Individual taxpayers and businesses prepare for Union Budget 2026 spending and tax plans.

Budget planning begins early as ministries submit revenue and spending estimates.

Union Budget preparation begins months early, allowing detailed planning and consultations.

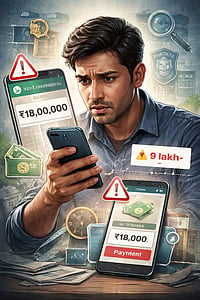

Individual taxpayers and businesses have started preparing for the Union Budget 2026, which will set the government’s spending and taxation plans for the upcoming year. Many are hoping for a smoother shift to the new Income Tax Act, 2025, with changes that make compliance easier and reduce financial pressure.

With inflation affecting household budgets, middle-class families are seeing for measures that increase disposable income and simplify tax rules. Business leaders are also keen on incentives that encourage investment and growth in key sectors.

The budget process starts months in advance. The Ministry of Finance sends out instructions to ministries, states, and autonomous bodies, asking them to submit their revenue and spending plans. These submissions form the basis of the government’s annual financial blueprint.

Officials go through these numbers to estimate revenue, spending, and the fiscal deficit. The Chief Economic Advisor offers guidance on economic trends and policy priorities, helping decide how funds should be allocated.

Union Budget Process

The process of preparing the Union Budget usually begins in August or September, nearly six months before the finance minister presents it in Parliament. This long time helps the government to carry out detailed planning and consultations.

Under Article 112 of the Constitution, the Union Budget is presented as the government’s yearly statement of projected income and spending. It sets the broad economic direction for the year and highlights policy priorities and key expenditure plans.

The exercise starts with the Ministry of Finance issuing guidelines to ministries, states, Union territories and autonomous bodies, asking them to submit estimates of their revenue and expenditure. These inputs serve as the foundation for the entire budget exercise.

Officials then go through the submissions to prepare detailed projections of income, spending and the expected fiscal deficit. The Chief Economic Advisor provides inputs on economic conditions and fiscal choices.

Based on these assessments, the finance minister begins distributing resources across ministries and departments, following consultations with stakeholders and subject experts.

Once the proposals are finalised, they are placed before the Union Cabinet or the Prime Minister for approval. The traditional Halwa Ceremony then signals the start of printing the Budget documents, after which strict confidentiality is maintained until presentation day.

What Can We Expect from Budget 2026–27?

Taxpayers are hoping the budget will make it easier to follow the new Income Tax Act, 2025. Many want simpler procedures and some relief to help households cope with rising prices.

Businesses are looking for support in key sectors. Reports say the government may introduce a new incentive under the Drone Shakti program to encourage domestic drone manufacturing with subsidies and long-term backing.

With Budget day nearing, focus is on how the government will balance spending discipline with relief for households, businesses, and the wider economy.