Chinese authorities have advised local companies to avoid using Nvidia Corp’s H20 processors, especially for government or national security-related work, Bloomberg reported. This move aims to further undermine the US chipmaker’s efforts to regain lost revenue from the Chinese market and complicate Washington’s controversial plan to take a cut from such sales.

Over the past few weeks, Beijing has reportedly sent notices to a range of firms, including state enterprises and private companies, discouraging purchases of the H20, Nvidia’s less-advanced AI accelerator approved for sale in China under US export rules.

Some notices reportedly included questions for buyers, such as why Nvidia’s H20 was chosen over domestic alternatives and whether any security issues had been identified in the hardware. State media outlets have even cast doubt on the security and reliability of H20 processors, underlining the concerns regulators have raised directly with Nvidia.

However, the company has denied any vulnerabilities, stressing that the H20 is “not a military product or for government infrastructure”.

China–Nvidia History

For more than a decade, Nvidia has been at the centre of China’s AI ambitions. Its powerful GPUs became the backbone of many of the country’s AI breakthroughs, powering everything from Baidu’s language models to Alibaba’s cloud services. But that relationship, once purely commercial, is now entangled in geopolitics, as Washington’s export controls transformed the flow of high-end chips into a matter of national security.

This is the story of how a technology partnership flourished, faltered, and adapted under the weight of global politics.

In the early 2010s, China’s major internet companies, Baidu, Alibaba, Tencent, and later ByteDance, were racing to build their own AI capabilities. Training neural networks at scale required massive computing power, and Nvidia’s GPUs quickly emerged as the industry standard.

Nvidia’s CUDA programming platform and specialised data-centre chips allowed Chinese engineers to train models way faster than with conventional CPUs. By the mid-2010s, Chinese research labs and cloud providers had become some of Nvidia’s most important customers. AI services like Baidu’s ERNIE model, Alibaba’s cloud-based AI APIs, and Tencent’s computer-vision platforms all ran on fleets of Nvidia hardware.

This was not just about private enterprise. China’s government has also declared AI a strategic industry in its Next Generation AI Development Plan (2017), setting goals to become a world leader by 2030. In effect, Nvidia’s GPUs became one of the core imported tools helping China chase that target.

Strain In Relationship

The relationship began to feel strain during the Trump administration. In 2019, the US Commerce Department placed Huawei, one of China’s top tech champions, on its Entity List, citing national security concerns. The move sharply restricted US technology exports to Huawei, including advanced chips and software.

While Nvidia was not Huawei’s main supplier for AI chips, the episode sent a clear signal: advanced semiconductors were no longer just a matter of business. They were now a strategic asset Washington could cut off.

The real inflection came in October 2022. The US government unveiled sweeping export controls targeting advanced computing hardware and semiconductor manufacturing tools destined for China. The rules barred the sale of high-performance GPUs, including Nvidia’s flagship A100 and H100 chips, without a special licence.

The goal was to slow China’s ability to train and deploy the most advanced AI systems, which US officials warned could have military applications. The impact on Nvidia was immediate. China had accounted for a significant share of its data-centre revenue, and suddenly its most profitable products were off the table.

China-Specific Chips

Nvidia responded with a mix of engineering and diplomacy actions. If the A100 and H100 were too powerful to export under the new rules, it would design “compliant” variants that stayed just under the performance thresholds.

The result was chips like the H800 and H20, versions tailored for the Chinese market with reduced interconnect bandwidth and other limitations. These chips were still far more capable than most domestic Chinese GPUs, making them attractive to local cloud providers.

Alibaba, Baidu, and Tencent all reportedly bought large quantities of these models to keep their AI infrastructure growing while staying within US rules.

At the same time, China accelerated efforts to cut dependence on foreign chips. Huawei, long active in telecoms, began pushing its Ascend AI processors. Start-ups like Biren, Moore Threads, and Enflame entered the market with homegrown GPU designs.

Baidu deepened its collaboration with Huawei, adapting its PaddlePaddle deep-learning framework to run efficiently on Ascend hardware. But while domestic chips made progress, they still lagged Nvidia in ecosystem maturity, developer adoption, and raw performance, gaps that made even restricted Nvidia chips appealing.

The 2025 Licensing Controversy

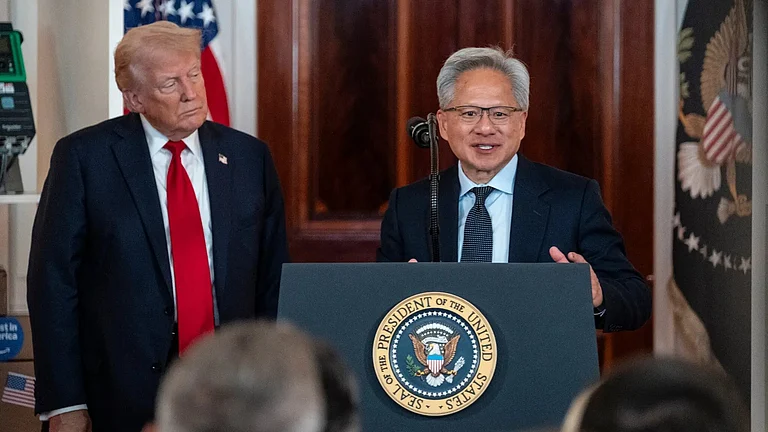

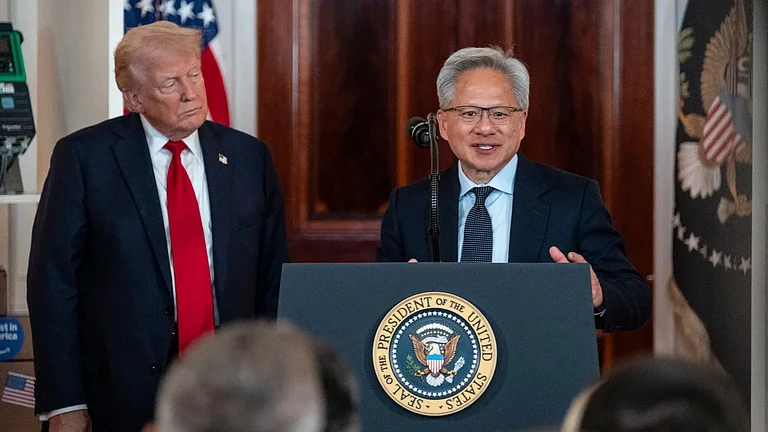

In 2024 and 2025, Nvidia kept lobbying for licences to export its China-compliant GPUs. Then came a striking development: US officials and chipmakers reached a deal allowing limited AI chip sales to China, but with a twist.

Under the arrangement, Nvidia and AMD could sell approved chips like the H20, but they would share 15% of the revenues from these sales with the US government. Supporters argued it maintained US oversight and generated funds, while opponents saw it as undermining the original intent of export controls. The most advanced GPUs, including the unrestricted H100, remained banned.

The deal drew political fire in Washington, where lawmakers questioned whether any AI chip sales to China should be allowed at all. Still, for Nvidia, it was a partial reopening of a vital market.

The Nvidia–China relationship is now a balancing act shaped by both commerce and strategy. For Nvidia, China remains too big to ignore: it is home to hundreds of millions of potential AI users, vast cloud infrastructure, and companies eager to pay for GPU power. But every sale is now weighed against US export rules and the risk of future political backlash.

For China, Nvidia chips remain a crucial tool, even in restricted form, to keep pace in AI. But each restriction reinforces the urgency of building domestic chip capacity and reducing vulnerability to foreign sanctions.