Vishal Mega Mart shares surged by nearly 10% on the bourses after the company announced robust Q4 results. The hypermarket chain recorded a net profit of Rs 115 crore for the quarter ending March, marking a surge of 88% from Rs 61.2 crore recorded in the corresponding quarter of the previous year.

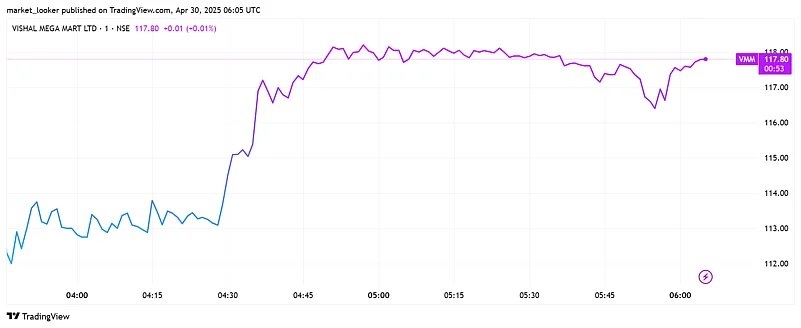

At 11:10 am, the shares of Vishal Mega Mart were trading at Rs 117.68 price level, up by around 9.26% on the National Stock Exchange.

Revenue from operations soared to Rs 2,547.9 crore during the quarter under review, an uptick from Rs 2,068 crore recorded in Q4FY24. The company also witnessed a surge in overall margins. While EBITDA increased to Rs 357 crore from Rs 250.5 crore, experiencing a 42.6% surge, EBITDA margins improved to 14% in Q4FY25 as against 12.1% reported in the same previous fiscal period.

For the full financial year 2024-2025, the company's net profit levels increased by 36.8% to Rs 631.97 crore. As for revenue from operations for the full fiscal year, the figure surged to Rs 10,716 crore, experiencing an uptick of 20.2%.

Vishal Mega Mart Shares

In the last 6 months, the shares of the hypermarket chain surged over 5%. On a year-to-date basis, the shares have surged by around 11% on the bourses. However, the stock is still down by over 7% from its 52-week-high of Rs 126.87.

Expansion in the quick commerce segment remained robust, with 656 stores operational across 429 cities. The registered user base saw a strong 65% year-on-year growth, reaching 8.7 million. As per a report by ICICI Securities, the loyalty program continues to perform well, contributing to around 95% of total sales from registered users. Regionally, revenue remains well-distributed across north (43%), east (29%), south (19%) and west (8%).

"We maintain our earnings estimates for FY26E/FY27E, modelling revenue/ EBITDA/PAT CAGR of 18%/19%/26% over FY25-27E," the brokerage firm said in its report and maintained a 'Buy' call on the stock with a prospective upside of 30% from the current market price (CMP) of Rs 108.

_(1)_570_850_1642198580.jpg?auto=format%2Ccompress&fit=max&format=webp&w=768&dpr=1.0)