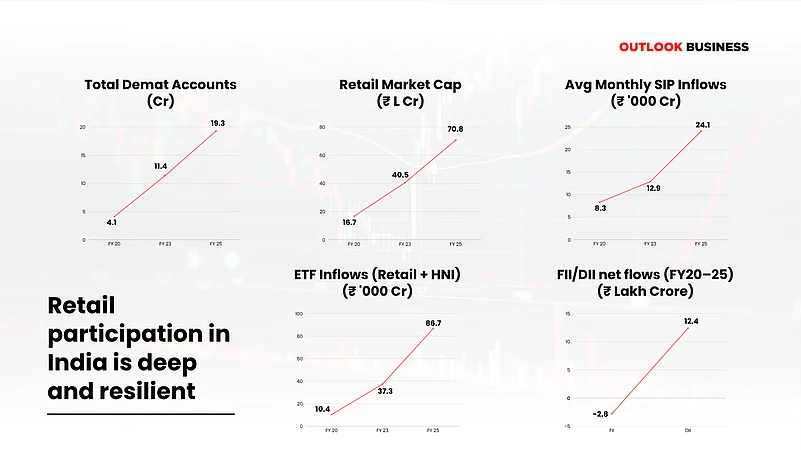

India’s capital markets are in the middle of a quiet but powerful revolution. For decades, retail investors played a supporting role, stepping in occasionally during bull runs or IPO frenzies, then fading out just as quickly. But today, that narrative has flipped. With over 19 crore demat accounts, record-breaking SIP inflows, and a sharp rise in direct equity and derivatives trading, retail investors are no longer on the sidelines, they’re part of narrative building.

The Third Front: What Sparked the Surge?

This wave of participation didn’t come from nowhere. It’s the result of years of change, both technological and regulatory, that made markets more accessible for the mango people.

Platforms like Zerodha, Groww, and Upstoxx took investing out of the jargon-heavy world of terminals and into the comfort of smartphones. Zero-commission trading, clean mobile interfaces, democratised access to internet, and fast KYC processes lowered the bar for entry.

Add to that the impact of the pandemic. With lockdowns in place and savings growing, millions turned to the markets after the March 2020 crash. Within just 18 months of that correction, India’s demat accounts tripled. But the growth didn’t stop when the lockdowns lifted. Instead, the combination of convenience, opportunity, and digital infrastructure kept retail investors coming back. Top that up with the raging bull market that followed and the lure of stock markets kept growing.

Behind the scenes, regulators and market infrastructure players were laying the foundation. Market watchdog Sebi’s focus on investor protection, NSDL and CDSL’s simplified onboarding, and the broader ‘Digital India’ campaign ensured that even small towns and rural areas were not left behind. From Tier 1 cities to Tier 3 cities, the markets were suddenly open to everyone.

The Numbers Tell the Story

The shift is visible in the numbers. Mutual fund equity assets under management crossed ₹40 lakh crore in May 2025 while systematic investment plan (SIP) inflows hit a record ₹26,688 crore in the same month, data from AMFI showed. More than 9 crore SIP accounts are now active. Meanwhile, data from NSE also reflected the growing presence of retail investors that have consistently contributed upwards of 45% of daily turnover in the cash market.

In the derivatives space, retail dominance is even clearer. A recent report by Sebi showed that 62% of volume in NSE’s F&O segment is retail-driven as of April 2025. IPOs have also seen overwhelming participation, Zomato’s 71.7 times oversubscription was one of many such cases that prompted a rethink of allocation rules.

Retail portfolios are evolving too. Crypto exposure has grown too, from 11% in 2020 to 17 % in 2023 among retail investors, data from WazirX, a crypto trading platform showed.

More Than A Bull Run

This isn’t just a bull market phenomenon. What’s emerging is a deeper, more consistent investor base. Dinesh Thakkar, Chairman and MD of Angel One, captures it well by saying that “over the past five years, we’ve seen something far more powerful than trading volumes. Retail participation in India is no longer fragile. It’s foundational.”

“We’ve witnessed confidence, consistency, and conviction from a new generation of Indian investors across SIPs, ETFs, equity ownership, and market breadth. This isn’t headline-driven momentum. It’s a structural shift. Retail India is not just trading. Retail India is owning,” Thakkar added.

And their ownership is changing how markets behave. Domestic institutional ownership rose from 13% in 2019 to 20% in 2025, helped along by steady SIP flows and growing ETF popularity. Even during bouts of foreign investor outflows, Indian markets have remained relatively stable, powered by retail liquidity.

“And as that ownership compounds in value, they’re not stepping away. They’re staying in, trading and investing with purpose,” Thakkar believes.

Platforms are adapting too. Market experts are also deploying new order routing strategies that take into account retail behaviour.

Risks and Growing Pains

But this surge is not without concerns. Sebi recently released data showing that 88% of retail traders in the F&O segment lose money, on average, about ₹1.25 lakh per year per account. In response, the regulator has intensified investor education, conducting over 43,000 awareness programs in the first half of FY25 alone. Yet, funding for these initiatives has dropped sharply, from ₹11.84 crore to just ₹2.78 crore over the same period. There’s also the challenge of financial literacy gaps. NSE’s latest Market Pulse report revealed that states like Bihar and Jharkhand lag significantly behind their western counterparts in retail participation, by as much as 73%. The disparity reflects wider regional economic inequalities and underlines the need for more targeted educational outreach.

The Aftermath of Retail Surge

The sharp rise in retail investors has fundamentally altered the behaviour of Indian stock markets. With over 14 crore demat accounts and steady monthly inflows, retail liquidity now acts as a cushion against global volatility. This was most visible during the downturn between October 2024 and mid-April 2025, when relentless FII selling could not pull the markets into a freefall, due to the strength powered by domestic retail flows.

However, while retail participation has brought resilience, it has also introduced new forms of volatility, particularly in the derivatives space, where sentiment-driven, leveraged trades can cause sharp intraday swings.

In the cash market too, growing retail participation has also led to the rise in popularity of ‘narrative’ themes, which according to Kotak Institutional Equities, oftentimes, run far away from fundamentals or actual growth potential. A huge chunk of new-age investors, especially those that have witnessed the markets only in its bull run showcase price agnostic tendencies, as pointed by KIE. These price agnostic tendencies have also led to a sharp surge in valuations to levels seen as ‘frothy’ across several pockets of the market, a cause of concerns for times of distress.

In IPO markets, massive retail demand has made public issues more competitive and forced changes in allocation rules to ensure fairer access. Retail enthusiasm has also influenced price discovery, particularly in small-cap offerings. Institutions, in turn, are adapting their strategies, tweaking order flow models, designing retail-focused products like thematic funds, and building longer-term plans around the growing stickiness of retail AUM.

The Road Ahead

Today’s retail investor is not the same as the one who first entered during the post-pandemic boom. With time, many have matured, becoming more measured, more informed, and more strategic in their approach. Their regular SIPs, growing engagement across asset classes, and hunger for financial literacy have become a stabilising force for India’s markets.

The traditional idea of financial security is also being reshaped. More and more Indians are moving beyond gold and fixed deposits, turning instead to equities, ETFs, mutual funds, and even digital assets like crypto. As Dinesh Thakkar of Angel One said, “They’re not stepping away. They’re staying in. Trading and investing with purpose.” This new wave of investors is gradually dismantling old models of wealth creation, once dominated by a select few and replacing them with something far more inclusive. Their revolution may not be loud or dramatic. But it is steady and here to stay.