India weighs autonomy and competitiveness while navigating shifting alliances and trade dynamics.

Rising deficits and tariff battles reshape opportunities for India’s global trade strategy.

BRICS realignments and weakening China boost India’s competitiveness in emerging global markets.

On August 15, PM Modi’s address to the nation contained two key ambitions–being globally competitive and strategically autonomous. The desire for autonomy often exacts a heavy price. Trump treaded on India’s autonomy by imposing a ‘penalty tariff’ for buying Russian oil. What price would India pay to exercise its autonomy?

India hoped that the Trump-Putin Summit at Alaska on the same day, August 15, could offer respite but nothing of that sort happened. The penalty tariff pushed India towards Russia and China. Russia has been an old ally but China has been an adversary since long. The threat of rising imports from China makes people implode with fear.

How close should India get to China? To stay globally competitive India needs a large economy as ally. Trust in Trump has been eroded despite his turnaround and saying that there is “nothing to worry” about the US-India relationship, which he termed a “special relationship”. He may have called Narendra Modi “a great Prime Minister” but his advisors continue their rants against India.

Can China be trusted more than the US in this scenario? There is a natural apprehension about moving closer to China. Once bitten twice shy does apply but the global equations are changing fast. In this reorganisation India needs to pick its allies with thorough analysis.

The Fear of Dragon is Irrational

Two important facts need to be highlighted here. First, the entire tariff turbulence unleashed by Trump emanates from Navarro’s analysis of the rising trade deficit the US has with other countries. If New Delhi also worries about the trade deficit with China then it cannot blame Washington for raising tariffs. Trump, with his protectionist mindset, finds himself distanced and isolated. Speculation is rife about the wreckage of the US economy. Import is not evil; the devil lies in protection.

The US is the largest economy and also the largest importer. China is the second largest economy and also the second largest importer. If India wishes to grow, imports will grow too and China is probably the cheapest source of imports. History shows that raising barriers to imports has raised the prospects of wars. Second, fearing China’s dominance in bilateral trade is a thing of the past.

Trade deficit with China has not created any foreign exchange crisis for India. Despite the $100bn trade deficit with China the forex reserve is healthy at $694bn. India runs a deficit with China but a surplus with the US.

Now there is a new trade environment. India-EU trade negotiations have gained urgency and there is a high likelihood of a Free Trade Agreement. The India-England Comprehensive Economic and Trade Agreement (CETA) has been signed. China is also being targeted on tariffs by the US.

A fresh look at global opportunities is required instead of wilting under the weight of past statistics. The world order has been redrawn. Brazil, Russia, India, China and South Africa (BRICS) and the Shanghai Cooperation Organisation together account for more than 43% of the world population and 23% of global GDP. Old trade surpluses and deficits have little relevance today.

This is India’s moment

India, with 1.46bn population full of aspirations, has less than $5trn GDP which indicates a big appetite for growth. Despite all the global turbulence, its growth rate is the fastest, 7.8% in the last quarter, among large nations.

The US, with $30.5trn GDP and a population of 340mn, has peaked witnessing diseconomies of scale. US debt at $35trn is scary. Fitch downgraded the US sovereign rating in 2023 and Moody’s has also done so in 2025. Fiscal deficit as well as the current account deficit need to be curbed. Last year it spent $525bn on Chinese goods.

As it curtails expenditure, demand for Chinese goods will fall, leaving China with a huge unutilised capacity and raising the average cost of production. China’s strategy of building economies of scale and having low-cost production will not work without US consumption. Thus, China’s growth story too seems to be losing steam.

China fails to recover despite fiscal and monetary incentives. Consumer demand stays tepid while manufacturing and real estate companies stagger. Banks are not as healthy. Liquidity will tighten soon as instances of loan default increase.

Given this, the average cost of production in China will rise, making Indian goods relatively more competitive.

Shifting Trade Dynamics

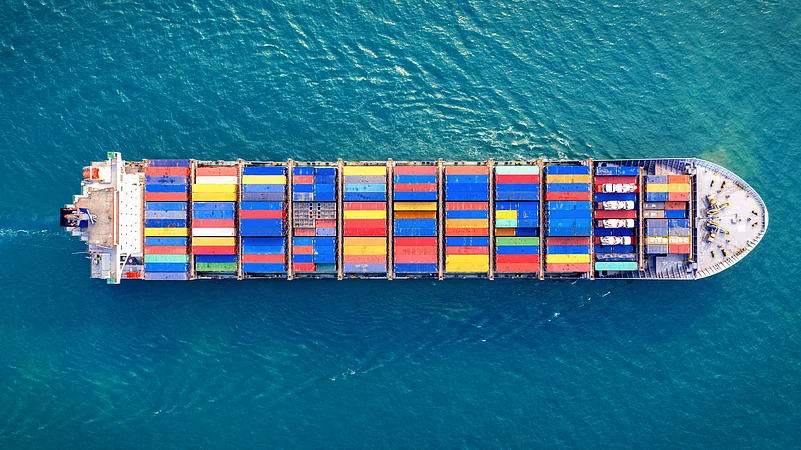

China imports large amounts of soybean, corn, oilseeds, aluminium, integrated circuits, chemicals, computer equipment, medical equipment, industrial machinery, motor vehicles and their components and meat products from the US. India has the capacity to export many of these items like chemicals, aluminium, soybean, oilseeds, integrated circuits, medical equipment and computer equipment.

In the new order, exchange rates will undergo a significant change if the US dollar loses its dominance. If BRICS nations decide to trade among themselves in local currencies, then exchange rates will not be determined via the US dollar.

A high current account deficit between India and China will lead to an appreciation of the yuan, making Indian goods cheaper. The alacrity visible in Modi’s expressions, the defiance seen in Jaishankar’s tone and the confidence conveyed in Sitharaman’s statements indicate that the journey to Viksit Bharat has become more interesting and Trump’s tariffs have acted as an accelerator.

The author is the PGPM Director, Great Lakes Institute of Management, Gurgaon. Views expressed belong solely to the author.