India, as the world's fastest-growing economy, showed enough resilience amid global turbulence but now faces a bout of uncertainty. A fresh spate of geopolitical shocks, including the recent escalation of the Israel-Iran conflict, fraught US-China and US-India trade relations, is starting to weigh on India's economic outlook.

While experts are not predicting any immediate distress over India's economy, however, they flagged that these shocks may start showing up in trade data, market behaviour and macro indicators sooner than policymakers hope.

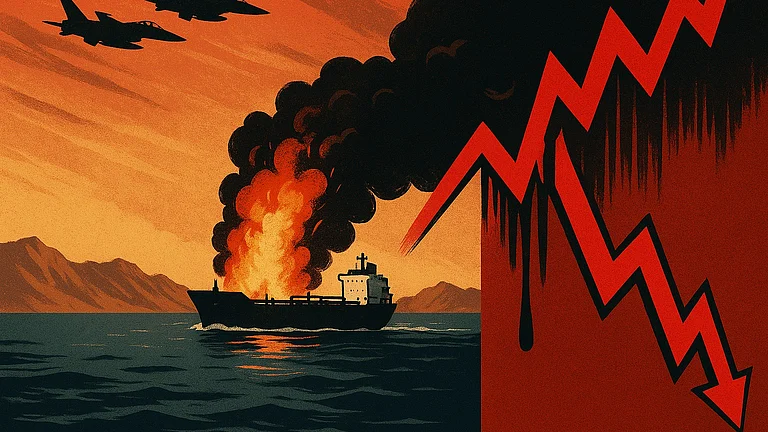

Cruelty of Crude

The ongoing conflict in West Asia has pushed global crude oil prices to a five-month high already, amid fears of a supply shock through the vital shipping route the Strait of Hormuz. Due to India's dependence on energy imports, it may bear the brunt of any sustained rise in crude oil prices.

Sanjeev Prasad, MD at Kotak Institutional Equities, said in a report that rising oil prices and staying at elevated levels may weaken India’s macroeconomic position, which was looking quite solid, given the low oil prices. It could also strain the current account and fuel inflation. Nomura, a Japanese financial services group, quantifies the impact, noting every 10% increase in crude oil prices typically widens India’s current account deficit (CAD) by 0.4% of GDP. In addition, some reports indicated that India-based exporters are concerned about higher freight and insurance rates as a result of this crisis.

Trade Gains at Stake

At first glance, India's trade performance in May provide some relief as the merchandise trade deficit narrowed to $21.9bn, down from $26.4bn in April. However, the improvement masks underlying weakness: export growth slipped 2.2% year-on-year and import growth also declined by 1.7%.

Nomura highlighted that there was an increase in export growth to the US and import growth from China in March-April, which could be reflective of a mix of frontloading by India-based exporters before the reciprocal tariffs kick in from July onwards, and China-based exporters rerouting exports through India. During the period, exports to the US grew by nearly 17% year-on-year in May (down from 27% in April), while imports from China remained elevated at 21.6%.

It further underlined that this as a temporary boost that could reverse once inventories are stocked and tariff measures take effect. In sectors like petroleum products, textiles, and engineering goods—key export categories—volume growth has already been weak.

Rare Earth Trouble

On April 4, China imposed export restrictions on seven rare earth elements (REEs) in response to US President Donald Trump's "Liberation Day" tariffs. The supply chain disruptions are adding to India's challenges when Indian auto and electronics manufacturers are struggling with a shortage of rare earth magnets, which are crucial components sourced primarily from China.

Over 80% of India’s annual 540-tonne magnet imports come from China. And as per the latest reports, applications of 30 Indian manufacturers of rare earth-related components are still awaiting the green light from Chinese authorities for supplies to resume. Inventories could run dry by early July, posing risks to the auto sector—which makes up around 5% of India’s merchandise exports—and potentially stalling output in high-growth industries.

India-US BTA Hangs in Balance

Despite India's proactive engagement with the US even before the tariffs were announced on April 2 and reiteration from top officials of both countries that New Delhi might become the first country to seal a deal with Washington, DC, it is yet to materialise. Meanwhile, the UK negotiated a 'mini deal' with the US and Trump also claimed that the deal with China was also "done."

With a 9 July deadline looming—when the temporary exemption from US tariffs is set to expire—talks have entered a critical phase; failing to conclude the deal on time could result in a new wave of protectionism that would directly impact Indian exporters.

Policy Options Narrowing Too

One of the most concerning takeaways from Kotak’s Strategy report is the limited room available for policy intervention amid global headwinds. On the monetary front, the Reserve Bank of India (RBI) has already cut policy rates by 50 basis points and reduced the cash reserve ratio by 100 bps during June review. Further easing looks unlikely unless the external shock deepens substantially.

On the fiscal side, rising oil import bills and narrowing fiscal space are likely to rule out popular stimulus options such as cutting fuel taxes or goods and services tax (GST) rates. Kotak notes that the government may have no scope for fiscal stimulus in the near term, given existing constraints.

Markets May Be Too Confident

Indian equity markets remain buoyant—arguably too buoyant—despite mounting risks. Kotak notes that the Nifty-50 index is trading at 21.2 times forward earnings, well above historical averages amid the swirl of geopolitical uncertainty. But it also flags a deeper concern: the decline of global peacekeepers like the UN, US, and Europe signals a shift from a “rule of law” to a “rule of might” world order. This increases the risk of regional conflicts, trade disruptions, and instability in global capital flows.

"We have long argued for a higher cost of capital to factor in (1) higher geopolitical risks, (2) higher probability of regional conflicts between regional powers and (3) more frequent disruptions to global investment and trade," Kotak noted.

Nevertheless, both reports highlight that India remains well-positioned to benefit from long-term global trends such as supply chain diversification. As firms look beyond China for stable production bases, India is emerging as a preferred alternative, particularly in low- and mid-tech manufacturing.

As world enters one after another phase of heightened uncertainty, the months ahead will reveal whether India can maintain its growth trajectory or will need to recalibrate in the face of global headwinds.