mangaldas.

Further, the introduction of Group Insolvency finally addresses the inefficiencies of handling related companies through separate CIRPs, as per Hingmire.

"By allowing one CoC, one resolution professional, and a unified resolution strategy, the amendment will make it easier to manage inter-company loans, guarantees, and asset pooling. This will not only reduce duplication and administrative costs but also curb forum shopping and prevent strategic shifting of assets between sister concerns to escape creditor reach," he said.

Hingmire also added that the amendment strengthens Cross-Border Insolvency, with provisions for dedicated NCLT benches and a legal framework for cooperation with foreign courts.

"By aligning with UNCITRAL principles, this reform will make it far more practical for creditors to pursue overseas assets and participate in coordinated global proceedings. It opens the door for reciprocal arrangements with key trade partners, placing India in line with international best practices and making our insolvency system more attractive for cross-border investors and lenders," the Vis Legis Law Practice Managing Partner said.