FMCG firms struggling with weak demand, rising costs, and competition may see relief with GST rationalisation.

PM Modi’s Independence Day announcement could boost consumption and bridge the price gap with unorganised players.

Analysts believe the move will help expand the companies' market reach and improve penetration across segments.

Fast-moving consumer goods (FMCG) companies, which have been facing weak demand, high competition and input cost pressure, might finally see a turnaround with the upcoming rationalisation of GST rates. Analysts say the announcement by Prime Minister Narendra Modi on Independence Day has the potential to spur demand, narrow the price gap with unorganised players and improve market penetration.

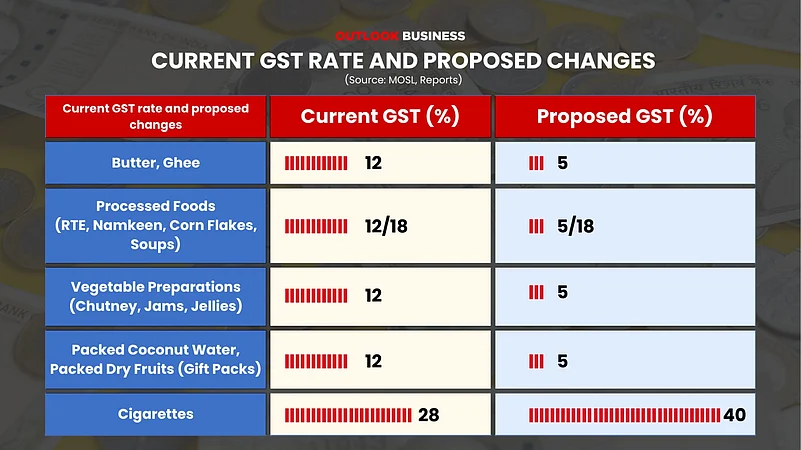

Though there is no official confirmation, the government plans to reduce the current four slabs of goods and services tax (5%, 12%, 18%, 28%) to just two slabs 5% and 18%.

Citing media reports, Motilal Oswal Financial Services in a note said that 99% of items currently in the 12% slab are likely to move to 5%, benefiting everyday consumer goods. Around 90% of the items in the 28% slab may be moved to 18%. A special 40% GST slab is also proposed for sin or luxury goods like alcohol and cigarette.

"This is in addition to the income tax relief provided under the new tax regime in the last Union Budget 2025–26, with potential savings of ₹1 trillion for taxpayers. These moves show that the government has strengthened its focus on consumption revival," said Motilal Oswal in a report on August 18.

The proposal, set to be rolled out around Diwali, will still have to go through a Group of Ministers (GoM) panel and be passed by the GST Council.

How Will FMCGs Benefit from GST Rejig

Among the goods expected to benefit from a GST rate cut from 12% to 5% are dairy products, processed foods, and packaged items. Brokerages say dairy products like butter and ghee will directly help dairy firms, while also supporting food processing companies and quick-service restaurants that rely on butter. Processed foods such as ready-to-eat items and namkeens will boost players like Britannia, Nestle and Bikaji.

Preparations made from vegetables, including chutneys, jams and jellies, are likely to aid companies such as Hindustan Unilever and Dabur. Additionally, packed coconut water and packed dry fruits in gift packs will also become cheaper under the lower tax slab.

Centrum says tax changes for the 18% slab will be closely monitored given its high salience in overall GST collections. Several essential categories currently have an 18% GST rate, including home care (detergents, utensil cleaners, air fresheners), haircare (hair oils, shampoo, serum, hair colour), oral care (toothpaste, toothbrush, dental floss), and skin care (soaps, hand wash, face wash, skin cream & lotions, body wash).

"At lower price points (₹5–10), pricing will remain the same; however, grammages will increase, which will lead to volume growth. At higher price points, companies can increase grammage or cut MRP," it wrote on August 17.

They believe the overall GST rationalisation will improve consumer sentiment, spur demand (volume pick-up), narrow the pricing gap between large organised players and unorganised players, leading to formalization, and enhance market penetration (low-priced SKUs will enable accessibility, especially in rural markets) and premiumisation.

How Deep-Rooted Is the Consumption Slump?

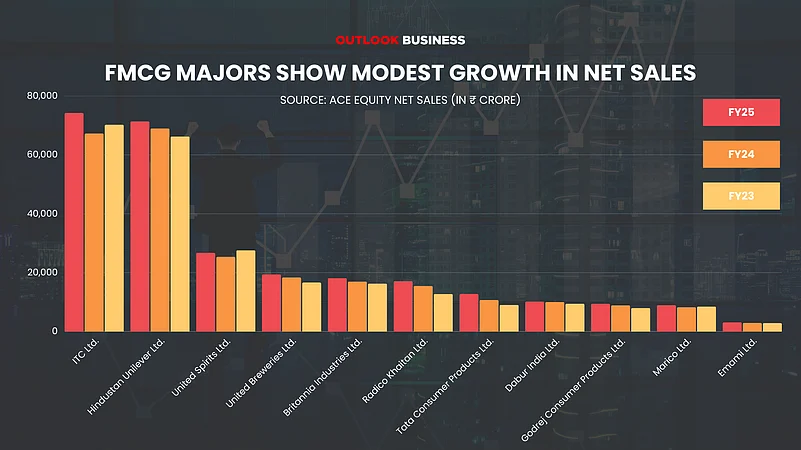

In the last three years, consumption was impacted by high inflation, rising interest rates, and a lack of government initiatives, says Motilal Oswal. This has led to stagnation in companies’ revenue growth. Among the FMCG companies the brokerage covers, revenue growth has been just 6% and 5% in FY24 and FY25. These companies include giants like Hindustan Unilever, ITC, Britannia, Godrej Consumer and others.

Post pandemic, rural India saw high inflation, weak farm incomes, and stagnant wages eroding savings and consumption. Between FY21–23, rural inflation averaged 7.5% due to erratic weather and rising input costs. Since then, easing inflation, better harvests, and government support have lifted agricultural wages and pushed rural consumption growth above urban levels.

Meanwhile, in urban India, high food inflation, muted income growth, and rising housing costs weighed on demand. Essentials like cereals, oils, vegetables, and fruits witnessed sharp price spikes in 2024, in many cases passed on by FMCG companies. Though inflation in food items has eased since mid-2024, housing costs remain a drag. Still, RBI data shows consumer confidence in cities has been improving since April 2025, narrowing the gap between current and future outlook, and indicating a more positive trend in consumption going forward.

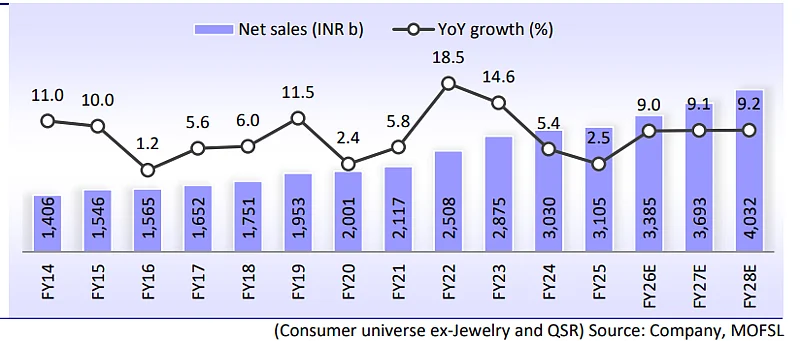

Data collected by Motilal shows that net sales growth of FMCG companies sharply declined after FY22. It fell from 18.5% in FY22 to 5.4% in FY24 and further down to 2.5% in FY25. The brokerage says sales growth was impacted by price cuts, weak rural sentiment, and faster changes in consumer preferences in urban areas in terms of brands (D2C, etc.) and distribution channels (e-commerce, quick commerce, etc.).

Q1 Shows Signs of Revival

In the first quarter of FY26, the stagnating revenue growth of the sector seems to have improved, with companies reporting 10% growth, as per Motilal. But Centrum analysts note that large companies have seen lower growth compared to the overall industry, showing smaller players have gained share.

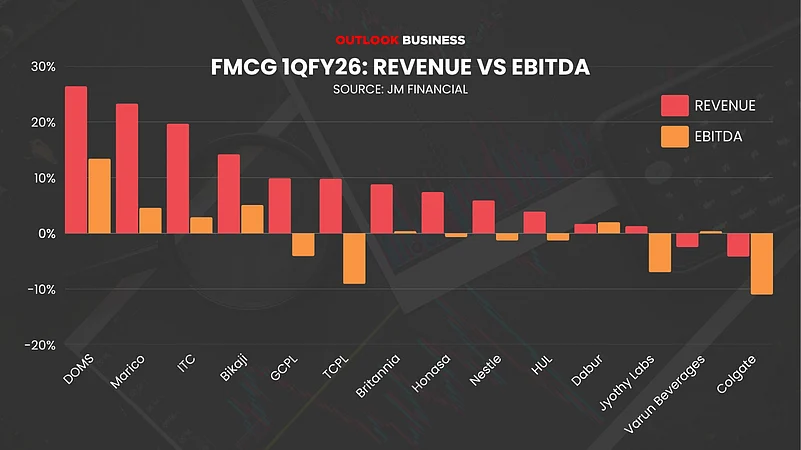

In Q1FY26, barring ITC, all the larger FMCG players delivered single-digit revenue growth. HUL recorded a modest 3.9%, Godrej Consumer 9.9%, Tata Consumer Products 9.8%, Britannia 8.8% and Nestlé 5.9%. Meanwhile, Marico delivered 23.3% topline growth, Bikaji 14.2%, and DOMS 26.4%. Some companies like Colgate (-4.2%) and Varun Beverages (-2.5%) saw declines.

Not Everyone Will Win

According to JM Financial, in Q1FY26 FMCG companies’ EBITDA slipped 2% YoY. According to its earnings estimates, Marico, Honasa, and Bikaji hit the mark in EBITDA growth, while GCPL, TCPL, Nestlé, Britannia, and Colgate missed. Most players, except Colgate and Britannia, saw an improvement in volumes compared to recent quarters, but gross margins disappointed due to higher-cost inventory and limited price hikes.

As per NIQ, in the near term rural markets continued to outpace urban for the sixth consecutive quarter. However, urban markets are witnessing a rebound and the gap is narrowing. Rural demand grew at double the pace of urban demand in Q1FY26. Rural volume growth was 8.4% vs 4.3% in urban areas. However, the gap is narrowing as urban areas show signs of sequential recovery.

According to Motilal, most consumer companies in their recent earnings calls stated that with inflation easing and a favourable monsoon outlook, they remain positive on the consumption uptick.

"While there are early green shoots of urban demand recovery, any delay in these markets can weigh on our projections," said the brokerage, adding that the next 12–24 months will be an interesting period for consumption.

With fast-changing consumer behaviour, rapidly evolving consumer reach, and a rising competitive landscape, Motilal says companies need to be more agile to remain fit for their consumer base.

"Consumer acquisition is becoming difficult, and retaining the same is also becoming a task. Thereby, companies with futuristic portfolios and those ready to take risks to be more aggressive and agile will command rich valuations," it said.