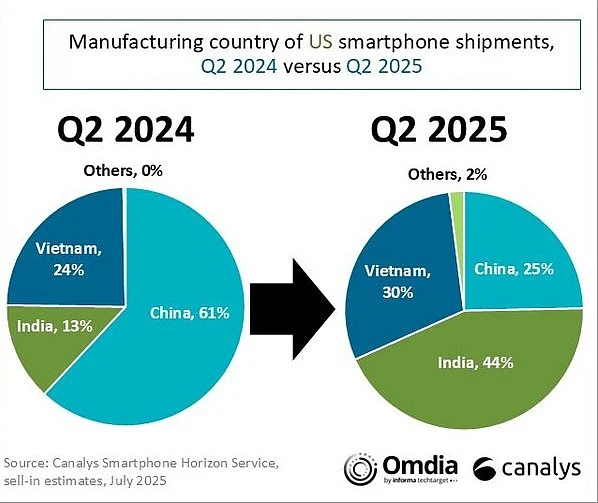

India shipped 44% of US-bound smartphones in Q2 2025, overtaking China’s 25%. A year ago, China led with 61%.

Accelerating its 'China Plus One' strategy, Apple ramped up Indian production to counter US tariff risks.

Vietnam’s share also rose to 30% in Q2 2025 from 24% last year, riding the supply chain shift.

India exported more smartphones to the US in the second quarter (April–June) of 2025 than China, amid US tariff concerns affecting giants like Apple and Foxconn. According to Canalys (now part of Omdia), India shipped 44% of US-bound smartphones in Q2 2025, compared to China’s 25%.

The market research firm’s data shows that just a year ago, the picture was reversed: Chinese smartphones accounted for 61% of US-bound devices in Q2 2024, while India contributed only 14%.

“India became the leading manufacturing hub for smartphones sold in the US for the very first time in Q2 2025, largely driven by Apple’s accelerated supply chain shift to India amid an uncertain trade landscape between the US and China,” said Sanyam Chaurasia, Principal Analyst at Canalys (now part of Omdia).

He noted that the Tim Cook-led company has ramped up production capacity in India over the last several years as part of its ‘China Plus One’ strategy, dedicating most of its Indian export capacity to supply the US market in 2025.

Notably, while India’s gains came largely at China’s expense, Vietnam also benefited: its share rose from 24% in Q2 2024 to 30% in Q2 2025.

Inventory Build-up Amid Tariff Risks

According to Canalys analysts, smartphone makers like Apple and Samsung are stockpiling inventories to hedge against potential high tariffs.

US President Donald Trump, on April 2, unveiled a sweeping list of reciprocal tariffs for all trading partners and implemented a 10% universal tariff. Days later, he paused the “reciprocal tariffs” first for 90 days, then until August 1. Since then, he has reached trade deals with the UK, Japan, and the EU, agreeing on lower reciprocal tariffs. The US is currently in talks with China for a potential trade deal that could reduce tariffs further.

Amid this uncertainty, Apple, which still produces most of its products in China, shifted US-bound production to factories in India. It reportedly asked key vendors Foxconn and Tata Electronics to ramp up iPhone production.

Earlier reports indicated that in March, Apple even airlifted billions of dollars’ worth of phones from India just days before tariffs were expected to take effect.

Canalys noted that in the first half of 2025, iPhone exports surged 53% year-on-year to 23.9 million units, with 78% shipped to the US. Tata Electronics emerged as Apple’s fastest-growing supplier, contributing 37% of India’s iPhone exports—up from 13% in 2024.

“Vendors continue to frontload devices and maintain high inventory levels to best cope with the risk of tariffs later in the year. Apple built up inventories rapidly toward the end of Q1 and sought to maintain this level in Q2,” said Runar Bjorhovde, Senior Analyst at Canalys.

He added that Apple is not alone; Samsung also increased its inventory in Q2, boosting shipments by 38% year-on-year, largely driven by its Galaxy A-series.

“Yet, the US smartphone market grew only 1% despite vendors frontloading inventory, indicating tepid demand in an increasingly pressured economic environment and a widening gap between sell-in and sell-through. Even if smartphones remain exempt from tariffs, many other categories are impacted, which could affect consumer spending and keep smartphone demand modest in H2,” Bjorhovde noted.

Small Firms Struggle in US

According to Canalys, uncertain tariff policies, weak consumer demand, and the need for local operations are making the US market less attractive for mid- and small-sized vendors.

“This is exemplified by HMD’s announcement to scale back its US operations,” Bjorhovde said. Earlier this month, the Finnish company behind Nokia-branded phones said it would reduce its US presence and stop selling both HMD and Nokia devices in the country, citing “challenging geopolitical and economic conditions.” HMD’s US webstore is offline, and product pages no longer provide buying options, though some devices remain available via Amazon and other retailers.

Data shows that in Q2 2025, the US smartphone market saw total shipments of 27.1 million units. Apple led with a 49% market share and 13.3 million iPhones shipped, followed by Samsung at 31% with 8.3 million units. Motorola maintained a 12% share with 3.2 million shipments, while Google and TCL each captured 3%. Other brands made up the remaining 3%, underscoring the dominance of the top two vendors.

Year-on-year, Samsung posted the strongest growth at 38%, Google grew 13%, and Motorola was nearly flat at 2%. In contrast, Apple’s shipments fell 11% as it ceded market share, while TCL and other smaller brands faced steep declines of 23% and 34%, respectively. Overall, the market contracted for Apple but saw gains for Android players, led by Samsung.

“Successful long-term strategies for smartphone vendors in the US require significant scale, but over 90% of the market is held by the three largest vendors. That leaves very limited opportunities for the rest, which must rely on prepaid carrier slots or non-carrier-driven channels,” Bjorhovde added.