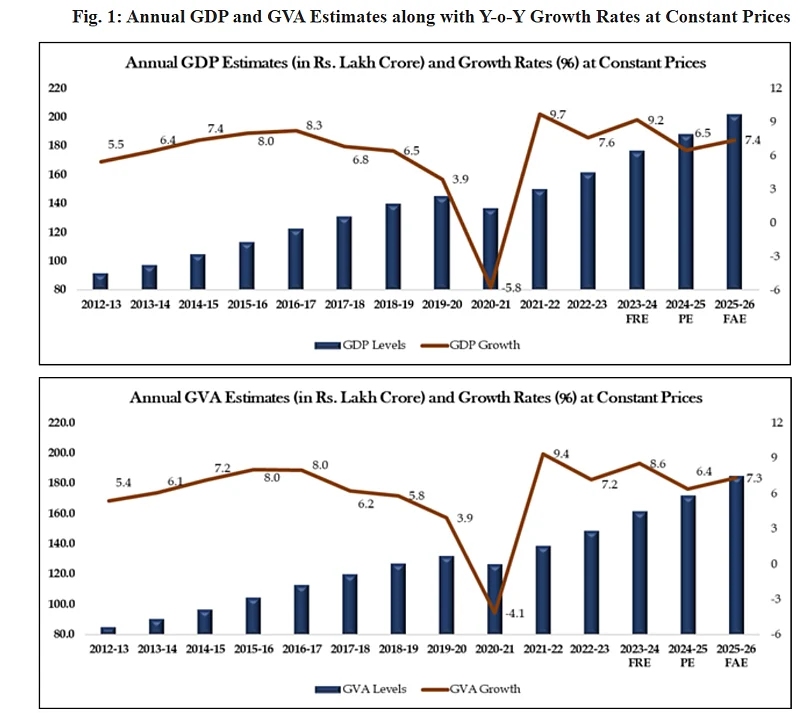

India’s real GDP is estimated to have grown 7.4% in FY26, up from 6.5% a year earlier, according to first advance estimates.

Real GVA growth is pegged at 7.3%, driven by nearly 10% expansion in key services segments such as finance, real estate and public administration.

Government consumption and investment pick up, while private consumption growth moderates slightly.

India’s economy is estimated to have expanded by 7.4% in FY26, accelerating from a growth rate of 6.5% in the previous fiscal year, according to the First Advance Estimates of Gross Domestic Product released by the National Statistics Office (NSO) under the Ministry of Statistics and Programme Implementation (MoSPI).

The data show that robust growth in the services sector was the primary driver of overall expansion, with real Gross Value Added (GVA) projected to grow 7.3% in FY26. Nominal GDP growth for the year is estimated at 8%.

Within the tertiary sector, Financial, Real Estate and Professional Services, along with Public Administration, Defence and Other Services, are projected to record strong growth of 9.9%. Trade, Hotels, Transport, Communication and Broadcasting services are estimated to expand by 7.5%, reflecting sustained demand across contact-intensive segments.

The secondary sector, comprising manufacturing and construction, is expected to grow by 7% in FY26. In contrast, growth in the primary sector remains moderate. Agriculture and allied activities are estimated to grow by 3.1%, while electricity, gas, water supply and other utility services are projected to expand by 2.1%. The data indicate subdued growth in these segments compared to services. Mining output is projected to contract by 0.7%, reversing growth of 2.7% recorded in the previous year.

Real GDP at constant prices is estimated to reach ₹201.90 lakh crore in FY26, compared with the provisional estimate of ₹187.97 lakh crore for FY25.

On the expenditure side, private final consumption expenditure (PFCE), a key driver of domestic demand, is projected to grow by 7% in FY26, slightly lower than the 7.2% recorded a year earlier. Government final consumption expenditure is expected to rise sharply by 5.2%, up from 2.3% in FY25, indicating stronger public spending support.

Gross fixed capital formation, a proxy for investment activity, is projected to increase by 7.8% in FY26, compared with 7.1% in the previous year. Industrial activity is estimated to have grown by 6.2% during FY26, marginally higher than the 5.9% growth recorded in the corresponding period last year.