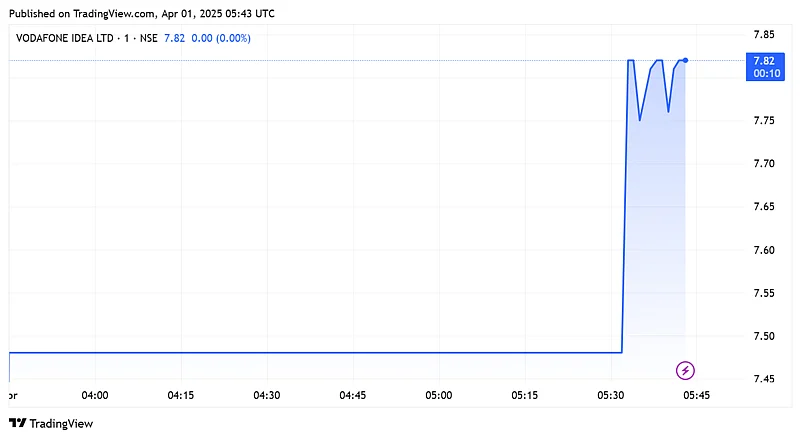

Vodafone Idea Shares Rise: To investors' relief, the debt-ridden telecom company witnessed another lifeline provided by the government. Vodafone Idea shares hit the upper circuit on Tuesday after the central government announced it would increase its stake in the company by converting its outstanding spectrum dues into equity.

At 11:30 am, the shares of the telecom company were trading at Rs 8.08 price level, up by over 18% on the National Stock Exchange.

A total amount of Rs 36,950 crore will be converted into equity shares. As per the exchange filing, Vodafone Idea will issue 3,695 crore equity shares with a face value of Rs 10 each within 30 days of receiving necessary approvals from relevant authorities.

"The pricing of shares to be allotted has been arrived basis the higher of the volume weighted price of equity shares during the last 90 trading days preceding the Relevant Date or 10 days preceding the Relevant Date (the Relevant Date being 26 February 2025), subject to provision of section 53 of the Companies Act, 2013 (i.e. shares cannot be issued at less than the par value)," the exchange filing read.

Post the conversion of dues into equity shares, the government's shareholding in Vodafone Idea will increase to 48.99% from the existing 22.6%. However, the promoters will continue to have operational control of the company.

"The company will take all necessary actions to undertake the aforesaid issuance, upon receipt of the requisite approvals," Vodafone Idea said in its exchange filing.

Not the first time the Govt threw a lifeline

This is not the first time the government has thrown a lifeline to Vodafone Idea. In 2021, a relief package was announced for the telecom company wherein the government increased its shareholding in the company to 33% (in 2023) by converting dues worth around Rs 16,000 crore into equity.

On year-to-date basis, the shares of the telecom company have remained under pressure, declining by over 6.6% on the National Stock Exchange. The stock is down by over 50% from its 52-week-high of Rs 19.18.