CEAT Share Price NSE: The shares of the tyre manufacturer witnessed a sharp surge on Monday after the company announced that it has signed a definitive agreement with Micheline to acquire the Off-Highway construction equipment tyre and tracks business of the Camso brand. The all-cash deal is valued at $225 million.

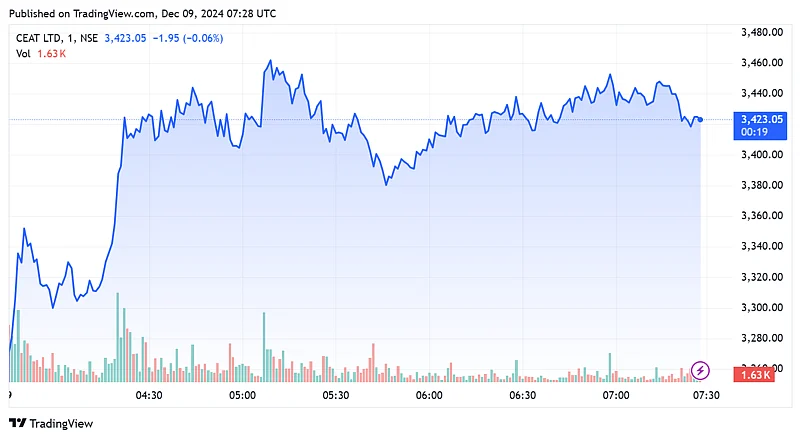

At 12:30 pm, CEAT shares were trading at Rs 3,443 price level, up by more than 11 per cent on the National Stock Exchange.

The deal includes a business with a revenue of $213 million for CY23, alongside two manufacturing facilities and global ownership of the Camso brand.

"Camso is a premium brand in construction equipment tyre and tracks with strong equity in EU and North American aftermarket and OE segments. The Camso brand will be permanently assigned to CEAT across categories after a 3-year licensing period," CEAT said in an exchange filing.

The deal is also expected to expand CEAT's product portfolio in the off-highway tyres and tracks segments, such as agriculture tyres and tracks, harvester tyres and tracks, power sports tracks and material handling tyres.

What do analysts have to say?

Post the acquisition announcement, many brokerage houses have taken a positive call on CEAT's share price. JM Financials has given a BUY rating with a target price of Rs 3,500.

IIFL has also maintained a BUY rating on the company with a target price of Rs 4,000 calling the Michelin deal as a "good strategic fit." The acquisition is expected to be EPS accretive, with reasonable valuations implying a 7-8 per cent EPS accretion by FY26, the brokerage house stated.

However, Nomura has maintained a NEUTRAL rating on the stock with a target price of Rs 3051. According to the investment firm, the acquisition will provide CEAT a wider OTH (off-highway) portfolio and access to Camso’s extensive network in the longer run.

On year-to-date basis, the shares of the company have delivered a return of more than 40 per cent on both NSE and BSE. On an annual basis, the shares of the company have surged by more than 50 per cent.