Christopher Wood, a well-known Indian bull at Jefferies, warned the Indian stock market of high valuations – especially in the midcap segment, and a fresh wave of equity supply via initial public offerings (IPOs). In his latest investor note titled GREED & Fear, he said the recent market rally has pushed valuations to “uncomfortable levels”.

It has even triggered a $13 billion selloff by promoters and other investors, the note read. Since hitting its low on April 7, the Nifty 50 has gained 14.1% and is currently trading at 22.2 times its projected 12-month earnings. The Nifty Midcap 100 Index has also jumped 23.7% in the same timeframe, pushing its forward earnings valuation to 27.1 times.

“This is also why corporates are again placing equity to take advantage of such valuations. The equivalent of $7.2 billion of equity supply was raised last month, and $6 billion so far in June. It is this supply which poses the main risk to the market. Equity supply was running at around $7 billion a month before the correction which began in late September last year,” Wood said.

According to the Global Head of Equity Strategy at Jefferies, the focus in the Indian market since the budget announcement on February 1 has rotated to playing consumption rather than investment. This trend has been supported by the monetary easing context with consumer finance stocks rallying sharply.

For example, Bajaj Finance is up 35% year-to-date. But still, Wood has not given up on a private capex even though the stock market may have. Such an investment cycle is likely to be “more drawn-out” and “prolonger than the boom-bust cycle experienced in FY03-17 which resulted in an excess of power capacity, it added.

Jefferies Still Sees Momentum Ahead

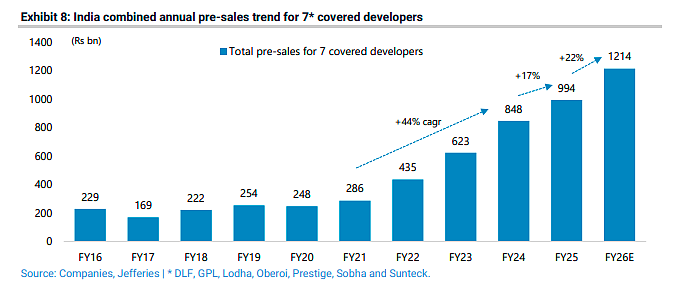

Despite warnings, Wood still remains optimistic about the property market - now in its fifth consecutive year of growth. It expects the uptrend to continue. Supporting this view, Jefferies’ India property analyst Abhinav Sinha noted in a recent report that pre-sales for the top seven developers tracked by the firm are projected to grow 22% year-on-year in FY26—up from a four-year low of 17% in FY25.

In addition, a lower mortgage rate - currently at 8% and expected to fall to 7.5% when the RBI's latest rate cuts are passed on - should help boost sales in the affordable and mid-income segments. "This would be healthy since a feature of India’s property upturn in recent years has been that most of the action has been in the luxury end of the market."

The investments in Larsen & Toubro, Thermax and Godrej Properties will be removed and replaced by investments in TVS Motor, Home First Finance and Manappuram Finance, with four percentage points each. An additional one percentage point each will be added to the existing investments in PolicyBazaar and Bharti Airtel, it added.