Abhi (name changed on request), a Bengaluru-based techie worked with a few small start-ups, before launching his own AI venture. Though he initially spurned the well-trodden path to a top-dollar Silicon Valley job, reasoning, “who would want to leave the comfort of home?” he eventually made the move. “You cannot wait endlessly, can you?” he reflects with a little shrug.

Months of discussions with investors and customers had taken him nowhere, showing that start-ups in India were simply not quick enough on the AI draw. The bottom-line: Compared to global tech hubs, India enterprises are labouring at an early stage of the AI curve and adoption continues to be slow. Result: like Abhi, many start-up founders are moving out.

A Worrying Exodus

India must step up its AI game because as Vladimir Putin, of all the people, recently pointed out, “Whoever becomes the leader in this sphere will become the ruler of the world.” True.

In the midst of tumultuous geopolitical changes that are shaking up established power equations, resurrecting protectionism, and resetting political alignments, countries must focus on developing their own AI infrastructure, to secure their strategic fences. The surge of MAGA-driven jingoism in the US, for example, has seen Donald Trump unleash a flurry of tariffs and restrictions, at least some of them aimed at capping advanced AI chips exports to countries like India.

Moreover, other than being more affordable, indigenous AI would be far more suitable to India, trained for its diverse languages and contexts, precisely the reason countries like Japan and Korea have developed their local models. This is what G20 Sherpa Amitabh Kant meant when he recently said that "we cannot be colonies of the USA and China.”

The start-up founders Outlook Business spoke to said that though AI application ventures can raise capital in the country, infrastructure requires larger funding rounds which is tough given only a handful of Indian investors truly understand the space. Not surprisingly, 90% of Indian AI funding goes to AI applications and tools, with applications alone cornering around 76%, says a report titled ‘SenseAI Annual Report 2025’.

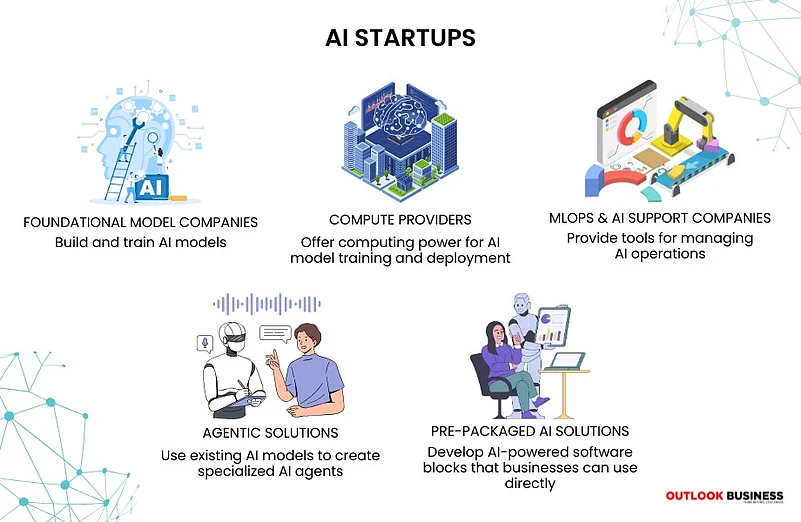

AI infrastructure start-ups develop the technologies underlying AI building-blocks, such as computing power, AI models, and supporting tools for other businesses or for their own use.

Abhi’s story of frustration is echoed by start-ups across the space. Take for example, Arko C, co-founder & CEO of Pipeshift, a platform that helps engineering teams use open-source AI. After struggling in vain for months to get investors interested, the firm moved to the US in March 2024. The experience highlighted two facts: First, many investors in India didn’t understand the space and, second: It was much easier to find takers for such ideas in places like the Bay Area. The start-up raised a US $2.5 million seed round on its Y Combinator demo day.

An AI start-up founder speaking on condition of anonymity , talks about how during its seed round, investors focused on the venture’s go-to-market strategy and revenue projections, particularly its roadmap to reach $1 million in revenue within a set timeframe. “While this is a fair expectation, many investors didn’t probe us on our GTM strategy or developer platform, as they lacked a strong understanding of the infrastructure businesses,” said the founder whose start-up relocated to the US in February 2023.

Indian VCs often encourage founders to relocate if their primary market is the US, not to move them away from India but to help them capitalise on the stronger market demand and greater market exposure there.

Many start-up founders highlight that when they pitch to Indian companies, they realise that the market here is still quite nascent. US investors and businesses are more inclined to buy off-the-shelf solutions rather than build in-house quite unlike Indian companies, which prefer to develop their own AI infrastructure, making it a harder market to crack.

“Customers in the US know exactly what they’re looking for, creating a strong demand pull,” said Sarthak Shrivastava, co-founder, Floworks. The company builds AI agents that can replace humans in B2B sales. In early 2023, the company joined Y Combinator’s in-person cohort, spending four months in San Francisco—a move that highlighted the importance of US market exposure for Indian start-ups. The relative price sensitivity of the Indian market is another dampener, prompting start-ups to flock to the US, says Sudarshan Kamath, co-founder of smallest.ai.

“In India, a voice agent at Rs 4 per minute is considered costly, with companies comparing it to a Rs 15,000–20,000 monthly salary for human callers. In the US, however, customers readily pay Rs 8–9 per minute for quality,” said Kamath. With the US market being larger and more mature, smallest.ai operates in both countries. While it has no immediate plans to relocate, Kamath does not rule out the possibility. “You never know,” he says, enigmatically.

Fault-lines Beyond Funding

Many investors argue that AI startups in India prefer applications over infrastructure due to the sheer complexity of the latter. Unlike AI application startups, which can serve small businesses with straightforward solutions, infrastructure AI demands sophisticated technology and caters to more demanding customers. This makes it a tougher, though less crowded space.

“There is enough funding available in India for both application and infrastructure AI companies. However, the latter need to cater to international markets like the US to scale significantly, which makes them harder to build within India alone,” said Prayank Swaroop, Partner at Accel.

Other investors point to successful start-ups like Sarvam.ai and Krutrim.ai to argue that had funding been the issue these ventures wouldn’t have raised money. So, where is the problem according to them: “Start-ups require a strong research ecosystem, access to top scientists, and collaboration with industry experts. Additionally, if most potential customers are in the US or Europe, relocating makes good business sense,” said Murali Krishna Gunturu, founding member, Inflexor Ventures.

But this raises a larger question: Is India truly ready for the AI race? India lags in AI research, essentially owing to how little it invests in R&D compared to global leaders like the US and China. The country's Gross Expenditure on Research and Development (GERD) has consistently hovered around 0.7% of its GDP over the last decade, much lower than the US (3.4%) and China (2,68%). The difference is far bigger than even those figures indicate given the much bigger GDPs of those countries. India ranks 11th in AI research, with the US, China, and the UK leading the pack. If the country is serious about vaulting to global AI leadership, it must build a robust research ecosystem and prioritise long-term funding for infrastructure and policies that incentivise innovation. Otherwise, the its best AI brains will continue to drain to the US and other attractive destinations.