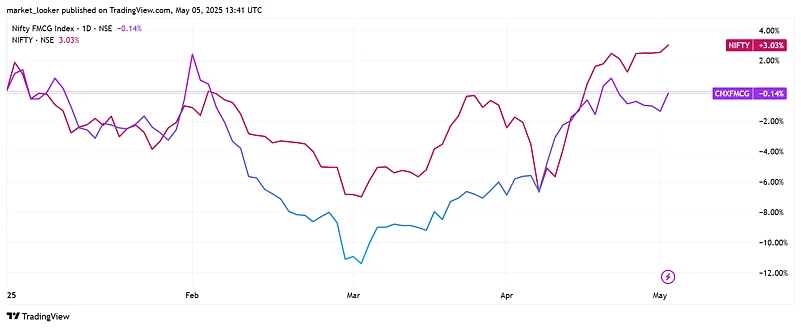

Soaring commodity prices and faltering urban demand have made things anything but predictable for risk-averse investors who usually find comfort in defensive sectors like consumer staples. This unease is quite visible in the Nifty FMCG index, which has barely managed to stay afloat so far this year, up by less than a per cent. In contrast, the broader Nifty50 index has surged over 3.45% during the same period.

However, Marico's recent Q4 play has signalled a revival in the ongoing trend with a double-digit surge in consolidated revenue levels of 20% to Rs 2,730 crore. Profit figures also witnessed a modest year-on-year (YoY) jump of 8%.

On the volume front, Marico's newer product lines in the food and premium personal care segment might have saved the day as its core products (Parachute and Saffola) witnessed a decline in overall volume due to higher prices and changes in packaging sizes. For instance, Parachute's volume dropped by 1% on muted demand play, but pricing increased by 23%. So, the overall revenue figure for the product still grew by 22%.

"Marico has navigated the inflation cycle well by demonstrating strong pricing power in core & also has other margin levers (margin expansion in Foods/D2C & some recovery in value-added hair oil) to cushion the impact on profitability," as per JM Financials.

During the earnings call, the management said that the overall consumer sentiment remained relatively stable as rural demand improved albeit the affluent urban segment continued to signal mixed trends. Going ahead, easing inflationary pressure might improve the overall consumption trends, the management added. However, a consecutive decline in margin figures might make things difficult for Marico.

During Q4FY25, EBITDA margins dropped by over 260 bps (basis points) YoY to 16.8% owing to rising input costs. While copra prices jumped 48% YoY, vegetable oil rose by around 25% as per Elara Capital estimates. On top of this, Marico is planning to maintain high spending on advertising and promotions (A&P) segment.

In the quarter under review, the FMCG giant's A&P spending soared to 35% YoY to Rs 305 crore. Staff costs and other expenses also grew by around 11-12% YoY.

What analysts Say

While margins continue to face pressure, analysts expect a potential upside in the long run citing strong momentum in its new business vertical. Despite profitability constraints, Marico's portfolio diversification and pricing power position it at a relatively better spot than its peer players in the space.

So far this year, the company's shares have surged over 12.7% on the National Stock Exchange, outperforming larger rivals like HUL and Nestle India.

Elara Capital has reiterated its 'Accumulate' rating with a revised target price of Rs 785 from the previous Rs 752 level. "We raise our FY26 and FY27 estimates by 1% and 3%, respectively, primarily due to higher revenue growth, aided by pricing intervention partly offset by margin contraction," the brokerage firm said in its report.

JM Financials has adopted a more optimistic 'Buy' rating at a revised target price of Rs 765 "We continue to like Marico within our HPC (home and personal care) coverage; execution on portfolio diversification remains strong and earnings visibility is relatively better...Pace of recovery in core portfolio volumes and movement in copra prices will be key monitorable," the brokerage firm said.