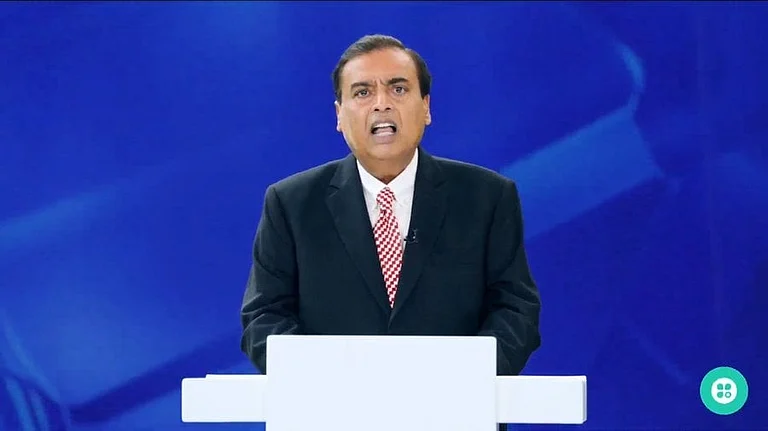

Mukesh Ambani's telecom giant, Reliance Jio, which is reportedly planning an initial public offering (IPO), is set to become the world’s sixth most valued company in the telecom sector post-listing. The company is expected to replace its Indian rival, Bharti Airtel, which currently has a market valuation of about $135 billion.

This is according to a report by Business Standard, citing analysts' estimates. Analysts project Jio's enterprise value (EV) to range between $136 billion and $154 billion at its peak, placing it among the top global telecom companies by valuation.

According to the report, Goldman Sachs offers the most optimistic valuation for the Akash Ambani-led firm at $154 billion. The base-case and bear-case valuations are pegged at $123 billion and $98 billion, respectively. Even at the base-case EV, Jio would rank as the eighth-largest telecom company globally, ahead of American Tower.

Jefferies values Jio at $136 billion, which would place it sixth globally. Of this, $110 billion is attributed to its core telecom operations, with the remainder coming from its non-mobile businesses.

Jio Platforms owns several subsidiaries, including Reliance Jio (mobile and broadband), Jio Satellite, Saavn Media, Jio Haptik Technologies, and Asteria Aerospace. These ventures contribute to its diversified digital and telecom ecosystem.

To date, Jio has raised Rs 152,055 crore from major global investors such as Facebook, Google, KKR, Silver Lake, Mubadala, and TPG. These investors collectively hold a 32.9% stake in the company.

Jio’s Position in Global Telecom Leaderboard

According to current market valuations listed on CompaniesMarketCap.com, Bharti Airtel, led by Sunil Mittal, holds a market capitalisation of $135.41 billion, based on its current share price of $22.59. This places Airtel at the sixth spot among the world’s largest listed telecom companies.

The world’s top five telecom companies by market capitalisation are: T-Mobile US ($281.93 billion), China Mobile ($232.93 billion), AT&T ($197.95 billion), Verizon ($183.57 billion), and Deutsche Telekom ($177.26 billion).

If Jio Platforms reaches its estimated peak valuation of $154 billion, it would surpass Bharti Airtel to take the sixth position globally. This would place it ahead of global giants such as Comcast, China Telecom, NTT, SoftBank, KDDI, Saudi Telecom, América Móvil, and Singapore Telecom.

With its rapid growth, diversified services, and strong investor support, Jio is well-positioned to climb the global telecom rankings—especially if it proceeds with a public listing that could unlock even greater value, as per analyst commentary following Reliance Industries' Q4 results.

Reliance Provides No Comments on IPO During Q4 Conference

The company’s management did not provide a timeline for Jio’s IPO during the post-earnings analyst call last month.

"Someday we will come and tell you now we are going to launch an IPO process. Before that, there is no comment," said Anshuman Thakur, Head of Strategy at Reliance Jio Infocomm Limited.

Reliance's digital business, primarily Jio, reported an EBITDA of Rs 172 billion in Q4FY25, up 3.8% quarter-on-quarter and 18% year-on-year. This slightly beat estimates due to better-than-expected ARPU of Rs 206, driven by the continued effect of the July 2024 tariff hike.

Management expects some more impact from the hike in Q1FY26. Jio added 6.1 million new subscribers, slightly above estimates. Revenue for the quarter stood at Rs 304 billion, 1% higher than expected, though operating costs were also marginally higher.