2024 has been the year of quick commerce boom for India! The 15-minute delivery took centre stage in the India market, with the q-commerce giants Blinkit, Swiggy Instamart, and Zepto introducing new product categories to serve evolving consumer demands. From groceries and electronic gadgets to beauty products and festive gift hampers, these platforms expanded their offerings to cater to a broader range of consumers who prefer convenience.

While the combined revenue of the quick commerce trio surpassed $1 billion, the industry witnessed an impressive 280 per cent growth over the past two years. Some players are delivery products in 15-20 minutes, while others have won the race by fulfilling orders in 8-10 minutes. This mimics the change in the purchase behaviour of Indian consumers.

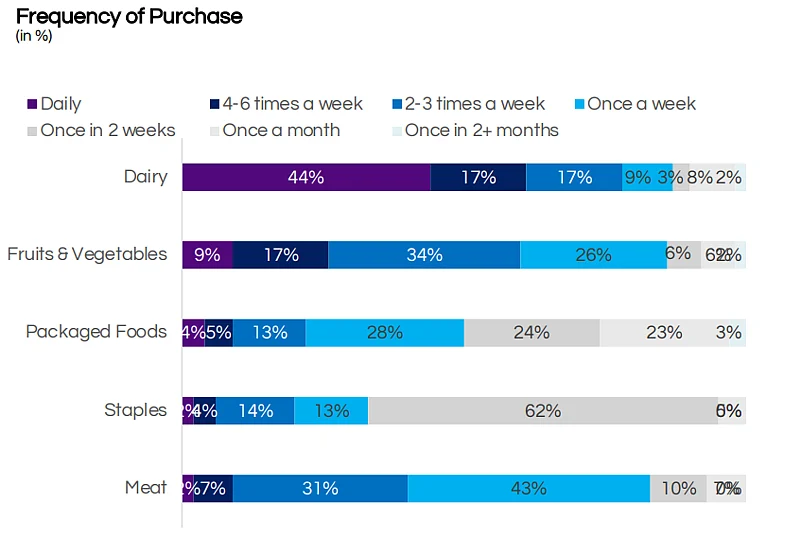

A recent survey stated that 75 per cent of online grocery buyers saw a jump in unplanned purchase in the last six months, while 53 per cent of buyers place more than five orders monthly on quick commerce platforms. It added that nearly 67 per cent of buyers have an average order value of more than Rs 400 on the instant delivery apps.

Beyond these major players, a wave of start-ups and ecommerce platforms have also entered the competitive quick commerce game to replicate the success of the incumbents. The surge came after the Datum Intelligence report revealed India's grocery market is expected to grow at a CAGR of 7.5 per cent between 2024-28.

Big Players, New Entrants

The bustling online retail market is witnessing a heated competition between quick commerce and ecommerce platforms, with both blurring the lines between their business models and entering into each others’ territories as a part of their expansion plans. Ecommerce giants like Amazon and Flipkart have tapped into the buzzing quick commerce space to snag a piece of the pie.

Amazon will launch its q-commerce arm 'Tez' this month, while Flipkart has already introduced 'Minutes' to deliver products within 30 minutes. Besides these, Nykaa and Myntra have also piloted the fast delivery models. Myntra launched 'M-Now' to deliver apparel and other lifestyle accessories within 30 minutes, and Nykaa started 10-minute delivery in select parts of Mumbai, covering 5 per cent of its SKU base as of now.

Other players like Tata-owned BBnow BigBasket, and Reliance Retail's JioMart have transitioned to a full-scale quick commerce platform. BBnow has planned to deploy 500-600 dark stores across the nation and aims to generate $1 billion from its quick commerce segment, according to media reports. On the other hand, JioMart is also re-entering the instant delivery space with a pilot in Mumbai, promising FMCG deliveries within an hour.

Several new players who entered the competitive market include Swish, Slikk, and First Club. Swish delivers fast food within 10-15 minutes in Bengaluru, while Slikk delivers branded fashion items within 60 minutes and FirstClub (founded by former Cleartrip CEO Ayyanppan R) has established a Costoco-like experience in India, delivering curated premium products within 20-30 minutes.

These platforms have emerged as strong competitors to traditional kirana stores and established e-commerce platforms in the grocery delivery segment. The grocery delivery landscape is now driven by innovation, technology, and the growing demand for instant gratification.

Kiranas Under Pressure

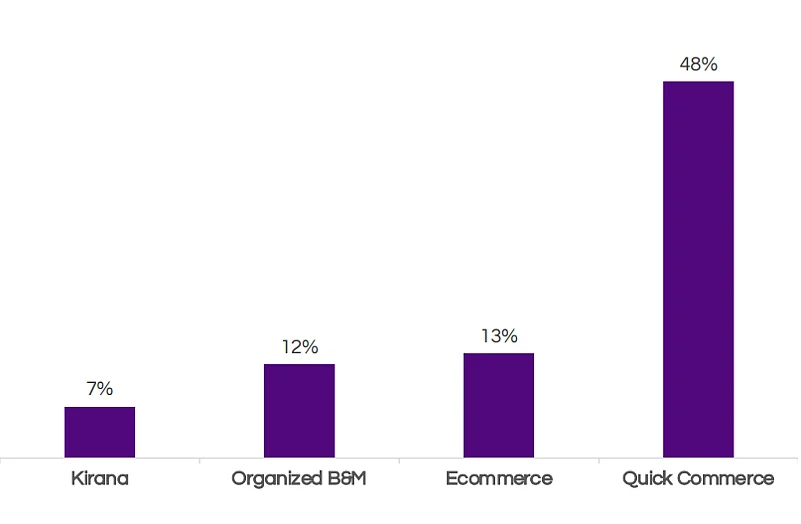

Quick commerce companies are outpacing traditional retailers, with 46 per cent of consumers surveyed reporting a cut in purchases from kirana shops. The quick commerce market size is expected to reach USD 40 billion by 2030, a jump from USD 6.1 billion in 2024, a report said.

The report further added that quick commerce market is projected to capture approximately USD 1.28 billion of Kirana sales by 2024, accounting for 21 per cent of total sales on these platforms. More than 82 per cent of consumers have shifted at least one-fourth of their grocery spending from Kirana stores to quick commerce platforms.

However, conventional retail stores are now experimenting with taking orders and scheduling home delivery on WhatsApp. Several local shop owners are stepping up their game offering digital billing, free home delivery and return and replacement services.

Quick Commerce Boosts FMCG Sales

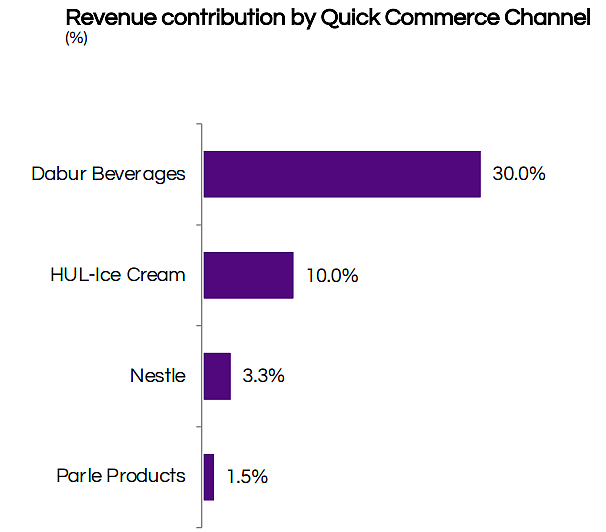

FMCG brands which have adopted an omnichannel distribution strategy experienced a significant rise in their sales. To name a few, Dabur's beverage revenue increased from 15 per cent to 32 per cent during October 2022 to September 2023 time period.

Similarly, HUL mentioned that its quick commerce, which currently accounts for around 25-30 per cent of e-commerce sales, is one of the fastest-growing channels for the company. Nestlé India reported that quick commerce now contributes 50 per cent of its e-commerce sales.

Tata Consumer Products also noted a strong 28 per cent growth in e-commerce sales, with quick commerce outperforming other channels. 4 FMCG major Emami is expecting 4-5 fold growth in sales through quick commerce in the next two years, the report said.

"We are surprised the way large packs of staples have taken off in quick commerce, which is growing 100 per cent q-o-q for us. On the other hand, growth in kirana grocery stores is about 10 per cent, though on a larger base," said Ayush Gupta, head of domestic market at Marico.

Opportunities for Growth

A business consultancy firm Grant Thornton Bharat asserted that the success of quick commerce companies will depend entirely on how efficiently they can manage their delivery infrastructure in a cost-effective manner using technology and artificial intelligence (AI).

"The model has delivered returns to investors and it is going to become a more dynamic space. Players are likely to focus on the six themes explained above and follow the road to profitability. We foresee some consolidation happening in the market with key acquisitions," the report read.

Since consumers are price conscious, this poses a challenge for the long-term sustainability of q-commerce players but on the positive side, the potential is huge, given India’s consumer demographics and segmented demands, it added.

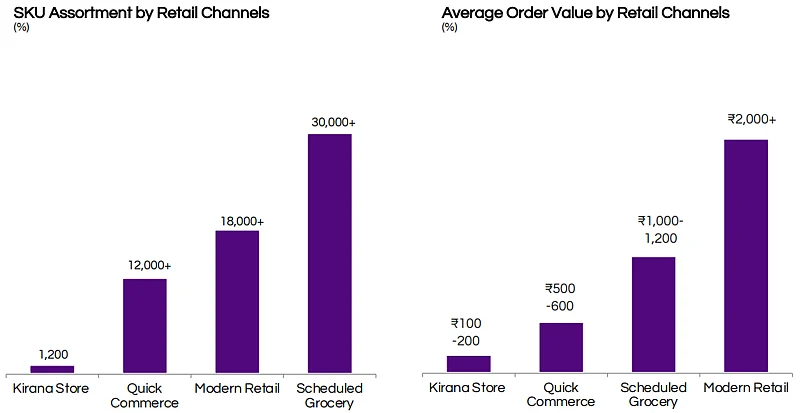

The study also suggested that the platforms need to work on product assortments, private brands, and increase frequency through targeted offers. Currently, the ticket sizes and margin profile results in delivery cost eating into two-thirds of the gross margins.

In addition, the firm added that organised quick commerce players need to actively look at developing alternate revenue streams such as advertisements or joint product development with FMCG brands.