Even as the direct impact of the Israel-Iran conflict is limited on Indian companies, but they are not breathing easy yet. According to a report from Crisil Ratings, the immediate impact of the West Asia crisis on India Inc as "limited for now," but if the situation deteriorates, some sectors such as basmati rice could see heightened impact and will require

monitoring. Other sectors like fertilisers and diamonds—both cut and polished—may also see some impact.

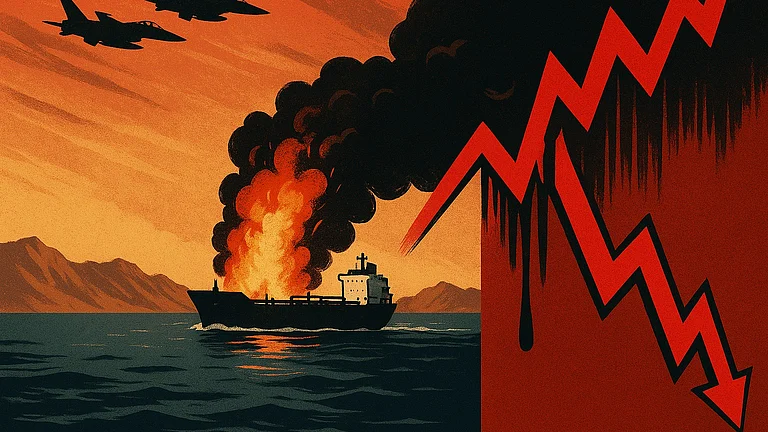

Rising crude prices have already begun to send ripples across global markets, with Brent oil prices climbing to $73-76 per barrel—up from an average of $65 per bbl during April-May 2025. "While this is still lower than the fiscal 2025 average of ~$78 per bbl, any escalation of tensions, say through disruption of energy supply chains, could result in a further spike in oil prices. If crude oil prices continue to be elevated over longer periods, it could impact India Inc’s profits," the rating agency noted.

Industries like aviation, paint, chemicals, synthetic textiles and flexible packaging, which have 30–80% of their input costs linked to crude, may see pressure on profit margins. Airlines, for instance, are grappling with both elevated fuel costs and airspace diversions, even as they try to ride on robust demand. For aviation companies, fuel accounts for about 35-40% of operating costs. Further, the operators will also witness higher fuel costs due to increased travel time on account of airspace closures/diversions.

The paint and speciality chemical sectors, still recovering from past demand shocks and Chinese competition, may struggle to fully pass on these costs to customers. Both the sector's nearly 30% of the operating cost is crude oil linked.

The basmati rice trade could also get caught in the crossfire, as India's 14% of basmati exports go to Iran and Israel. For domestic diamond polishers, Israel is mainly a trading hub, accounting for 4% of the total diamond exports last fiscal year. Additionally, 2% of all rough diamonds imported are from Israel. Disruption could reroute supply chains and complicate logistics.

Even fertilisers aren’t insulated. Israel supplies around 7% of India’s imports of muriate of potash (MoP), and although India has alternate suppliers, costs may rise if global trade flows shift.

And then there’s the less tangible, yet equally potent, risk—freight costs and insurance premiums. Should tensions escalate further, expect increased costs for sea and air shipments, compounding the burden on exporters.

To be clear, India’s overall trade with Israel and Iran is marginal—less than 1% of the country’s total exports and imports. If this geopolitical crisis endures or escalates, India Inc’s resilience could be tested not by direct exposure but by ripple effects in costs, logistics and market confidence.