From geopolitical turbulence to escalating border tension between India and Pakistan, Dalal Street appeared immune as the stock market closed Wednesday’s session in the green. Benchmark indices— Sensex and Nifty — ended marginally higher, even as India launched a retaliatory strike 'Operation Sindoor' in response to Pakistan’s terrorist attack.

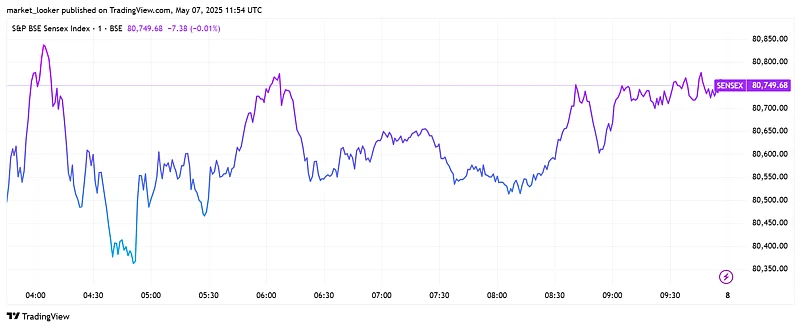

BSE Sensex closed the trading session at 80,746 level mark, up by over 100 points. NSE Nifty 50 followed the uptrend, and closed above 24,400 level. Interestingly, small-cap and mid-cap stocks witnessed strong investor interest. The S&P BSE smallcap index experienced a surge of more than 500 points or 1.16%. Mid-cap index also soared by nearly 580 points or 1.36%.

Sectorally, automobile stocks shined with the Nifty Auto index rising over 270 points or over 1.6%. On the other hand, Nifty FMCG was the worst-performing sector, losing nearly 300 points.

Here's what drove the bullish sentiment across D-street on Wednesday-

India-UK FTA

In a major development, India and UK have finalised the Free Trade Agreement (FTA) after over three years of negotiations. A key element of this trade deal includes a reduction in import duties by India on automotive products from the UK. Plus, import duties on spirits such as gin and whisky will be slashed from 150% to 75%.

"The FTA is likely to boost bilateral trade and investment between both countries and benefit several Indian sectors like textiles, auto and auto ancillaries, pharma, agri products, gems & jewellery. This helped improve domestic sentiments and provide support to market on a volatile day," said Siddhartha Khemka, head- research, wealth management, Motilal Oswal Financial Services.

FII Flows

Foreign institutional investors continue with their buying spree, signalling a strong reversal in the previous trend. FIIs were major net sellers on the exchanges during the first quarter of 2025, offloading equities worth a total of Rs 1,29,680 crore. However, they reversed course and became net buyers last month.

"Looking ahead, domestic uncertainties are expected to continue driving volatility. However, stable global cues and sustained FII buying are helping to delicately balance the market despite geopolitical risks. All eyes are now on the US Fed, and markets are likely to react to the FOMC meeting outcome and commentary in early trades," Ajit Mishra, SVP, research, Religare Broking, said.

It is also worth mentioning that India’s retaliatory move, ‘Operation Sindoor’, remained non-escalatory in nature. As for now, most analysts have adopted a wait-and-watch stance.

"We have to wait and watch how the enemy reacts to this precision strikes by India. The market is unlikely to be impacted by the retaliatory strike by India since that was known and discounted by the market," said Vijayakumar, chief investment strategist, Geojit Investments.