RBI keeps repo rate steady at 5.50%, maintains neutral policy stance.

Re-KYC camps for Jan Dhan accounts, insurance, pensions begin from July.

Standardised process to ease claim settlement, locker access for families.

Retail-Direct platform to offer SIP option for treasury bill investments.

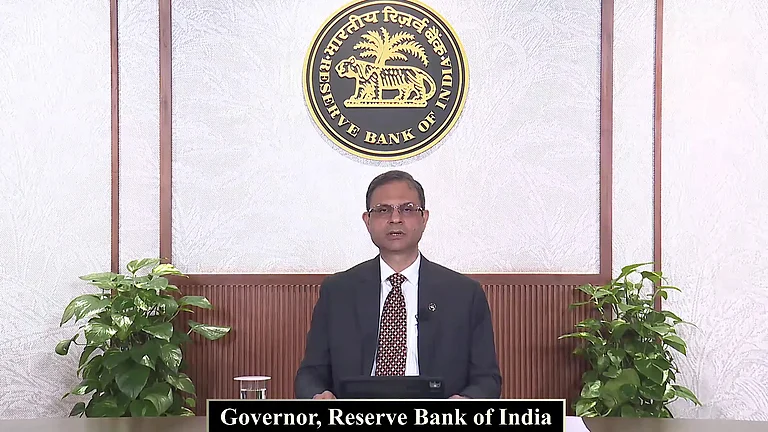

Reserve Bank of India Governor Sanjay Malhotra announced three consumer centric measures on Wednesday, following the monetary policy committee’s decision to keep the repo rate unchanged. He said that these measures are aimed at interest and welfare of citizens, including those at the lowest of the economic pyramid.

While addressing the meeting, Malhotra stated, “Let me underline that for us at RBI, the interest and welfare of the citizens of India is foremost. It is the people of India, including those at the bottom of the pyramid, who are our raison detre, or the reason of our being. In this regard, I have three consumer-centric announcements to make.”

What are the 3 Consumer Centric Moves?

Camps for re-KYC for Jan Dan accounts, micro-insurance & pension schemes - The RBI Governor said that with the 10 years completion of Jan-Dhan scheme, a large number of accounts have fallen due for re-KYC. He further said, “The banks are organising camps at Panchayat level from July 1-September 30, in an endeavour to provide services at customer doorsteps.” Other than opening new bank accounts, these camps will also be focusing on micro insurance and pension schemes for financial inclusion and customer grievance redress. The Pradhan Mantri Jan-Dhan scheme is a national mission that aims financial inclusion to ensure access to financial services, like basic savings and deposit accounts, remittance, credit, insurance, pension in an affordable way.

Settlement of account claims, locker items for deceased family - Secondly, the RBI will standardise claim settlement of accounts and articles that are kept in bank lockers. The central bank’s Governor said, “We will be standardising the procedure for settlement of claims in respect of bank accounts, and articles kept in safe custody or safe deposit lockers of deceased bank customers. This is expected to make settlement more convenient and simpler.”

RBI Retail-Direct platform expansion – During the announcement, Malhotra also mentioned that the central bank is expanding functionality in RBI Retail-Direct platform in order to “enable retail investors to invest in treasury bills through systematic investment plans (SIPs)”

RBI's Repo Rate Remains Steady

The Reserve Bank of India’s Monetary Policy Committee (MPC) on Wednesday voted unanimously to keep the key policy repo rate unchanged at 5.50%, ending a succession of rate cuts earlier this year.

In a press briefing following the meeting, Governor Sanjay Malhotra announced the stance to be “neutral”, as the central bank balances growth support with inflation containment.