The primary market is buzzing again after a bit of a snooze, and at the centre stage this week is HDFC Bank’s subsidiary, HDB Financial’s mega Rs 12,500-crore public offer. After a four-month delay courtesy of the market regulator, the NBFC’s public offer is finally opening for bids from 25 to 27 June, with a price band set between ₹700 and ₹740 per share.

But while the IPO itself is grabbing headlines, all's not so rosy in the grey market. Just a few weeks ago, HDB Financial shares were trading in the unlisted space for ₹1,200–1,350 apiece, roughly 70–80% higher than the IPO's upper band. Fast forward to now, and the grey market premium has cooled off considerably, hovering at just over 8%.

The drop in grey market premium seems to reflect changing expectations. Some early investors had picked up HDB shares in the unlisted market hoping for big listing gains. But with the IPO price set lower than those earlier grey market expectations, those hopes have taken a hit.

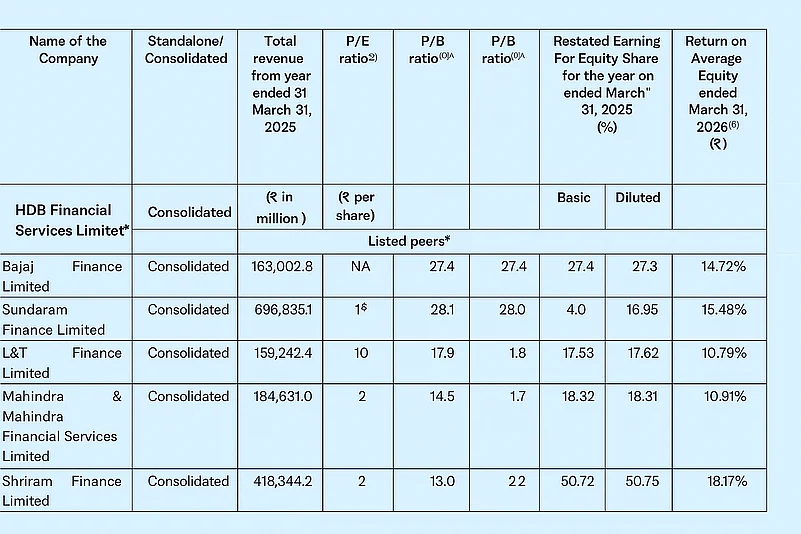

That said, analysts did not raise caution bells as they see the IPO price of ₹740 per share as fairly valued, especially when compared to other listed NBFCs like Bajaj Finance and Shriram Finance. At 3.72 times its FY24 book value, HDB’s valuation looks more in line with market standards than the higher prices seen earlier in the grey market.

Meanwhile, as HDB Financial Services eyes a potential listing, its FY25 financials reveal a mixed picture when stacked up against its publicly listed peers—Bajaj Finance, Cholamandalam Investment and Finance Company, Shriram Finance, and L&T Finance. While HDB’s scale and profitability show promise, the company seems like a dark horse running with the big dogs in the NBFC space.

Scale & Profitability: A Mid-Sized Contender

HDB Financial Services reported a net profit of ₹2,175.9 crore in FY25, placing it firmly in the mid-tier among its peers. It lags behind heavyweights like Bajaj Finance (₹16,779 crore) and Shriram Finance (₹7,299 crore), but surpasses L&T Finance (₹2,444 crore).

On the topline, HDB’s Net Interest Income (NII) stood at ₹7,445.6 crore, again reflecting a mid-level position between L&T Finance’s ₹8,048 crore and Cholamandalam’s ₹13,570 crore.

Asset Base & Market Capitalization

With Assets Under Management (AUM) of ₹1.07 lakh crore, HDB is smaller than most of its peers—Cholamandalam’s ₹1.84 lakh crore and Shriram Finance’s ₹2.63 lakh crore tower above. Bajaj Finance leads the pack with a staggering AUM of ₹4.16 lakh crore.

Market capitalization also reveals HDB’s underdog status at ₹61,287.9 crore, dwarfed by Bajaj Finance’s ₹5.62 lakh crore and even trailing L&T Finance’s ₹47,490 crore, despite having stronger profitability metrics.

Return Ratios: A Soft Spot

HDB lags in profitability ratios, with a Return on Assets (ROA) of 2.2% and Return on Equity (ROE) of 10.6%. Both figures fall short compared to Bajaj Finance (ROA: 4.6%, ROE: 22.4%) and Shriram Finance (ROA: 3.5%, ROE: 19.7%), meaning it has some catching up to do in how effectively it uses its capital.

Asset Quality: A Mixed Bag

On asset quality, HDB performs reasonably well. Its Gross NPA of 2.3% is better than Shriram and L&T Finance, though not as strong as Bajaj or Cholamandalam. Its Provision Coverage Ratio (PCR) of 66% is competitive, better than L&T Finance (61%) and Cholamandalam (54.6%) but behind Bajaj Finance’s 82%.

Valuation Metrics: Premium or Discount?

With a P/E ratio of 27.1x and a Price-to-Book Value (P/BV) of 3.7x, HDB is priced at a discount compared to Bajaj Finance (P/E: 33.5x, P/BV: 6.4x) and Cholamandalam (30.6x, 5.5x), suggesting potential upside if profitability metrics improve post-listing.