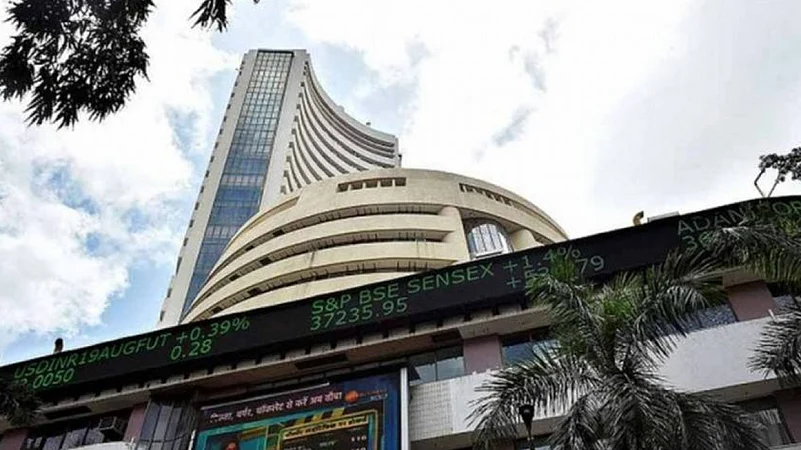

Indian headline indices retreated from day's highs to slip into the negative territory on April 25. Uncertainty around geopolitical tensions following the Pahalgam terror attacks prompted investors to take home partial profits after the recent surge.

Nifty 50 fell 1.6% and Sensex fell 1.5% to their intraday low. With today's fall, the Nifty 50 index plunged below the 24,000-mark, a milestone it reclaimed on Monday after over four months. On the other hand, the 30-stock BSE Sensex tumbled below 79,000--mark again, after floating above that level for four sessions.

The market extended losses for the second day after notching gains for seven straight sessions. The Nifty 50 index gave around 9% returns during the winning streak, but is currently down almost 2% from its last close in the green, that was on April 23.

The benchmarks rebounded amid continuous foreign inflows, but they failed to carry forward the momentum on the back of geopolitical tensions.

Uncertainties around India’s response to the Pahalgam terror attack and the expected consequences, was also visible in an over 8% jump in the fear gauge, India VIX, that acts as a barometer of fear among investors.

India has taken a hardline stance with key steps like suspending the Indus water treaty and investors are likely doubtful of taking a long position ahead of the weekend in this situation. There also have been firing at multiple locations along the LoC today, as per media reports.

Broader market also witnessed selling pressure the small and midcap indices were down 2-3% during the session. Fall in the share prices of prominent names such as Axis Bank and Adani Enterprises weighed on the headline 50-stock index.

Axis Bank declined after reporting muted Q4 results as its net profit for the quarter ended March slightly fell year-on-year. Shares of SBI Life, on the other hand, zoomed on the bourses after the company’s MD & CEO said that the 12% growth in individual rated premium of the company for FY25 was more than the industry growth of 10.5%.

Barring, SBI Life Insurance and IT stocks—Tech Mahindra, Infosys, TCS and HCL Tech, all other stocks were in red today.