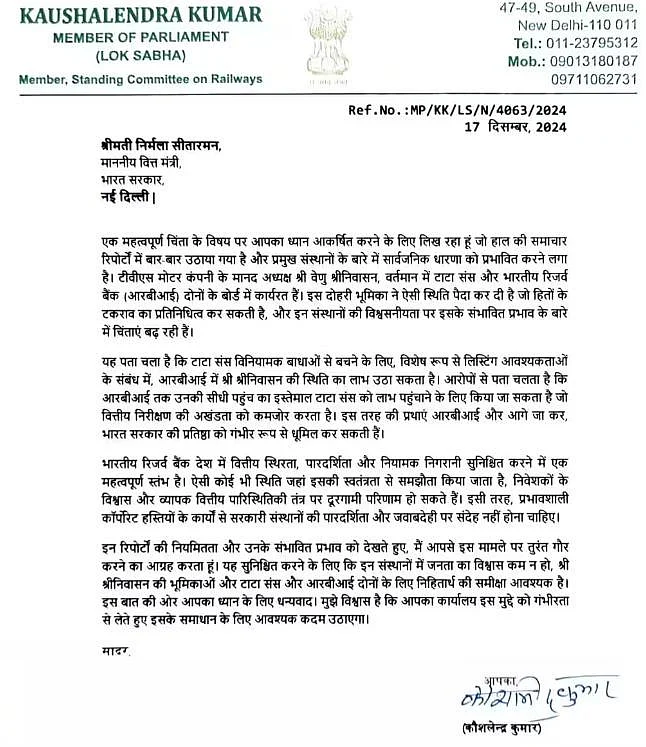

Lok Sabha MP from Nalanda Kaushalendra Kumar has knocked on the finance ministry’s doors regarding Tata Sons public issue. In a letter addressed to finance minister Nirmala Sitharaman, Kumar alleged that the IPO of Tata Sons is being deliberately postponed and has requested Sitharaman to intervene in the matter. The four-time LS MP Kumar highlighted that the IPO, which is likely to be valued around Rs 7-8 lakh crore in the IPO, according to a Mumbai-based investment banking firm, Spark PWM Pvt, will give a boost to the stock market.

RBI’s Regulatory Nudge Drives Tata Sons IPO

The delayed Tata Sons IPO has become a concern as according to the RBI regulations, the company falls under the category of “upper layer non-banking financial companies” (NBFCs) and hence it must fulfill the regulatory requirements of being listed on the stock exchange. The company was classified as an upper-layer NBFC in September 2022 and as per the RBI regulations, the company has to get listed within three years of such classification. The company has a deadline to get listed by September 2025.

Tata Sons, which is the principal investment holding company and promoter of Tata Group requested RBI exempt it from listing its equity shares. However, the regulator turned down its proposal, leaving the company with no options but to abide by the mandatory regulation.

The letter by the Nalanda MP, flagging concerns with the IPO was first reported by Daily Pioneer and Zee News.

Earlier an RTI with the RBI was filed seeking information regarding the progress in Tata Sons application. The RTI stated, “Has a decision been taken on the application of Tata Sons”.

In its reply to the RTI, the central bank said that Tata Sons’ application for surrender of Certificate of Registration (COR) as a core investment company is “under examination”.

While the time around which Tata Sons IPO will get listed is uncertain, investors are eyeing Tata Capital’s public issue worth Rs 15,000 crore scheduled to make its D-street entry next year. This would mark the Tata Group’s second IPO in 20 years after Tata Technologies public issue in November last year. Prior to these two, Tata Group’s IT giant Tata Consultancy Services had made its D-Street debut back in 2004.