US tariffs have hit Indian auto component makers, forcing them to explore shifting production overseas.

Analysts says firms like Sona BLW, Bharat Forge, Balkrishna Industries and Motherson are seen among the worst affected.

They warn of shrinking US car demand and pressure on supplier margins as companies absorb higher costs.

Automotive component manufacturers are considering shifting production overseas to navigate the 50% tariffs imposed by US President Donald Trump. The sector, one of the hardest hit along with textiles, gems and seafood exports, faces heightened pressure after the US imposed an additional 25% tariff on India for buying Russian oil on August 27. This makes India one of Washington’s most heavily tariffed trade partners.

Auto part makers, who exported about $3.5 billion worth of components such as engines, transmissions and electrical parts, are scrambling to avoid a severe impact on their business.

According to an Economic Times report on Wednesday, companies are weighing options to set up plants in regions facing lower tariffs compared to India. Industry executives said firms with existing overseas facilities are evaluating whether supplying from those bases makes more economic sense.

In recent weeks, several listed exporters told analysts they are considering similar contingency plans to cope with the uncertainty caused by Trump’s move.

For instance, on August 13, Samvardhana Motherson’s Director Laksh Vaaman Sehgal, said, “We are always focused on sourcing locally, producing locally, and supplying locally. So we do not have a very large number of businesses exporting to the US from outside the US. That’s a big strength of Motherson, and it has played out really well for us.”

He was talking to analysts during the quarterly earnings call.

A Kotak Institutional Equities report in April noted that while Motherson does not export directly from India, but about 20% of its overall revenue comes from the US. The firm also has exposure to the EU carmakers, whose exports to the US indirectly affect its business.

Kotak has warned of dual implications of the tariffs on Auto part makers, which was initially expected at 25%. “The US car market may witness a steep decline as prices rise and supplier margins could come under pressure as they may need to absorb part of the cost,” it noted.

It highlighted Tata Motors, Sona BLW Precision Forgings, Bharat Forge, Balkrishna Industries, and Samvardhana Motherson International as the worst hit firms.

Why US Matters for India’s Auto Part Makers

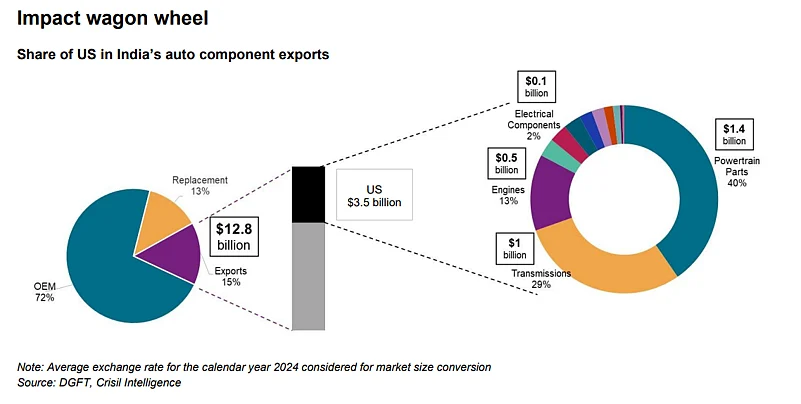

Of India’s $12.8 billion auto component export in 2024, which accounts for 15% of total production value, the US shipments contributed $3.5 billion. CRISIL Intelligence data shows that within US-bound exports, powertrain parts formed the largest share at 40% ($1.4 billion), followed by transmissions at 29% ($1 billion) and engines at 13% ($0.5 billion). Electrical components comprised just 2% ($0.1 billion).

Automotive Component Manufacturers Association (ACMA) data for FY25 shows India exported $22.9 billion worth of auto parts, with North America the largest destination at $7.35 billion (up 8.4% year-on-year). The US alone contributed 27% of India’s total auto component exports, while imports from the US stood at just 7%.

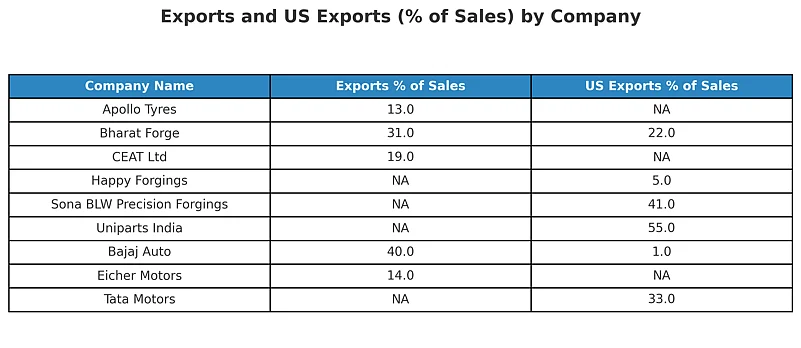

A JM Financial report showed the company-level exposure of Indian industry. Uniparts India (55%) and Sona BLW (41%) derive significant revenue from the US, while Happy Forgings (5%) has limited exposure. Apollo Tyres, CEAT and SJS Enterprises have little or no direct US export dependence. Tata Motors’ JLR division, however, derives about one-third of its volumes from the US, underlining the market’s importance.

How Auto Part Makers Plan to Navigate Tariffs

While Samvardhana Motherson plans to serve US customers locally, Sona BLW Precision is still assessing the impact. During its Q1 FY26 earnings call, Managing Director Vivek Vikram Singh, said, “The new tariff announced a few days ago applies only to certain auto components not already covered by sectoral tariffs. Its impact will depend on how customers respond. The US government also has a two-year scheme to help automotive OEMs absorb extra costs.”

Bharat Forge has already felt the strain. Vice-Chairman Amit Kalyani revealed that the firm absorbed ₹14 crore in tariff-related expenses in Q1 FY26. During the period its revenue stood at ₹2,105 crore, down 2.7% year- on-year. Kalyani told analysts, “Uncertainties around tariffs have created disruption in the global automotive outlook. Delays in emission norms reduced pre-buying demand, while seasonality in aerospace also impacted top-line performance.” However, he added the company does not plan to set up new overseas facilities.

Bengaluru-based Sansera Engineering, which supplies engine and chassis parts, is fast-tracking plans to open a US plant, as per the ET report. The country contributes 6–7% of the company's total exports. The company is also scouting new markets to offset potential demand loss.

Meanwhile, Uno Minda during earnings call this month said tariffs have minimal impact as US exports form less than 2% of its revenue. “In fact, we’ve seen rising US demand for our two-wheeler products, reinforcing our global competitiveness,” its management noted.

Investors Take Positions

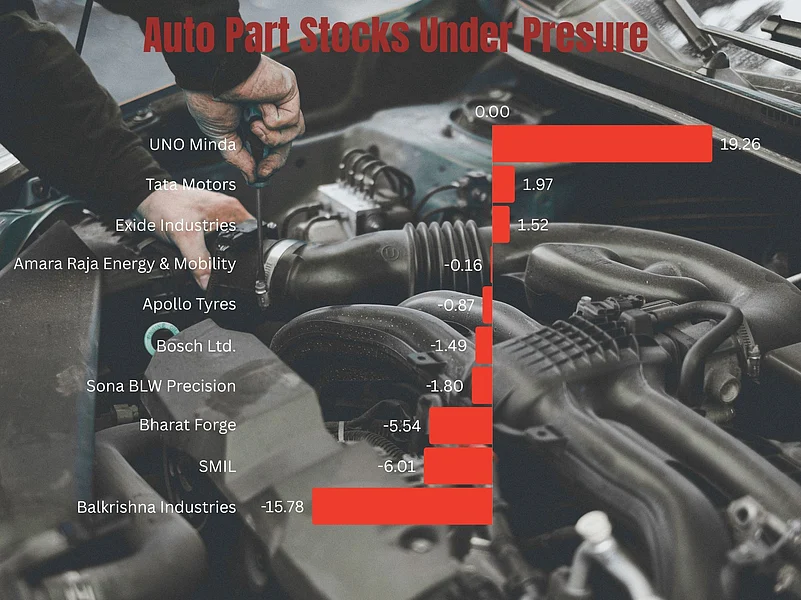

Stock market performance reflects this mixed outlook. Ace Equity data shows Uno Minda shares gained 19.26% over the past month.

In contrast, Balkrishna Industries fell 15.78%, while Samvardhana Motherson (-6.01%), Bharat Forge (-5.54%), and Bosch (-1.49%) also declined. Apollo Tyres (-0.87%), Sona BLW (-1.80%), and Amara Raja Energy & Mobility (-0.16%) posted marginal losses.