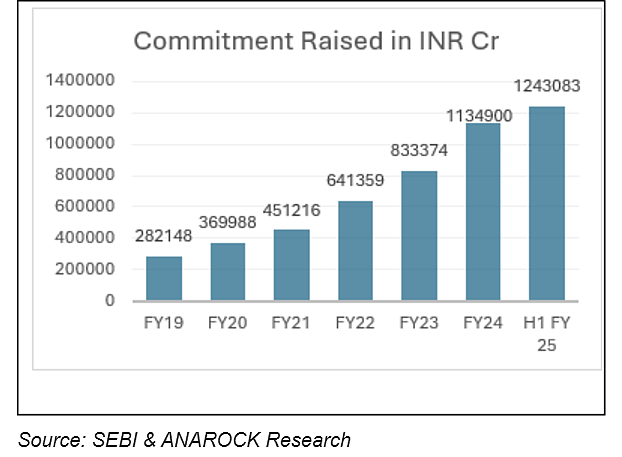

In India, Alternative Investment Funds (AIFs) have shown remarkable growth in the number of funds available for investment. The AIFs have increased 340 per cent across various sectors in the last six years, from Rs 2,82,148 crore in FY19 to Rs 12,43,083 crore in H1 FY25.

Of these, real estate sector stands out as the leading choice for AIF investments in India, with holding 17 per cent share --- totalling nearly Rs 75,468 crore --- of total funds, according to the Sebi data compiled by Anarock research company.

Other sectors benefitting from AIF investments are IT/ITeS, Financial Services, NBFCs, Banks, Pharma, FMCG, Retail, Renewable Energy, and others. The IT sector has invested Rs 2,78,15 crore through AIFs, followed by Rs 2,57,82 crore in financial services, Rs 2,15,03 crore in NBFCs, Rs 1,82,42 crore in banks, and others.

Also Read | HSBC Sees Strong Demand in Real Estate Sector

Traditionally, domestic investors have been the primary source of AIF funding. However, foreign portfolio investors (FPIs) are also stepping up, especially in the case of Category II AIFs. In this category, FPIs now have an almost equal participation alongside domestic investors.

The real estate sector also attracted significant private equity investments, amounting to Rs 28,560 crore in the first nine months of CY24, as per Anarock data. Additionally, the sector raised Rs 12,801 crore through Qualified Institutional Placements (QIPs) during the same period, making it the second-highest among all major sectors.

Home Prices Spike in India

India's housing market is expected to witness another sharp rise in prices as the demand for premium housing steadily grows. According to a Reuters poll, average home prices in the country are likely to climb in the coming years, thanks to affluent buyers.

The report stated that rents are also expected to rise at a similar pace. It added that rents could climb by 7.5 per cent to 10 per cent over the next year.

It also mentioned that India’s middle class is cutting back on other things as they feel the pinch of soaring inflation. It's largely the wealthy class that is keeping the housing prices high as for now.

While this trend may drive price increases in the short term, property analysts caution that the wealthy alone cannot sustain demand indefinitely in an economy already losing momentum.