Budget 2026-27 may see only a limited rise in capital expenditure, officials suggest

Central capex may be pegged at 3.2% of GDP in FY27, up slightly from the current year, as the government balances investment with economic stability

The Finance Ministry leads the Budget process with inputs from other ministries

As preparations for India’s Union Budget 2026-27 gain pace, officials indicate that central capital expenditure may rise only slightly to maintain fiscal balance. Three senior finance ministry officials told Moneycontrol that pushing spending beyond current levels could lead to unsustainable market borrowing and risk crowding out private investment.

According to the report, the budget may peg central capex at 3.2% of GDP for FY27, slightly higher than 3.1% in the current financial year. The focus, it said, is to balance government investment with private sector revival and overall economic stability.

While these numbers are being discussed publicly, the finance ministry works behind the scenes for months to prepare the Union Budget.

How the Indian Budget is Prepared?

The budget is a coordinated exercise led by the Ministry of Finance in consultation with other ministries, NITI Aayog, and key stakeholders. It lays out spending priorities, revenue targets, and policy measures aligned with the government’s economic agenda for the coming financial year.

The budget preparation starts with the Ministry of Finance issuing a circular to all ministries, states, Union territories, and autonomous bodies.

The finance ministry first sends out a circular to all ministries, laying out guidelines for estimating revenues and expenditures. Following this, each ministry submits three sets of figures: budget estimates for the next year, revised estimates for the current year, and provisional actuals for the previous year. This system helps officials track trends and correct any errors well in advance.

Meanwhile, revenue estimates are prepared by the Central Board of Direct Taxes (CBDT) and the Central Board of Indirect Taxes (CBIC) and Customs. These figures are then combined with ministry expenditure plans to form the consolidated Budget.

The finance ministry holds discussions with other ministries and key stakeholders, including farmers, businesses, and civil society groups. The aim is to match spending plans with available resources, including borrowing and savings. If differences remain, the Union Cabinet or the Prime Minister steps in to take the final call.

Once spending plans are settled, the cabinet approves the budget draft. This is followed by the traditional “Halwa Ceremony”, which signals the start of printing the budget papers. Officials involved work under strict confidentiality until the budget is presented.

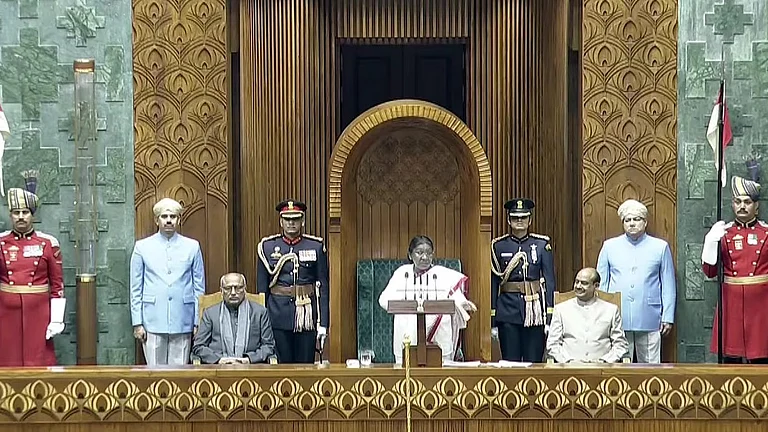

On budget day, the finance minister presents the budget in the Lok Sabha and places the documents in the Rajya Sabha. Parliament then begins a general discussion, followed by a closer review by parliamentary committees.

How Budget Is Passed in Parliament?

The Budget next goes through Parliament’s approval process. The Lok Sabha examines Demands for Grants, showing how much each ministry plans to spend. Certain expenses are discussed but are not put to vote.

After this, the parliament passes the Appropriation Bill, allowing the government to use public funds. At the same time, the Finance Bill is cleared, bringing tax and policy changes into force.

However, if the full budget cannot be passed in time, such as during election years, an interim vote on account allows the government to continue essential spending for a short period. Once it is approved, ministries receive funds, tax changes take effect, and government schemes are rolled out.