As if things were not already difficult for NBFCs (Non-banking financial companies). With regulatory pressure building up in the unsecured lending space, rising delinquencies and tightening funding conditions, shadow banks seem to be driving on a tough road.

Unlike banks, deposit levels can't come as a savior for NBFCs. These institutions largely rely on instruments like NCDs (Non-Convertible Debentures), CPs (Commercial Papers), ECBs (External Commercial Borrowing) or simply bank borrowings, which are, as of now, seeing a declining trend.

This has pushed many NBFCs to eventually take the foreign road and rely on dollar-denominated bonds to meet their funding requirements. Piramal Finance, Tata Capital, Manappuram Finance, Muthoot Finance and even the state-run REC announced the issuance of dollar bonds this year to diversify their funding amid a tight domestic credit picture.

While this is not something new as NBFCs and sometimes even banks have long resorted to such alternatives, what makes the current outlook tricky is the rising dollar.

If the value of the foreign currency rises, which it sure will as Trump is all set to take the Presidency next year, there is a good chance that things might get tougher for NBFCs.

The hard pill for NBFCs

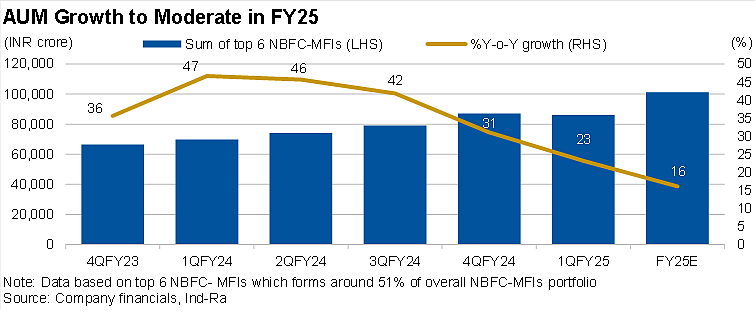

Many analysts are already expecting a steady slowdown in the growth rate of NBFCs. As per rating agency India Ratings and Research, AUM (Asset under management) growth is expected to slow down by nearly 16 per cent in FY25. This marks a gradual decline from the earlier estimate of 23 per cent and a significant drop from the 30 per cent growth figure seen in FY24.

Plus, credit cost is also expected to witness a surge by around 130 basis points, which will no doubt take a toll on the bottom line of NBFCs.

On one hand, these institutions are facing slower growth in their loan books, which is in turn impacting their ability to scale up operations. On the other hand, rising credit costs are putting pressure on overall profitability. This entire scenario is turning the outlook into a tough pill for NBFCs to swallow.

What's even worse here is that banks, which remain the dominant lenders to NBFCs, are also cutting down on their exposure. "Rising delinquencies in unsecured loans have made banks wary of increasing exposure to NBFCs. Following RBI guidelines, banks are either cutting down or maintaining their current exposure to these institutions. This has further tightened the domestic funding situation for NBFCs," said Suman Chowdhury, executive director and chief economist, Acuité Ratings and Research.

With NBFCs stuck between a rock and a hard place, one viable option is to resort to other cheaper and easily accessible funding routes. Not only, these alternative routes can protect the bottom-line, but also diversify the current borrowing mix of NBFCs.

"Currently, the overall costs for the NBFC’s dollar bond issuance is around 8 per cent to 9 per cent in rupee terms which is significantly lower than any domestic options by 100-200 bps approximately," said Arshay Agarwal, research associate (equity-BFSI), Choice Equity Broking.

But there is a catch.

Any entity borrowing in dollars but operating in rupees faces a currency risk. This is primarily because the exchange rate between the rupee and the dollar can fluctuate. If the domestic currency depreciates, the original borrowing cost for NBFCs will surge.

To mitigate the impact of such adverse movements, many shadow banks often switch to hedging and protect themselves against currency movements. But that too comes at a cost.

However, analysts believe that any significant fluctuation in the currencies is highly unlikely.

"These (dollar-denominated bonds) do expose the institutions to currency risk but they are generally hedged. On top of it, as DXY is already at 107, I don’t think there is significant dollar appreciation vs rupee in a medium to longer term prospective that can lead to cost of funds going above the current level. However, any geopolitical adversity can fetch increased volatility in currencies in the short term," said Agarwal.

As of now, dollar-denominated bonds do remain an attractive route for funding, but the riskplay might push NBFCs to explore other alternatives.

Arushi Khandelwal, assistant manager, investment research and advisory at Aranca stated that a rising dollar can bring-in multitude of problems for NBFCs like higher debt costs, refinancing issues and asset-liability mismatches.

"Strategies like diversifying funding sources and lending to export-oriented businesses with dollar revenue streams can help mitigate these risks and navigate the current volatility," she mentioned.

Other options at-hand?

While banks are expected to remain the primary funding source for NBFCs, the bond market is likely to capture a larger share in the near to medium term, as per Crisil Ratings. In fact, the portion of NCDs in the sector’s borrowings grew by about 30 basis points to 28.5 per cent in the June quarter, in line with entities rated ‘AAA’ and ‘AA,' the rating agency stated in a September report.

NBFCs might even start exploring the AIF (Alternative investment fund) space for borrowings, but this will come at a higher cost as per analysts.

NBFCs may opt for securitization of their healthier asset portfolios to raise funds from banks. Also, they are likely to tap private credit funds (AIF) albeit the latter will come at a higher cost. Larger NBFCs who have deposit licenses may focus on raising more quantum of deposits by offering relatively attractive rates, said Chowdhury