A missed opportunity at a point in time does come back calling. That’s precisely the case with Star India and its tryst with the Indian Premier League (IPL). In January 2008, when bidding for the tournament began, it was in the backdrop of the Indian cricket team having performed miserably at the World Cup. It had been knocked out at the round robin stage and Sony Entertainment Television (now Sony Pictures Network) had its back to the wall.

The IPL was set to get off the ground in April and the level of interest from broadcasters was being closely watched. Those who put in bids for the 10-year broadcasting right ending 2017, included Sony, World Sports Group, Nimbus, NDTV, private equity major Providence, 9X and, finally, the ESPN-Star Sports combine. That was the scenario till Friday (January 11, 2008) evening. The envelopes were scheduled to be opened the following Monday morning. But to everyone’s surprise there were finally just two bidders in fray on January 14. Over the weekend, Providence, 9X and NDTV had backed out. What began as an exciting bidding process eventually turned out to be a damp squib. While ESPN-Star Sports felt Rs.3,000 crore was a good number, Sony-WSG won the bid by shelling out $1 billion (over Rs.5,200 crore). In 2009, the combine had to renegotiate the bid for Rs.8,200 crore after a brief controversy that saw BCCI terminating the previous deal.

A senior ESPN-Star Sports official admits that it was an error of judgment on Star’s part that saw them lose the bid, the first time around. “We were too conservative and believed it was better to play on the strength of properties such as the World Cup that we were keen on winning,” he says. The combined, which won the rights for the ICC 2011 tournament for $2 billion, eventually parted ways in 2013.

But no one anticipated the response that the IPL would generate, making it India’s marquee domestic cricket tourney with international players. The cocktail of cricketing icons and movie stars as franchise owners made for sound entertainment that was hard to ignore. Putting it in perspective, Rohit Gupta, president (network sales & international business), Sony Pictures Network, says, “We were drawn to it because it was a fast paced sport — just 20 overs. There was a pent-up demand since the 50-over format took too much time. The presence of international players and good promoters backing the teams were critical factors why we bid for it. There was no cricketing property at that point that offered this kind of a combination.” The channel took a chance and priced ad spots at the rates charged for a national level cricket series played between India and another country. The rates started off at Rs.2 lakh for a 10-second slot and increased by another 50% in ten days. “It was an aggressive decision but when the ratings for the first week came out, it was way beyond what we had anticipated,” recalls Gupta.

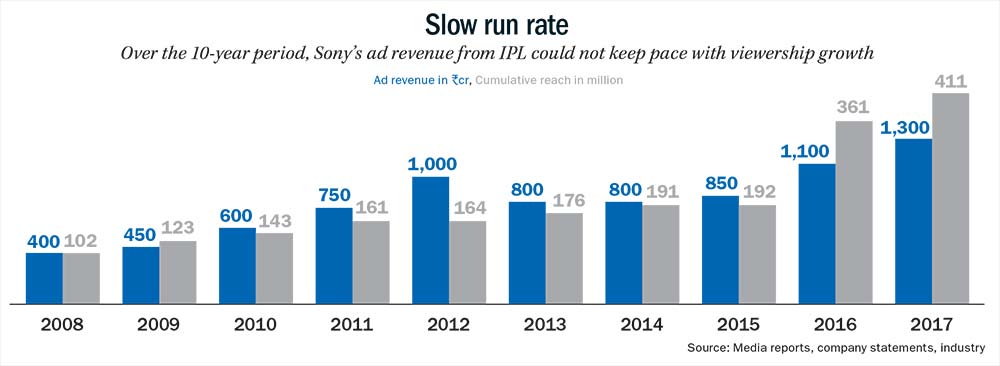

From a viewership of over 100 million in 2008, this year’s edition of IPL had over 400 million viewers, while advertising revenue took off from Rs.400 crore to Rs.1,300 crore over the same period. Not surprising that when the IPL rights came up for grabs this year, Star was keen not to miss the bus. In winning the $2.5 billion (Rs.16,348 crore) bid for all global media rights for five years, it dumb-founded observers and competition alike. There is no annual cricket property across the world that generates this kind of interest and that is what Star is betting on. With this, it becomes the owner of all that matters in cricket but at a huge cost, provoking a critical question — will Star’s big gambit pay off?

Digital play

Star’s bid was the lowest in each of the categories, primarily led by rights for Indian television and digital. What swung it was its consolidated bid, Sony put in a Rs.11,050 crore bid for television, while Facebook’s surprise Rs.3,900 crore bid was the highest for digital. Star’s global bid exceeded the sum of the individual highest bids in the seven categories (a total of Rs.15,819 crore), by 3.3%. It will have to pay Rs.55 crore per match and a minimum of 16% of the overall bid amount every year to BCCI.

By winning the IPL bid, it has starved competition, especially Sony, of content that is relevant to the Indian audience. When Sony acquired Ten Sports from Zee last September for Rs.2,600 crore, it was viewed as being sports content that would merely supplement the next round of the IPL rights. This was a clear indication that Sony would go all out to secure the broadcasting rights, which it did. It was, however, nixed by Star’s consolidated bid. As a result, Star now owns the cricket World Cup rights (the 50-over format and T20) till 2023 and the Champions Trophy till 2023. Now, with the IPL, it puts itself in a clear position of dominance in the cricket story. The task on hand will be to monetise the obvious revenue sources — advertising, subscription, digital and international syndication.

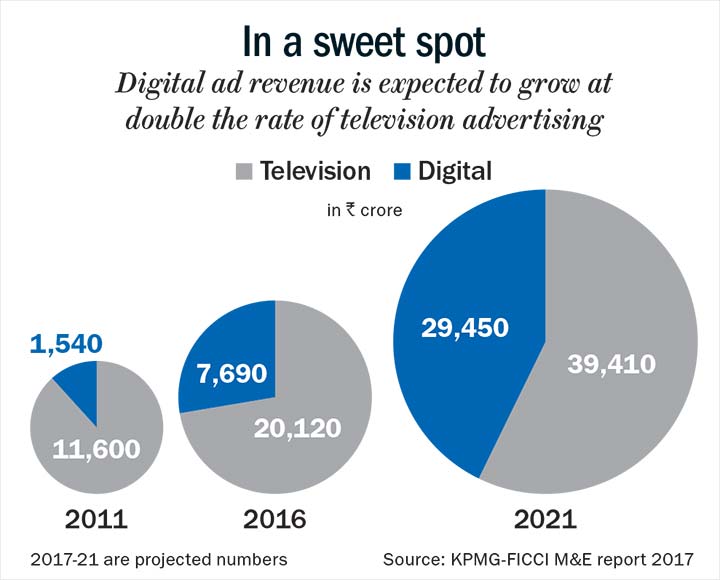

Though Star has had the experience of selling five editions of the World Cup to advertisers on television, digital is quite a different ballgame. It is still the newest medium for advertisers and on a small base has grown impressively. Between 2011 and 2016, the total digital advertising spend, according to KPMG-FICCI’s media and entertainment report, has increased from Rs.1,540 crore to Rs.7,690 crore. During the same period, television from Rs.11,600 crore has grown to Rs.20,100 crore. Of the overall digital advertising pie in 2016, Google (with YouTube) made Rs.5,000 crore, of which Rs.1,200 crore came from YouTube, while Facebook clocked another Rs.1,800 crore, taking away the lion’s share. Facebook has over 200 million subscribers, while YouTube has 100 million.

It is with this potential in mind that Star launched Hotstar, its OTT (over-the-top or content delivered over the internet) in February 2015 just before the year’s World Cup that was played in Australia and New Zealand. The broadcaster already had the television rights for the tournament. Around this time, Star also won the IPL digital rights for Rs.302 crore over three years. It is estimated that Hotstar made Rs.70 crore of advertising revenue on the World Cup and another Rs.35 crore on the IPL in 2015. For 2016 and 2017, Star made Rs.125 crore and Rs.150 crore respectively on the IPL.

Shantanu Sirohi, COO, Interactive Avenues, the country’s largest full services digital agency, says Star would not have made any serious money on the three-year IPL deal since a substantial amount (at least Rs.200 crore, which included Dhoni endorsing Hotstar) would have been spent on marketing. “They recovered the acquisition cost through advertising but realised there was a lot more money to be made in digital. For the incremental spend, the payoff has been in creating a digital platform whose reach rivals that of any large entertainment channel in the country,” he adds. According to filings with the Registrar of Companies, Hotstar grossed revenue of Rs.186 crore for FY16, of which Rs.139 crore was through advertising with the rest from subscription and licensing of content rights. In FY17, Hotstar is estimated to have made Rs.350 crore.

Getting in the buck

In the past, when Sony held the IPL rights, it was restricted to television broadcasting and only for India. Now, with all the rights resting with Star, there is the ability to offer a better deal to advertisers. Besides, Star has removed all the matches from YouTube to which it has the rights. It will, therefore, make it necessary for the digital viewer to watch anything related to the IPL or Star for that matter only on Hotstar.

For the three-year IPL digital rights, Star offered its content for free by relying on advertising. Even today, of its user base, it has only one lakh who pay a monthly fee of Rs.199, bringing in a total of around Rs.25 crore each year, through this revenue stream. The industry buzz is that Star is actively considering offering parts of the IPL free of cost, while special packages such as highlights, exclusive interviews and detailed expert analysis only through subscription.

Clearly, this is driven not by what the IPL has achieved so far but how much can be harnessed. Well known commentator Harsha Bhogle says that IPL 1 (in 2008) was the challenge and thereafter, it was just building on it. “Yes, it has brought into the fold not just the core cricket lovers but also marginal and loads of new viewers. Now, it is a must-see because there are discussions about it and people do not want to be left out of the conversation.”

Based on Star’s consolidated bid for Rs.16,348 crore and deducting Sony’s Rs.11,050 crore for the Indian broadcasting rights, which was the highest in that segment, Star will need to recover around Rs.5,300 crore from digital alone over the five-year period. This is nearly Rs.1,400 crore more than Facebook’s Rs.3,900 crore bid for the digital rights.

Star will need to make Rs.2,210 crore each year just to break even on its broadcasting bid of Rs.11,050 crore. With over 400 million viewers already watching IPL, it would be difficult for Star to get the kind of advertising hikes that Sony was able to get. In IPL 1, Sony made Rs.400 crore from advertising and over a 10-year period, grossed advertising revenue of Rs.8,000 crore. And that definitely looks like a tall ask given that the existing viewership base that lives little room for growth. Even in the case of Sony, the advertising rates couldn’t keep up with the increase in subscriber base (See: Slow run rate). For instance, while the viewer base grew by 15% during the 10-year period, ad rates grew by 12.5%. Even this 15% subscriber growth was helped by one time pop in numbers when the broadcasting industry moved from TAM rating to BARC to include rural viewers in 2016. Thanks to the change in ratings, viewership spiked by 88% to 361 million. Kunal Jamuar, managing partner, Havas Media, expects Star to get a 10% hike in viewers to 450 million in the first year of IPL owing to its strong distribution and then expects the viewership to grow at 2-3% each year from there on. Against this backdrop, it would be difficult for Star to see substantial ad rate hikes. For the current India-Australia series, Star is charging Rs.8.5 lakh for a 10-second ad spot. Assuming that as the base rate for the first year, Star is likely to generate around Rs.1,225 crore. Factoring a 10% growth in ad rate over the next four years will get Star about Rs.12.5 lakh for a 10-second spot, helping it gross Rs.1,800 crore in the fifth year. Based on these projections, Star is likely to garner advertising revenue to the tune of Rs.7,495 crore over the five-year period.

As far as digital is concerned, the growth in both viewership and ad rates look promising. In IPL 2016, Hotstar had about 3.3 million unique viewers per match. Hotstar was charging advertisers Rs.1.1 lakh for a 10 second spot. According to media reports, almost 12 million unique viewers saw the first ODI between India and Australia. Much of the surge in digital viewers has been thanks to the launch of Jio which has increased data usage in the country by around six times from 170 MB earlier to 1 GB. According to analyst estimates, the number of unique digital users is likely to touch 50 million per match at the end of five years given the increasing proliferation of smart phones and declining data costs. The advantage with digital is the advertisers get to know who their consumers are and that commands a certain premium. But the cost per eyeball for the medium continues to be higher given that one rupee spent on television gets advertisers a lot more viewers than in digital. So at best at the end of five years, the ad rates can only be around 50% of what broadcasting commands. According to Sirohi, Star will not make more than Rs.4,000 crore over the five-year period.

In FY16, Star’s revenue was Rs.8,245 crore, of which about Rs.3,000 crore (or 36%) comes from subscription. Within this, two-thirds comes from its entertainment channels, led by Star Plus and the other one-third from sports. In 2016, Sony made Rs.300 crore from subscription besides Rs.1,300 crore that came through advertising. Analysts say that given its stronger distribution reach and larger bouquet of channels, Star should be able earn at least Rs.400 crore from subscription every year. The overseas part of the story, which includes international syndication, too can be significant especially with the Indian diaspora. “We are focused on making IPL available to the Indian and larger South Asian diaspora no matter where they are. There is a great deal of interest for Indian content. But when it comes to getting content from this country, it is either difficult, expensive or both. We will cut through that whole proposition and make it easily available at a far more attractive price,” says Uday Shankar, chairman, Star India.

Pushing the envelope

Making a gamble is not anything new to Star. In early 2000, the network was reeling under losses and its English-specific content was heading nowhere. The decision to host the Hindi version of Who Wants to Be A Millionaire was discussed and Kaun Banega Crorepati was born. Old timers at Star recall Rupert Murdoch, NewsCorp’s owner, asking the top brass what the show should be called. The initial feedback was that the biggest prize would be Rs.1 lakh. Realising that it was an insignificant sum, Murdoch convinced the team to increase it to Rs.1 crore. Seeing the nervous Indian management, he told them the worst case scenario was that the show would bomb and the company would shut down operations.

Of course, the show went on to create history and saw Star eventually creating a Hindi content strategy. All this paid off handsomely making Star the biggest in the Hindi television channel business. The desire to push the envelope was again evident when it acquired the satellite rights to all Salman Khan and Ajay Devgan films released between 2013 and 2017 for a reported Rs.900 crore. This film bet did not quite work out, though by buying these big-ticket films, it left nothing on the table for competition. The bet on cricket this time is no different. According to Shankar, this bold IPL bid came from the entertainment business being at a very mature stage. “That gave us the confidence to invest big amounts in cricket and other sports as well. If we did not have that platform on entertainment or proprietary rights, Hotstar would not have been there,” he said in a media interaction.

Star, on its own and without the IPL rights, had already taken the mass route a few years ago by backing sports such as kabbadi, hockey and football. “While we built the entertainment business, it was important to identify another growth trajectory. To us, it was sports,” says Shankar. Star set up leagues and aired these matches on its own network, taking the total number of sports channels to ten now from just one five years ago. This includes sports channels in English, Hindi and Tamil with the objective of reaching out to a larger audience and having region-specific initiatives. Some of this was evident in the 2015 cricket World Cup when Star aired the matches on its bouquet of channels across Tamil, Malayalam and Bengali, with the commentary in that language. “The power of media consumption in this country can be unlocked by going deeper into regional and other languages. We have seen evidence of that across our portfolio be it entertainment or sports. The IPL for all its strengths has not been offered in a single South Indian language. This is when they have three teams from the region. With the power of cricket, there is a lot of headroom there,” he says. Star has managed to bring in local advertisers who could now spend their money targeting just their market of relevance or strength. Also, programming initiatives like bringing in a local film star or having an impromptu interview increases the levels of stickiness. “We believe by enhancing the experience of the sport for fans, cricket in general and IPL in particular, can still be bigger than what it is,” believes Shankar.

There is no doubt that Star is sitting pretty from the cricket rights point of view. With the IPL, competition has been kept at bay and it makes Star the clear choice of advertisers, with a dominant presence across genres and languages. None of its earlier big bets come remotely close to this IPL gamble, which though risky promises a numero uno position nonetheless. It’s something that will enthuse folks at Star for now. Only that it needs to ensure that after winning the toss it ends up winning the match.