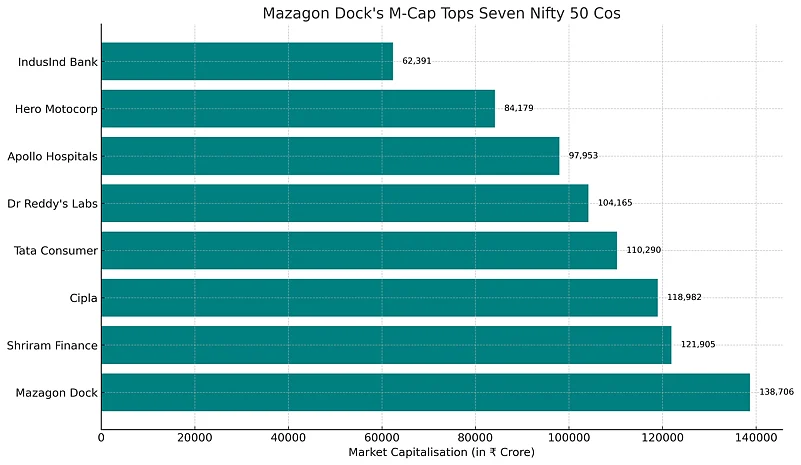

Mazagon Dock shares are now shining brighter than several Nifty50 constituents. The shipbuilding company’s overall market capitalisation has surpassed that of seven Nifty50 companies, including major names like IndusInd Bank, Hero MotoCorp and Apollo Hospitals.

Others on the list include Dr. Reddy's, Cipla, Shriram Finance and Tata Consumer Products, as per Capitaline data.

The multibagger defence stock has attracted heightened investor interest following rising border tensions between India and Pakistan. So far this year, the stock has surged over 52.33% on the National Stock Exchange. However, in the last 5 trading sessions, Mazagon Dock shares have plummeted over 8% on the bourses. The defence company's market cap currently stands ₹1.38 lakh crore. (as of June 4)

While Mazagon Dock shares are currently experiencing a phase of profit-booking following a sharp rally in recent weeks, analysts maintain a bullish outlook on the broader defence sector. This optimism is largely owing to a robust order book, strong domestic policy push and India’s firm response to recent border tensions.

Over the past three months, the Nifty India Defence Index has surged more than 65%, significantly outperforming the benchmark Nifty50, which has gained around 11% during the same period. According to analysts, the outlook for shipbuilding stocks appears even more promising, owing to strong order inflows.

"...the defence stocks are fairly valued because the capability and competence of the Indian defence products are clearly established and, therefore, defence stocks are set to move higher and onwards in 'the new normal'...India’s major defence stocks, viz. Cochin Shipyard, Paras Defence, Mazagon Dock Shipbuilders, Bharat Dynamics, Bharat Electronics and Hindustan Aeronautics are likely to do well. But the rise in these stocks will be a function of various factors," said Manoranjan Sharma, Chief Economist, Infomerics Valuation and Ratings Ltd.

The Defence Acquisition Council (DAC) has approved orders worth Rs 8.45 trillion over FY22–25, which is almost 3.3x the same number for the preceding three years. As per Antique stock broking, this is expected to translate into significant order inflows in FY26–27 for defence shipyards.

Mazagon Dock Share Price Outlook

In the last 6 months period, the shares of the company have witnessed a robust 40% rise on the NSE. So far this year, Mazagon Dock stock has surged over 52% on the bourses.

In the recent quarter earnings, the company exceeded its annual guidance, achieving higher-than-expected topline growth and profit before tax (PBT) margins. As of March 31, 2025, the total order book stood at ₹32,260 crore. For the upcoming quarters, the overall orderbook is projected to rise to over ₹1.25 lakh crore.

"The company is focused on strategic capital allocation for growth and infrastructure development. Overall, we remain optimistic about the shipbuilding sector in general and growth prospects of Mazagon Dock. The company has a strong order pipeline going ahead. Given its unmatched market presence and strategic growth initiatives, we remain positive on the stock," Ashika Institutional Equity stated in its report. On an annual basis, Mazagon Dock shares have delivered a triple-digit return figure of 155%.