Affordable housing in India has become a challenge as well as an opportunity due to rising property prices over the past few years. India is expected to have 31.2 million affordable housing units by 2030 with the market size of Rs 67 trillion, according to a report by Confederation of Indian Industry (CII) and Knight Frank. Currently, India has 10.1 million affordable houses.

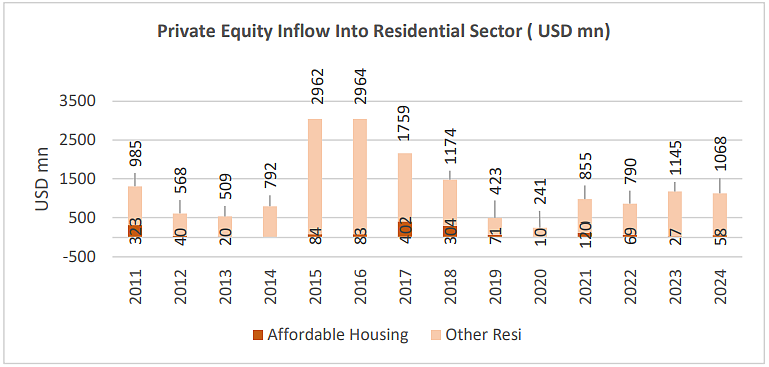

If we look at the breakdown, 22.2 million units of housing will be required in urban centres alone, of which 21.1 million will fall in the affordable homes segment. Desipite this demand, the affordable housing segment attracted capital inflows of $ 1.6 billion, which is just 9.8 per cent of the total capital directed towards the residential sector.

The data represents that a significant amount of money can be invested in building and developing affordable homes in the country. On the contrary, a recent survey stated that India’s housing market is expected to witness another sharp rise in prices as the demand for premium housing steadily grows.

The present average housing price across eight major cities stands at Rs 11,000 per square foot. Among these, Delhi NCR experienced the highest surge, followed by Bengaluru, Ahmedabad, Pune, Mumbai, and other cities. And the home prices are expected to rise further by 6.5 per cent in 2025.

Rising EMIs

The report stated that home loan EMIs and income ratio of a household with an annual income of Rs 0.3 million per annum has increased from 43 per cent to 62 per cent in 2024. The ratio exceeds the Fixed Obligation of Income Ratio (FOIR) limit of 50 per cent established by the banking sector in India. This automatically limits the scope of home loan borrowings for the EWS homebuyers.

In contrast, the EMI and income ratio of a household above the MIG category with an annual income of Rs 1.2 million, has increased by 13 percentage points, rising from 28 per cent to 41 per cent. And the affordability also continues to remain within the FOIR limit established by the banking sector, providing easy access to financing for home purchases.

Hence, an EWS household with an annual income of under Rs 0.3 million would find it challenging to avail this loan as the EMI requirement is above the FOIR limit set by the banks.

To enhance the accessibility of affordable housing schemes for EWS households, it is essential to revise the income eligibility criteria. Currently, the EWS category is capped at an annual income of Rs 0.3 million, whereas the income needed to purchase a 30 square metre home in tier-1 cities is estimated at Rs 0.6 million, the report said.

Balancing Costs

Given the gap between rising property prices and the current supply of affordable homes, the question arises: Is it possible to build affordable houses in India? Real estate experts expressed the need to address these housing problems to avoid possible consequences in future.

“Affordable homes are a sheer necessity in India. If not addressed adequately, the gap will continue to rise and may have some serious consequences. But the property prices are also soaring and its nearly impossible to build affordable projects in the main areas of a city. So, these projects have to be built in the peripheries where lands are available at reasonable rates,” Sanjeev Arora, Director, 360 Realtors told Outlook Business.

He asserted that land, which comprises 50 per cent of the overall housing cost, is a key component of building a home. In addition, property developers also need to ensure that off-side locations offer self-sustainable ecosystem with basic facilities like schools, healthcare, and transport to manage the overall cost,” Arora said.

“Mass transit and public transport has to be developed so that the total cost (Housing + Transport) can be reduced and is generally not over 30-40 per cent of the monthly household income. Otherwise, even if the housing cost is low but transport is high, the overall purpose will be defeated,” he added.

Another expert opined that affordable housing is essential for driving economic growth and social equity. In India, affordable housing demand is dominated by the economically weaker section (EWS) that accounts for 45.8 per cent of the industry, said Mohit Kalia, Vice President (Sales) Raheja Developers.

“Despite challenges like rising property prices and an existing shortage of 10.1 million units, solutions are attainable. Certain measures like unlocking vacant PSU lands, offering tax incentives, and enabling free FSI can lower costs, while innovative financing and public-private partnerships make projects more viable,” he said.

Additionally, developing satellite cities and boosting rental housing for industrial workers are also crucial, said Kalia, while calling for a collaborative approach between policymakers, developers, and financial institutions to make affordable housing a reality for millions.

In a nutshell, the growing demand for affordable housing will generate the need for active developer participation. However, private developers have moderated their interest in affordable housing projects due to lower profitability, increase in land costs, construction costs, lack of institutional investments, etc.