After SBI, Bank of India has also marked Reliance Communications’ loan accounts as ‘fraud’.

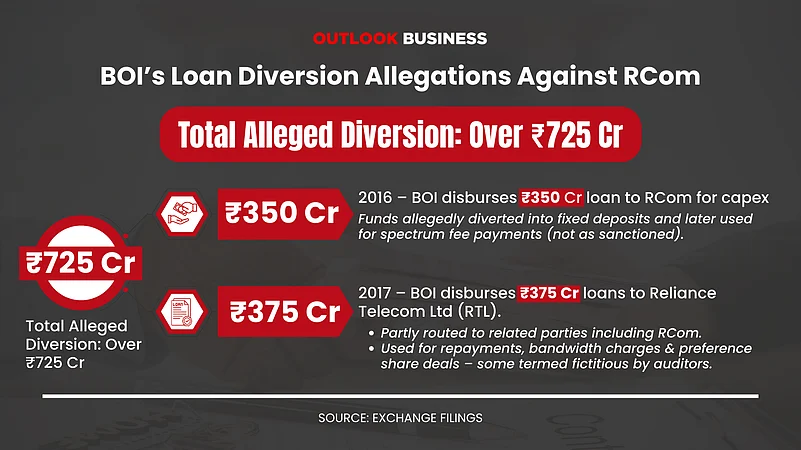

The BOI case involves dues of about ₹725 crore, allegedly diverted from spectrum payments to fixed deposits.

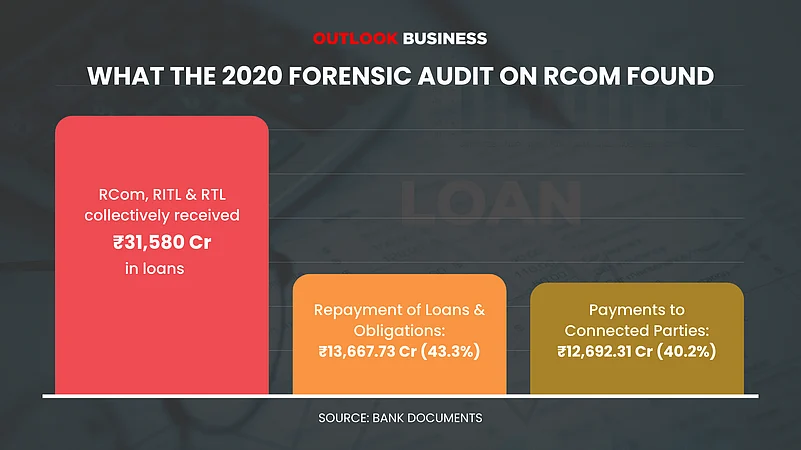

SBI earlier flagged a much larger suspected diversion of over ₹31,500 crore across RCom companies.

Its allegations are based on a 2020 audit report which says much of the loans were spent on unauthorised purposes.

After State Bank of India (SBI) another public sector bank, Bank of India (BOI) has also reclassified the loan accounts of Anil Ambani's bankrupt telecom firm Reliance Communications (RCom) as "fraud". This came less than two months after a similar move by SBI which has now filed an FIR with the CBI.

The latest case revolves around dues of just over ₹725 crore from BOI which it says were taken to pay spectrum dues in buying 3G spectrum but were actually invested in fixed deposits, mutual funds and other operational expenditure.

The above-mentioned amount is just a small part of the alleged fund diversion SBI flagged in its allegations against RCom. SBI's Fraud Identification Committee looked into RCom and its group companies, Reliance Telecom (RTL) and Reliance Infratel (RITL), borrowings of over ₹31,500 crore. It found that ₹13,667 crore of these loans were used to repay other borrowings, ₹12,692 crore was transferred to related or connected companies and ₹6,265 crore was used for purposes not approved by the bank, violating loan terms.

Over these claims Ambani's team has been flagging the delayed action by the lenders.

"It is a matter of record that RCom had a lender consortium comprising 14 banks. Astonishingly, after an inordinate lapse of more than 10 years, select lenders have now chosen to initiate proceedings in a staggered and selective manner," a spokesperson on behalf of Ambani said on August 24.

The rebuttal to BOI added that Ambani served only as a non-executive director on the board of RCom and resigned from this position in 2019 over six years ago. He had no role whatsoever in the day-to-day operations or decision-making of the company.

Notably, BOI has not only classified RCom's loan account as fraud but also named some of its executives. This includes Ambani who was promoter and director of RCom and another director Ashok Kacker, RCom subsidiary RTL, its two directors Grace Thomas and Satheesh Seth and other executives like Gautam Bhailal Doshi, Dagdulal Kasturchand Jain, Satyendra Mohanlal Sarpuria and Prakash Shenoy.

RCom Fraud Tag Timeline

RCom filed for bankruptcy in 2019 under the weight of roughly ₹49,000 crore debt. Most of this was taken to buy assets overseas or 3G spectrum in 2016. Subsequently, a consortium of lenders led by SBI ordered a forensic audit of its books in 2020 through BDO India, a forensic audit and accounting firm.

The audit report submitted on October 15, 2020 later became the basis of fund diversion allegations against the telecom firm and its promoters.

In the case of BOI, it first classified RCom’s account as non-performing in June 2017 and post forensic audit declared it as fraud on September 29, 2021. However, in December 2023 RBI deactivated the fraud classification report following a Supreme Court judgment in SBI vs Rajesh Agarwal.

The court ruled that banks must give borrowers an opportunity to be heard before declaring their accounts as fraud emphasising that classification cannot be based solely on forensic audit findings. In line with this ruling RBI directed banks to roll back fraud tags imposed without following due process.

BOI says, "Accordingly the branch initiated action for re-examination and issued a show-cause notice on August 19, 2024 to RCom and clarification on September 6, 2024 to all available addresses of erstwhile promoters/directors including RCom’s registered addresses." The lender says it could only declare the company as "fraud though the account is under National Company Law Tribunal (NCLT) moratorium". For the erstwhile directors it did not "find any merits in the reply". Earlier SBI had also followed a similar timeline. It sent notices on March 5, 2024 and then shared evidence on September 26, 2024.

Outlook Business earlier reported how RBI's revised master directions on fraud risk management on July 15, 2024 was one of the triggers for reclassification by SBI. The new RBI guidelines included a six-month window for banks to upgrade their early warning systems and account red-flagging processes and a mandatory review of fraud-risk policies by the board at least once every three years.

Under these rules, before classifying any account as fraud, banks must issue a show-cause notice and allow 21 days for a response in line with the Supreme Court’s ruling. Earlier Canara Bank had also classified the RCom and RTL loan accounts as fraud in November 2024.

What are RCom’s Alleged Violations?

As mentioned before, BOI claimed that dues of over ₹725 crore from the telecom operator and its subsidiaries were not used for the purpose sanctioned. The lender says that a forensic audit found that a ₹350 crore loan disbursed by BOI to RCom in October 2016 for capital and operational expenditure was diverted into fixed deposits and later used for spectrum fee payments, violating the loan’s sanction terms.

Similarly, loans totalling ₹375 crore disbursed to RTL were partly routed to related parties including RCom and used for repayments, bandwidth charges and preference share transactions, some of which appeared fictitious.

Another ₹50 crore loan given by BOI in December 2016 to RTL was also diverted to RCom contrary to sanction conditions. Auditor BDO concluded that these transactions involved diversion of funds, non-compliance with sanction terms and improper use of bank loans.

But this is just part of the allegations. Canara Bank outlined some other charges against RCom. It reiterated SBI's allegations of fund diversion where ₹31,580 crore from banks by RCom, RITL and RTL cumulatively, out of which ₹13,668 crore (44%) was utilised for repayment of loans and other obligations to banks/financial institutions and ₹12,692 crore (41%) was paid to connected parties.

For example, loans taken by RITL were passed on to RCom through group companies. Out of ₹1,976 crore raised around ₹1,784 crore ended up with RCom which used the money mainly to repay other bank loans and transfer funds to related parties.

In another instance, RCom got loans of ₹228 crore (Term Loan I) and ₹1,000 crore (Term Loan II) from Bank of Baroda in December 2016 for capital expenditure. However, ₹469 crore from these loans was diverted to Reliance Communications Infrastructure (RCIL) and Reliance Telecom Services (RTSL) for non-capital uses violating loan conditions.

The auditor found that RCom, RITL and RTL frequently shifted loan money between themselves. For example, RCom transferred ₹783.1 crore to RITL and ₹1,435 crore to RTL from bank loans it had raised. RITL used invoice discounting (raising money against bills) worth ₹200 crore but diverted the funds to RCIL for repaying related party loans. New bills were discounted each month to cover the previous facility creating a rolling misuse of funds.

RITL discounted bills worth ₹8,514.7 crore for RCom and ₹1,041 crore for RTL in one instance of large-scale bill discounting. Most of this money was again used to pay related parties instead of genuine business purposes as per the audit report.

In January 2015, RCom issued around 9 crore shares to Telecom Infrastructure Finance for ₹1,300 crore. The funds were invested in mutual funds (₹770 crore) and used to repay banks (₹527 crore) rather than being ploughed directly into operations.

RCom, RITL and RTL borrowed and lent extensively through inter-corporate deposits (ICDs) with connected parties. During the review period, ₹41,863 crore was raised via ICDs of which only ₹28,422 crore could be traced. Out of this, ₹23,128 crore went to related parties and ₹3,215 crore was used to repay bank loans.

More Lenders Coming After RCom?

Corporate insolvency resolution proceedings commenced in May 2018 against RCom and by 2021, its committee of creditors had received 1,791 claims.

The total claims admitted against the company are about ₹9.4 lakh crore while contingent claims (those dependent on future events) add up to about ₹4.5 lakh crore. Out of this about ₹4.3 lakh crore (46.2% of total claims admitted) comes from secured financial creditors which include major banks such as SBI, Canara Bank, Syndicate Bank, IDBI Bank, Standard Chartered, UCO Bank, SC Lowy, Vijaya Bank (now BOB), Yes Bank and 30 other lenders.

As Ambani’s statement says, at present RCom is being managed under the supervision of a committee of creditors led by SBI and overseen by resolution professional Anish Niranjan Nanavaty. The matter remains sub judice pending before the NCLT and other judicial forums including the Supreme Court for the past six years.

While Ambani has categorically denied all allegations and charges and will pursue remedies, the CBI has conducted raids at his home in Mumbai. On August 23 Ambani's home as well as RCom's office were also searched by the investigative agency.

As per a July 3 exchange filing by RCom, the company's total financial indebtedness including both short-term and long-term debt stands at ₹40,413 crore. This includes a total outstanding loan of ₹28,826 crore from banks and financial institutions all of which are in default and unpaid interest amounts of ₹31,175 crore on bank loans and ₹3,465 crore on non-convertible debentures. It remains to be seen if other lenders will take similar actions as SBI, BOI and Canara Bank.