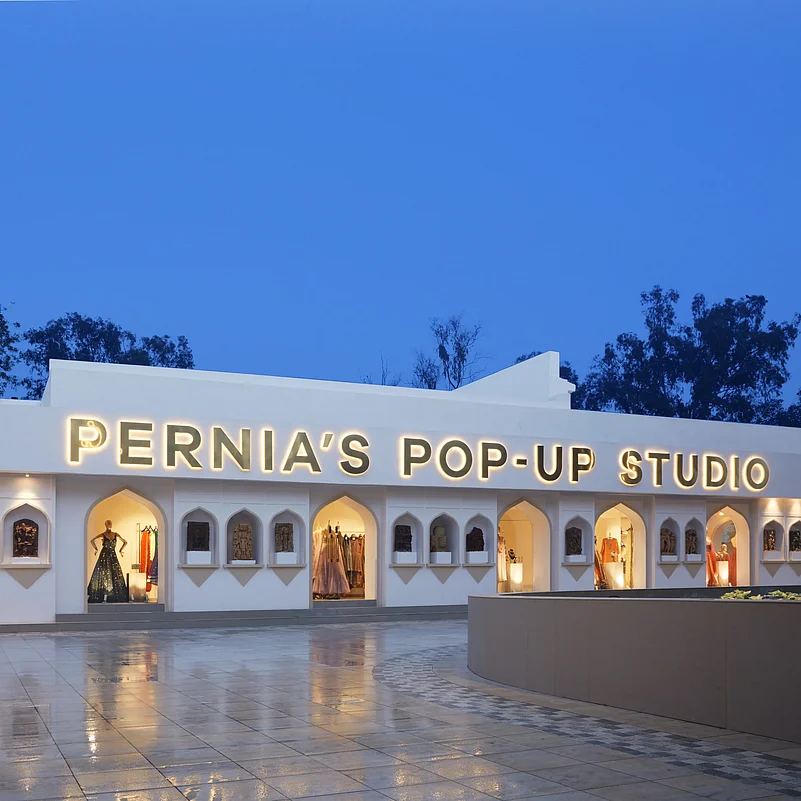

Purple Style Labs, parent of Pernia’s Pop-Up Shop, filed draft papers with Sebi to raise ₹660 crore via IPO.

The IPO will be a fresh issue of equity shares; no offer-for-sale component.

The company may raise ₹130 crore in a pre-IPO placement, which would reduce the IPO size.

Proceeds will fund lease liabilities for experience centres and offices (₹363.3 crore), sales and marketing (₹128 crore), and general corporate purposes.

The firm curates 2.12 lakh SKUs across 1,312 designer brands in apparel, jewellery, kidswear, and accessories.

Purple Style Labs, the parent firm of luxury fashion platform Pernia's Pop-Up Shop, has filed preliminary papers with capital markets regulator Sebi to raise ₹660 crore through an initial public offering (IPO).

The proposed IPO is entirely a fresh issue of equity shares with no offer for sale (OFS) component, according to the draft red herring prospectus (DRHP) filed on Monday.

The Mumbai-based company is looking to garner ₹130 crore in a pre-IPO placement round. If this is undertaken, the fresh issue size would be reduced accordingly.

The company plans to use IPO proceeds to the tune of ₹363.3 crore to invest in its wholly-owned subsidiary, PSL Retail, for lease liabilities related to experience centres and back-end offices in India; ₹128 crore will be deployed for sales and marketing, and the rest will go towards general corporate purposes.

With a portfolio of around 2.12 lakh SKUs across women's wear, men's wear, fine jewellery, fashion jewellery, kids wear and accessories, Purple Style Lab curates products from over 1,312 active designer brands.

Over the years, the company has demonstrated strong financial and operational progress. Its average order value grew from ₹39,499 in FY23 to ₹56,106 in FY25. Strategic cost discipline has reduced sales and marketing expenses from 12.88% of revenue in FY23 to 6.77% in FY25. Customer quality has also strengthened, with average GMV (gross merchandise value) per customer rising from ₹59,023 in FY23 to ₹83,270 in FY25.

Purple Style Labs catered for customers from more than 100 countries in FY25 through its online channels and flagship experience centre in the UK. Also, it has built a significant foothold in markets such as the US, the United Kingdom, and the Middle East.

Axis Capital and IIFL Capital Services have been appointed as lead merchant bankers to manage the public issue.