Bima Vistaar is a new insurance product covering life, health, and property aimed at rural India, expected to launch by December 2025.

It will be sold by all 26 life insurance companies including LIC at a uniform price with a coverage of ₹5 lakh per individual.

The product aims to increase insurance penetration in rural areas where it is currently low.

The Life Insurance Council’s Insurance Awareness Committee (IAC-Life) is driving a 360-degree awareness campaign called ‘Sabse pehle life insurance’ with a budget of ₹150 crore over three years.

Bima Vistaar, an insurance product covering life, health and property for rural people, is likely to be launched by December 2025, an industry organisation said on Wednesday.

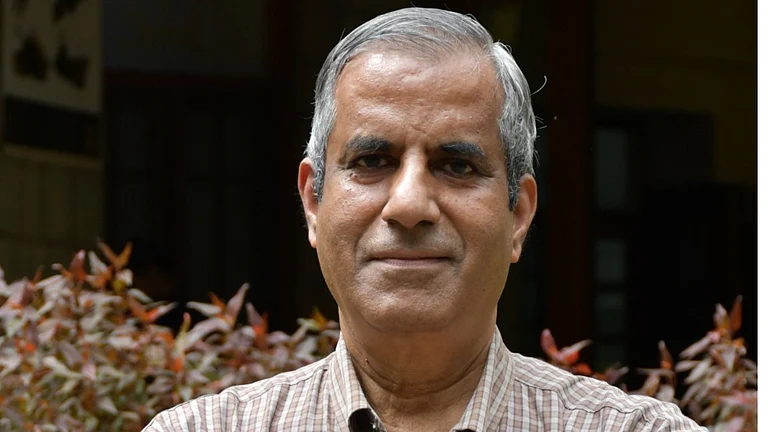

Life Insurance Council's Insurance Awareness Committee (IAC-Life) chairperson Kamlesh Rao said the products meant for rural India will be sold by all insurance companies at a uniform price with ₹5 lakh cover per individual.

The council has all 26 life insurance companies, including Life Insurance Corporation (LIC), as its members.

Rao said that the product will be launched to increase the penetration of insurance in the rural belts of the country.

"Penetration is lower in rural India. Bima Vistaar will be launched, targeting an increase in the insurance penetration in rural India," he said.

Talking of the life insurance industry in the country, Rao said total assets under management (AUM) of all the insurers had touched ₹67 lakh crore during the 2024-25 financial year, while the total premium collected had grown at a 10% CAGR over five years.

He said the IAC-Life has initiated a 360-degree campaign to raise awareness about life insurance in the country with the tag line 'Sabse pehle life insurance'.

He said an amount of ₹150 crore has been earmarked for the campaign, which would be carried out for three years.

The mutual fund industry has already initiated such a campaign, 'mutual fund sahi hai', for popularising its products.

To a query whether the life insurance industry is facing stiff competition from mutual funds, Rao said the AUM for the life insurers for a five-year CAGR has grown by 13%, while that of the latter by 17%.

He said that IAC-Life had commissioned a market research which revealed that West Bengal is one of the states with high potential for life insurance penetration.