The slow but steady exit of the Gangwal family from IndiGo is set to continue this week, with reports suggesting a fresh block deal worth around ₹7,020 crore. According to CNBC Awaaz, the family will offload as much as 3.1% of its holding in InterGlobe Aviation, parent company for India’s largest airline.

The block deal is expected to be executed on August 28 at a floor price of ₹5,808 apiece, roughly a 4% discount to Tuesday’s last traded price. The move comes just months after the family sold down close to 9% of its stake in 2025, including a ₹11,900 crore block deal in May.

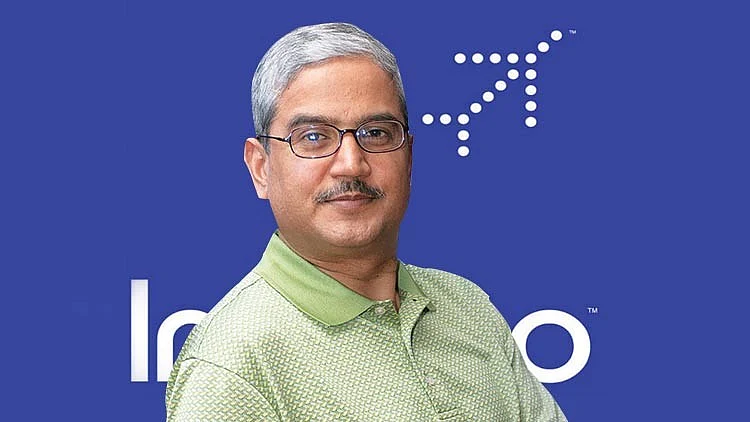

The sale highlights the family’s gradual withdrawal from the airline empire co-founded by Rakesh Gangwal. Once IndiGo’s driving force alongside Rahul Bhatia, Gangwal resigned from the board in early 2022 citing governance concerns, and has since been systematically unwinding his investment.

Yet, IndiGo itself has continued to soar. Shares of InterGlobe Aviation are up 31% so far this year and a massive 400% over the past five years, cementing its dominance in the domestic aviation space. Just last week, the stock was added into the benchmark Nifty 50 index after its semi annual rejig.

On the financial front though, the airline has hit some turbulence. For the June quarter, IndiGo reported a net profit of ₹2,176 crore, a 20% drop from a year earlier. Revenue rose a marginal 5% to ₹20,496 crore, even as passenger volumes grew 12%, signalling robust demand despite headwinds. Rising fuel costs, geopolitical tensions and restricted airspace have weighed on margins.

Mutual funds too appear to be easing their exposure. Data from Nuvama shows fund managers sold nearly ₹2,400 crore worth of IndiGo shares in July, the steepest outflow among listed firms.