India rebases CPI to 2024, cutting food weight to 36.75%.

January 2026 inflation prints at 2.75%, within RBI’s 2–6% band.

Silver jewellery surges 159.7%, driving metal-led price pressures.

New basket adds smartphones, OTT, e-commerce; drops obsolete goods.

India's Consumer Price Index (CPI) got a facelift in 2026. The Ministry of Statistics and Programme Implementation (MoSPI) released the first inflation figures on Thursday under a rebased CPI, year updated from 2012 to 2024.

The overhaul – part of a broader statistical reform – realigns the inflation gauge with today’s economy. The MoSPI notes the new CPI “reflects current consumption patterns”, using the latest Household Consumption Expenditure Survey 2023–24, and should yield more accurate, policy-relevant inflation estimates.

"The economy has undergone a significant transformation in the last decade. Consumption behaviour, market structures, and the compositions of household expenditure have evolved and the new CPI structure unsurprisingly reflects these changes,” Chief Economic Advisor V. Anantha Nageswaran said while releasing the data.

January 2026 Inflation

Retail inflation as per the new series stood at 2.75% in January 2026, while food inflation was 2.13%. As this is the first data release from the new series, a historical comparison is not immediately ready yet.

This was well within the RBI’s 2–6% target range. However, the figure was slightly above economists’ forecasts; analysts had expected around 2.4–2.5%.

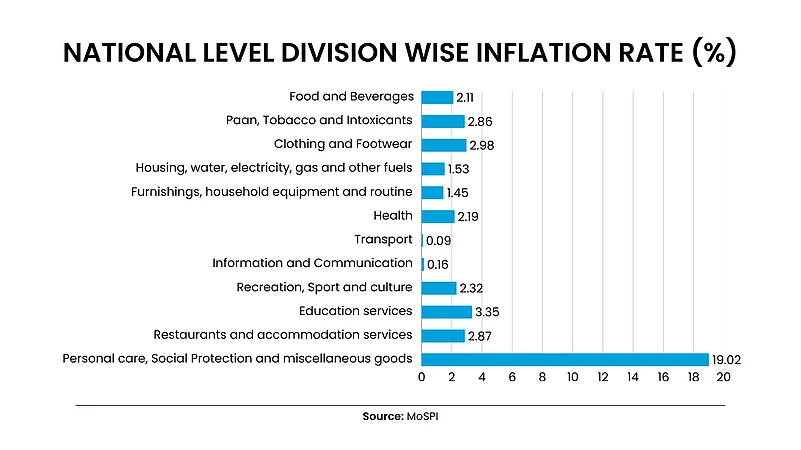

The drivers of the January uptick fit the new structure. Food prices had been deflating in late 2025, so a modest pickup to 2.13% inflation helped the headline. Meanwhile, gold and silver price surges fed into the “miscellaneous” and “personal care” categories.

Inflationary pressure in January was largely on account of price volatility in the metal segment, particularly silver, said Saurabh Garg, secretary at MoSPI.

Silver jewellery remained the top item with all-India combined inflation at 159.67%. Inflation of gold, diamond and platinum jewellery also remained high in January at 46.77%, while inflation in a large number of food items remained moderate.

Notably, within the F&B segment, the weight of vegetables and pulses has declined slightly, which may reduce the peaks and troughs for the headline print vis-à-vis the old series, given that these items have seen quite large variability in their monthly inflation rates. However, the weight of cereals, which had a relatively lower variance in monthly inflation rates, has come down quite sharply, which may partly offset the positive impact of the latter.

"The new CPI series is not comparable to the old series owing to the change in composition, weights and calculation methodology. Nevertheless, with a dip in the weight of the food and beverages (F&B) segment, we had expected the headline print to be slightly higher than our estimate of 2.5% for January 2026 as per the old series, which has been the case," said Aditi Nayar, Chief Economist at ICRA.

Basket Overhaul

Food markets and vegetable stalls remain central to Indian diets, but the new CPI dials down their influence. Under the updated series, the weight of food and beverages has been slashed to about 36.75% of the index from roughly 45.86% before.

The housing category, with an earlier weight of 10.07%, has been expanded to also include water, electricity, gas and other fuels, and this combined category now has a weight of 17.67% in the new series.

The revised series introduces additional groups, including furnishings, household equipment and routine maintenance (4.47% weight), health (6.1%), transport (8.8%), information and communication (3.61%), recreation, sports and culture (1.52%), education services (3.33%), restaurants and accommodation services (3.35%), and personal care, social protection and miscellaneous goods and services (5.04%).

Newly added categories include smartphones and AirPods, online shopping, OTT streaming subscriptions, air purifiers, digital payments, etc. Conversely, obsolete items like VCR/DVD players, cassette tapes, radio, second-hand clothing and library fees have been dropped. Subsidised freebies (like PDS foodgrains) are also excluded, since CPI measures paid household expenditure, not free distributions.

The weight of the paan, tobacco and intoxicants category has risen to 2.99% from 2.38% in the previous series, while clothing and footwear has declined sharply to 2.38% from 6.53%.

Prices are now collected from 1,465 rural and 1,395 urban markets up from 1,181 and 1,114 respectively. For the first time, data from 12 online retail platforms in large cities is included, to capture e-commerce trends.

New CPI Weights Impact

For now, the headline change to the CPI is mostly technical, with little near-term impact on monetary policy. Most analysts expect the RBI to stay the course. Madhavi Arora, chief economist at Emkay Global Financial Services told Reuters that they do not expect the new inflation series to materially influence policy in the near term.

The revised CPI may, however, yield a slightly higher-looking inflation in future if all else is equal. By downgrading food, the same price rise in other goods or services now

registers a larger effect. Some forecasts estimate this could raise reported inflation by a few tenths of a percent.

“Our preliminary assessment is that the expected uptick (as per the old series) in the CPI inflation in FY2027 relative to FY2026 was largely anticipated to be driven by the F&B segment. With a somewhat lower weight for F&B in the new series vis-à-vis the old series, the expected base-effect-led uptick in the headline print in FY2027 would likely be tempered,” Nayar said.