Only 8 Nifty 500 firms turned profitable in Q1 FY26, down from 14 last year.

Paytm, Network18, and UPL led the quarter’s turnaround stories.

Analysts expect a better H2 but caution on small-cap valuations.

With the June quarter earnings season emerging to be a mixed bag, the momentum in corporate earnings revival appears to be faltering. Fresh data from AceEquity shows that only eight companies in the Nifty 500 index returned to profitability in the June quarter of FY26, nearly half from a tally of 14 in the same period last year. The slowing pace of turnaround underlines the growing strain on India Inc’s profit growth.

Analysts attribute the slowdown to a mix of softening demand across several sectors, persistent input cost pressures, and a challenging global trade environment. The quarter also reflected the lagged effects of recent interest rate cuts, whose benefits are yet to be fully realised, alongside sluggish trends in urban consumption, limiting the breadth of recovery.

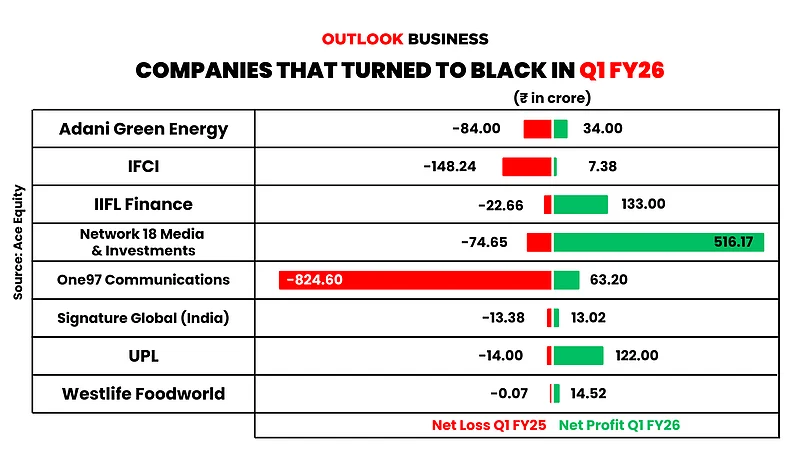

Data from Ace Equity showed eight major companies within the Nifty 500 universe that have released their Q1 earnings, namely, Adani Green Energy, IFCI, IIFL Finance, Network 18 Media & Investments, One97 Communications, Signature Global (India), UPL and Westlife Foodworld, to have jumped back into the black in Q1.

Among the players that staged a turnaround, Network 18 Media & Investments and Paytm parent One97 Communications, turned profitable for the first time, whereas UPL finally managed to shrug off its quarters long battle with weak demand to jump back in the black.

The most anticipated turnaround was of Paytm parent, which posted a net profit for the first time since listing on the bourses. The company had a turbulent journey since its market debut, with the RBI’s crackdown on its payments business which delayed its path to profitability.

Another major winner was Reliance Industries-owned Network18, which houses the media business of the conglomerate. The turnaround for the media company was driven by its strong audience leadership across digital and television platforms. Meanwhile, its tight leash on over costs helped it retain profitability despite a high base from last year’s election-linked advertising and subdued consumer demand.

Despite that though, the turnaround stories in Q1 FY26 sit at a stark contrast to Q1 FY25 wherein 14 names, including the likes of Delhivery, Tejas Networks, Piramal Pharma, AWL Agri Business among others jumped into profit. The narrower base of turnarounds this year raises questions over the slowing pace of earnings growth, a trend that has plagued India Inc in recent quarters.

The narrowing scope of earnings revival could weigh on valuations, particularly in the small-cap space where already elevated prices have put in pressure on investor sentiment. “Until now, 32 and 55 companies within our coverage universe have reported an upgrade and downgrade, respectively, of more than 3% each, leading to an adverse upgrade-to-downgrade ratio for FY26,” Motilal Oswal Financial Services wrote.

“The Q1 earnings have broadly been in line, with the intensity of earnings cuts moderating compared to the previous quarters, albeit the trend of a higher number of downgrades persists into the quarter,” it added.

However, analysts are yet to lose hope, anticipating a stronger recovery in the second half of FY26 as the impact of rate cuts seep in, along with the upcoming festive season which may boost demand. That said, for now, the drop in profit turnaround cases signals that India Inc’s earnings engine is running with fewer cylinders firing.

“Markets have staged an impressive recovery from the April’s lows, and even though July has been somewhat weak, we believe that better earnings prospects and reasonable valuations (barring small-caps) should help the market to eke out gains. We believe that the influence of the US tariff wars on Indian markets will be limited,” MOFSL forecasted.