Retail investors remain the dominant force in the market, with their steady inflows overpowering fundamentals.

Despite foreign portfolio investor outflows, valuations continue to look stretched as retail liquidity-driven optimism fuels prices.

Kotak cautions that investors may be mistaking elevated stock prices for sustainable returns, creating risks of disappointment ahead.

Indian equities are locked in the grip of retail investors as sentiment guides market moves rather than fundamentals playing in the background. A recent report from Kotak Institutional Equities highlights how the relentless flow of domestic capital, rather than earnings growth or fundamentals, is setting the tone for equities, particularly in the highly expensive mid- and small-cap space.

“The Indian market continues to be in the thrall of domestic retail investors and retail investors seem to be in thrall of the market,” Kotak said, highlighting the circular loop that has blanketed market patterns in recent times.

In that backdrop, analysts and institutional investors, normally seen as the anchors of valuation are faced with challenge to rationalize high prices in the market. “Fundamentals are playing a sideshow,” Kotak remarked, flagging how the upbeat sentiment is pushing market participants to stretch narratives and hopes of recovery in order to justify already stretched multiples.

The numbers behind the surge

Since 2024, domestic investors have poured in close to $117 billion into Indian equities, largely through mutual funds and direct retail flows. In the same period, foreign investors have dumped equities worth about $32 billion, according to Kotak’s estimates. And the effect has left clear footprints in the surge in market capitalisation and sectoral rallies that have often defied weak earnings or patchy consumption trends.

Promoters, for their part, are seizing on the opportunity, executing stake sales to make massive gains out of the high valuations. Several large stake sales in recent months suggest insiders are using elevated prices to pare holdings, Kotak believes. In several cases, like that in Whirlpool, the Indian subsidiaries of global firms command a higher valuation as compared to the parent. This disparity has also prompted promoters to offload stake to make stellar gains.

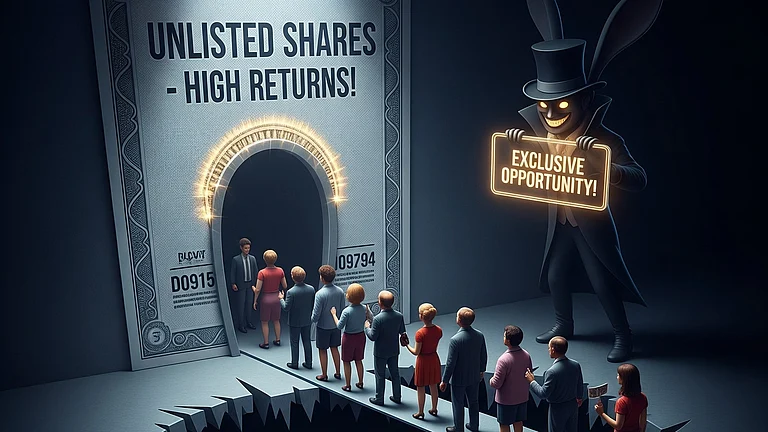

The root of the cause tends to lie in the confidence of retail investors in Indian equities delivering good returns at any price is creating its own momentum, Kotak said. This momentum, however, is not matched by the rate of profit growth across sectors.

Fundamentals take a back seat

Earnings downgrades, slower-than-expected demand recovery, and global headwinds have done little to dent the tide, despite the moderation in flows since February market downturn. “Analysts and institutions are compelled to justify elevated market levels, rather than markets being led by earnings fundamentals,” Kotak said.

This shift has given valuations an air of inevitability. Once prices rise, sentiment reinforces them, and research tends to follow, with analysts assigning new valuations and price targets based on current prices rather than pure fundamentals, Kotak flagged.

Returns mute, risks rise

The past year’s equity performance has been underwhelming by historical standards, with indices delivering marginal returns compared to the euphoria implied by fund inflows. However, consistent DII inflows has helped the market stand resilient in the face of the FII exodus and uncertain global macro conditions.

Weighing on that, Kotak suggests that households may be overestimating how much safety equities can offer at current levels. “High prices are not the same as high returns,” the report warned, adding that equities already account for a much larger share of household financial savings than before.

To that effect, any correction could therefore have a more direct impact on individual balance sheets. Kotak also flagged disruption risks across industries from technology to consumer-facing businesses which could pressure profitability even as valuations remain lofty.

The bigger picture

For now, domestic flows remain the guiding star of the market with fundamentals getting lost in the shadows. As long as retail investors continue to channel savings into equities, indices may remain stuck at elevated levels, even if the real economy sends more muted signals.

But Kotak’s bottom line comes with a warning forecast. “The market’s reliance on household flows makes it more vulnerable to sentiment shifts,” it said.