Average daily turnover fell below ₹1 lakh crore in August, marking the second monthly decline.

Retail and HNI participation slowed, while SIP flows stayed resilient.

Analysts cite weak returns, tighter F&O norms, and high STT as key drags on sentiment.

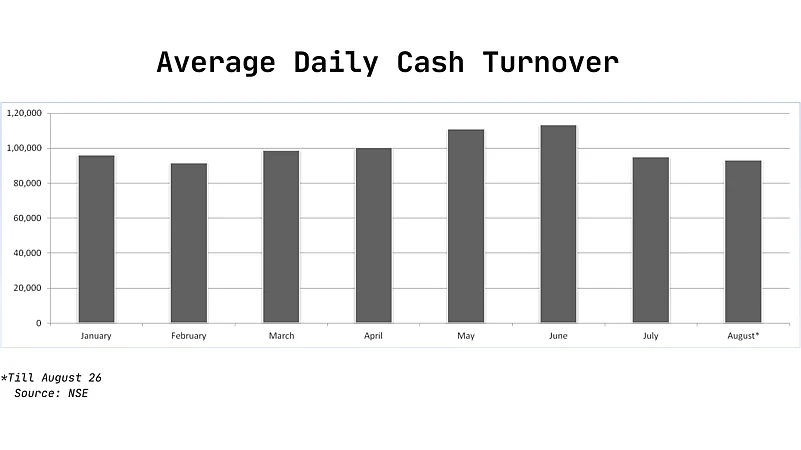

Muted market conditions, faltering sentiment as investors grapple with global uncertainties in the face of tariffs and trade wars, combined with a rather lackluster earnings season has taken a toll over cash market activity in August. The average daily turnover in the cash segment has taken a hit, dropping below Rs 1 lakh crore in August thus far, slipping to the lowest level seen since February.

The moderation in average daily turnovers also marks the second straight month of decline on a month-on-month basis. Average daily turnovers in July dropped over 16% from the year’s high in June to ₹ 94,995 crore. Thereafter, it has dropped another 2% on month to ₹ 93,156 crore in August.

Meanwhile, the stock market performance has also reflected a similar move through August as benchmark indices have traded sideways in recent weeks, on the back of muted volumes. The headline Nifty 50 has fallen just close to a percent in August thus far, reflecting the lackluster sentiment lingering among investors.

While domestic liquidity through systemic investment plans (SIPs) have remained resilient, testing all-time highs, individual investor participation has moderated. The sentimental change is also evident in the moderating retail interest seen in the primary market. Across most recent public offerings, retail investors have more often than not lagged in subscription numbers as compared to qualified institutional buyers (QIBs) and non-institutional investors (NIIs).

Experts added that while flows into primary markets and block deals have remained robust, direct investor sentiment in the secondary market has weakened due to lacklustre returns over the past year.

Analysts at Kotak have often argued the price agnostic nature of retail investments as a key concern to the market sentiment as it runs high on ‘narratives’ rather than fundamentals. In addition, the lackluster returns in the past one year, a major shift from robust gains made by investors post-COVID has been another cause behind the faltering sentiment. New-age investors, attracted by the lure of solid market returns are now staring at their portfolios not moving a needle, resulting in risk-aversion towards future investments.

Meanwhile, NSE’s latest market pulse report also highlighted the contraction in turnover to be primarily driven by high-ticket investors that recorded a decline in activity from the equity cash segment.

To that effect, market experts have also called for the government to take steps towards reducing Securities Transaction Tax (STT), in a bid to revive demand from high-net worth individuals (HNIs). Puneet Singhania, director at Master Trust Group, in an interaction with Moneycontrol, said the government must take steps to deepen the cash market and enhance volumes. “The reduction of Securities Transaction Tax (STT) is critical, as higher STT makes cash market trading more expensive compared to options,” he added.

Meanwhile, turnover in the derivatives segment also eased in August, which according to analysts, was impacted by the market watchdog Sebi’s (Securities and Exchanges Board of India) tighter F&O trading norms and an exit of Jane Street. Sebi’s tighter F&O norms, though aimed at curbing excessive retail speculation, have eventually weighed down on trading volumes. Meanwhile, reports of the market watchdog preparing to set up norms to mandate cash market presence when betting in the F&O space has also soured sentiment among traders.