Japanese investment holding company SoftBank Group announced its fiscal Q4 (January–March 2025) results on Tuesday, reporting a net profit of ¥517 bn (approximately $3.5 bn).

This marks a significant increase from the ¥231 bn profit recorded in the same quarter the previous year. The result defied expectations, as Reuters reported five analyst estimates compiled by LSEG had forecast a ¥26.9 bn net loss.

The profits were driven by robust performance in SoftBank’s telecommunications holdings, particularly T-Mobile US, and a ¥940 bn ($6.1 bn) gain at Vision Fund 1.

On the other hand, Vision Fund 2 recorded a ¥526 bn loss for FY25.

What is SoftBank Vision Fund?

The SoftBank Vision Fund, founded in 2017, is a venture-capital fund managed by SoftBank Investment Advisers, a subsidiary of SoftBank Group. With over $100 bn in capital, it is the world’s largest technology-focused investment fund.

The fund targets high-growth tech companies in sectors such as AI, consumer internet, fintech, robotics and communications infrastructure, with notable investments in Uber, ByteDance and Coupang.

Vision Fund 2, launched in July 2019 with an initial target of $108 bn, shifted SoftBank’s focus to earlier-stage and AI-centric ventures. However, after key external investors, including Mubadala and Saudi Arabia’s Public Investment Fund withdrew, SoftBank self-funded the majority of the fund.

The fund concentrates on seed-to-mid-stage investments in AI infrastructure, deep tech, robotics and climate technology, adopting a more cautious approach to capital deployment due to market and valuation challenges.

Similarly, Vision Fund 1 raised approximately $93 bn, with SoftBank contributing $28 bn and Saudi Arabia’s Public Investment Fund providing $45 bn, to invest in later-stage, high-growth technology companies.

Indian Start-Up Performance

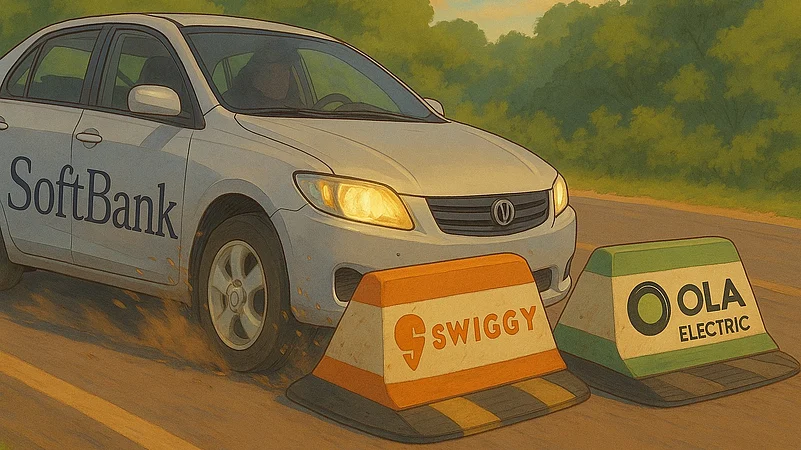

Vision Fund 2 backs around nine Indian start-ups, including Swiggy, Ola Electric, Oyo, Paytm, Meesho, Delhivery, Lenskart, Unacademy and Udaan.

The ¥526 bn loss in Vision Fund 2 was primarily driven by significant markdowns in the public-market holdings of Indian start-ups such as Swiggy and Ola Electric, whose share prices fell nearly 40 %, resulting in a 21.7 % quarter-on-quarter markdown of those assets.

Overall, Vision Fund 2’s fair value dropped 2.7 % during Q4, reflecting challenges in both public and private markets.

The loss in VF2 offset roughly half of what could have been a profit exceeding ¥1 trn, highlighting the significant impact of early-stage markdowns on SoftBank Group’s bottom line.

Swiggy’s Q4 FY25 net losses nearly doubled to ₹1,081 cr from ₹555 cr the previous year, despite a 45 % revenue increase to ₹4,410 cr, leading to a roughly 40 % share-price drop in Q4.

Ola Electric also faced operational losses, such as a Q3 net loss of ₹564 cr, and relied on heavy discounting to boost EV sales. While cost-cutting saved approximately ₹90 cr monthly, its stock also fell about 40 % in Q4, contributing hundreds of millions in markdowns to Vision Fund 2’s portfolio.

Simultaneously, Oyo’s IPO was postponed due to valuation cuts amid market challenges. SoftBank’s exit from Paytm triggered a significant markdown on its PayPay investment. Meesho’s valuation was also reduced, contributing to an estimated $900 m loss in listed holdings.

Additionally, Delhivery’s share-price slowdown led to modest fair-value write-downs. Lenskart incurred approximately $1.5 bn in unrealised write-downs. Unacademy faced a flat-to-downward re-rating after its $150 m raise, and Udaan’s down-round halved its valuation to $1.8 bn. These adjustments reportedly eroded Vision Fund 2’s performance significantly.

Global Start-Ups in Vision Fund 2

VF2’s non-Indian holdings demonstrated greater resilience in Q4 2024 compared with the 40 % share-price declines observed in its Indian portfolio.

AutoStore reported Q4 2024 revenues of $164.8 m, down 6.5 % year-on-year but up 14.3 % quarter-on-quarter, with a strong 73 % gross margin and adjusted EBITDA margins exceeding 46 %.

Symbotic achieved Q4 FY24 revenue of $577 m, a 47 % year-on-year increase, with a net income of $28 m and adjusted EBITDA of $55 m, marking a significant improvement from the prior year’s loss.

Didi Global recorded a 7 % year-on-year revenue increase to RMB 52.9 bn but posted an RMB 1.3 bn net loss, leading to a moderate 15 % stock pullback, less severe than the declines in VF2’s Indian public equities.

DoorDash reported 25 % year-on-year revenue growth to $2.87 bn and a $141 m GAAP profit, boosting its share price by approximately 5 % amid renewed investor confidence.