Orders from Chinese brands help Noida-based Dixon Technologies become India’s largest smartphone maker in Q2 2025.

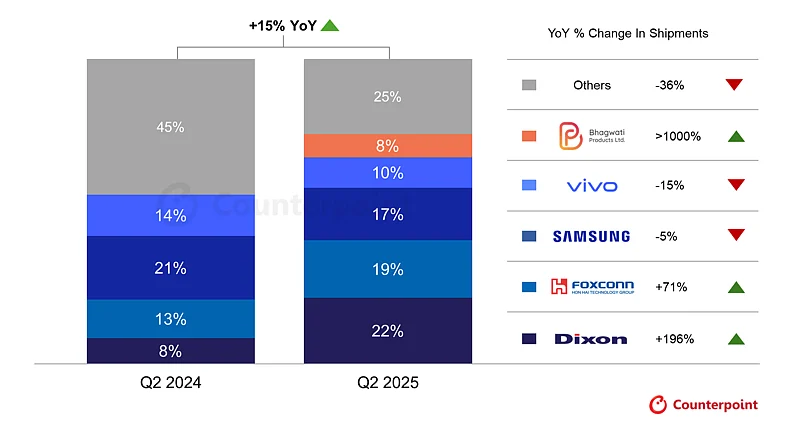

For the first time, Dixon overtook Samsung, with smartphone shipments surging 196% year-on-year.

It captured over 22% market share in Q2, 2025. In comparison, Samsung held a 21% share in Q2 2024.

Massive orders from Chinese smartphone brands such as Motorola, Transsion, Xiaomi and Realme pushed Noida-based Dixon Technologies to become India’s largest smartphone manufacturer in the second quarter of 2025.

According to data from Counterpoint Research, this is the first time the company has taken the top spot, overtaking South Korea’s Samsung Electronics. Dixon’s smartphone shipments grew 196% year-on-year, capturing over 22% of the market share among electronics companies manufacturing smartphones in India.

In Q2 2024, Samsung held 21% of the market share.

The reshuffle comes as shipments of ‘Made in India’ smartphones grew 15% year-on-year in Q2 2025, driven by a 32% surge in exports and an 8% rise in domestic sell-in, according to Counterpoint Research.

In FY25, Dixon’s Mobile & Other EMS division reported revenue of ₹33,043 crore, up 203% year-on-year, while operating profit rose 225% to ₹1,153 crore. The segment contributed 85% of total revenue and 76% of operating profit. In Q4 FY25 alone, the division posted revenue of ₹9,102 crore, up 194% year-on-year but slightly down 2% sequentially, with operating profit rising 232% year-on-year to ₹349 crore.

Dixon’s mobile segment has scaled sharply in recent years, with an annual manufacturing capacity of about 50 million smartphones and 40 million feature phones. The company continues to ramp up volumes for major clients including Oppo, Xiaomi, Transsion and Vivo, supported by backward integration and localisation efforts.

Over the years, Dixon has consistently expanded its client base, adding Panasonic, Gionee, Karbonn, Micromax, Blaupunkt, Tambo, LG, Samsung, Motorola, Nokia, Orbic, Jio, Tecno, Itel, Xiaomi, Realme, and more recently Compal (Google) and Vivo through a joint venture.

In FY25, Dixon acquired a 56% stake in Ismartu India for ₹2.4 billion, gaining access to additional smartphone and feature phone manufacturing facilities and becoming the sole supplier for Transsion brands such as Itel, Infinix and Tecno. With Transsion aiming to rank among the world’s top five mobile brands, Dixon is poised to benefit from rising production volumes even as the broader handset market remains relatively flat.

Meanwhile, another Indian EMS firm, Bhagwati Products Limited, crossed the two-million-units-per-month production mark in the June quarter, driven by orders from Vivo and Oppo. For the first time, it entered the list of India’s top five smartphone manufacturers. It also became the fastest-growing manufacturer, with shipment growth of over 1,000%.

“Indian manufacturers are now playing an important role as major Chinese OEMs outsource their production to these local players. Going forward, we expect the EMS (electronics manufacturing services) landscape to expand in India, benefiting local manufacturers,” said Counterpoint’s Senior Research Analyst Prachir Singh.

He added that the Union government’s Electronics Component Manufacturing Scheme would also play a key role in expanding the country’s electronics manufacturing supply chain, while technology partnerships with leading global ODMs (original design manufacturers) and component manufacturers would give electronics manufacturing a boost.

Apple, Samsung Still Dominate Exports

According to the market research firm’s data, while Apple and Samsung’s combined contribution to ‘Make in India’ smartphone shipments is around 36%, in exports they account for more than 93% of the market.

“Apple and Samsung led the export market with a consistent combined share of more than 93% of Made in India smartphones. While short-term global disruptions have helped EMS players based in India boost outward shipments, the long-term sustainability of exports depends on anchoring India as a key player in the global supply chain. This is possible only through deeper investments in building a robust ecosystem for smartphone components in India,” said Research Associate Abdul Rehman.

According to Counterpoint’s data, Apple supplier Foxconn Hon Hai captured the second spot in Q2 2025 among ‘Make in India’ smartphone makers, registering 71% year-on-year growth due to a surge in iPhone exports. According to Research Analyst Tanvi Sharma, Apple was the largest exporter in Q2.

“Geopolitical manoeuvring owing to Trump’s tariffs made India a more attractive destination for sourcing smartphones, leading to a surge in exports, especially for iPhones. This benefited Foxconn Hon Hai and Tata Electronics. Exports for Motorola also grew, driven by rising demand in the US, which benefited Dixon,” she added.

The report noted that the role of Indian manufacturers is expected to expand in the coming months as they ramp up production.

“Many such manufacturers have also invested in developing a component ecosystem in India through joint ventures for displays, camera modules, mechanics and more, which will further increase domestic value addition,” it said.