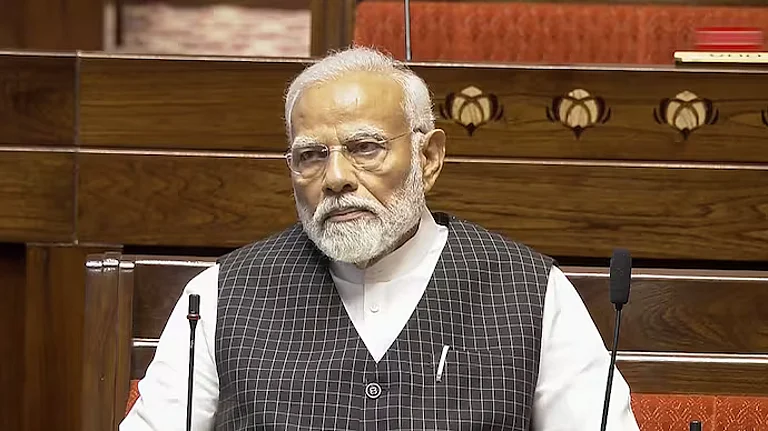

Prime Minister Narendra Modi recently reiterated his call to build India’s own version of ‘Big Four’ audit and advisory services firms. The renewed call comes three years after the deadline that PM Modi had set when he first broached the subject in 2017.

While PM Modi’s vision has been clear about building 'India’s Big Four’ that can compete with global giants—including the likes of Deloitte, PwC, EY and KPMG, among others—little progress has been made in its direction so far.

While the five-year deadline to turn this dream into reality has come and gone, global audit firms continue to have the run of the town in the meantime.

However, the government is in no mood to give up just yet. Recently, Prime Minister’s Office (PMO) held a high-level meeting on June 6 (Friday) to discuss a roadmap for India to have its own Big Four firms. Consequently, a committee chaired by Corporate Affairs Secretary Deepti Gaur Mukerjee has been set up to submit a detailed roadmap to chase down the dream of building India's own Big Four firms.

Commerce and Industry Minister Piyush Goyal, too, while addressing the media on Monday June 9, in Bern, Switzerland, highlighted that the government is mulling a strategic plan to create large, home-grown audit firms, which would then compete with international rivals.

“We will have our big four in India very soon--wait and watch,” Piyush Goyal said.

The Path Ahead

However, the path ahead looks decidedly difficult. PM Modi’s words from 2017 stand as a stark reminder.

At the Chartered Accountants Day Speech in 2017, PM Modi highlighted how the Big Four are trusted by the world’s top companies and institutions, while expressing his concerns over why no Indian audit firms are part of the Big Four.

“We are nowhere in these big four. You are capable of it and there is no dearth of talent either,” PM Modi pointed out. “All my friends, can you set a target for yourself if India were to gain respect in the world, then when India will celebrate seventy-five years of its independence in 2022, then we will convert these big four into big eight,” he had exhorted then.

The government’s committee, comprising mainly of government officials, is tasked with looking into revisions in partnership rules and audit regulations, facilitating mergers & acquisitions and consolidation among mid-sized Indian CA firms.

While the initiative looks commendable, challenges to the proposal merit a deeper look. As things stand, desi audit firms lag significantly behind their global counterparts in size and scale.

For instance, a significant number of India Inc. companies rely on the ‘Big Four’ and their domestic counterparts for their audit and advisory services needs. In the recently concluded financial year 2025, the Indian arms of the Big Six, including Grant Thornton and BDO, handled 326 of the 483 Nifty-500 company audits for FY25, according to a report by the Economic Times.

Also Read: Can India Deal With a Three-Front War?

This is the case when the presence of Indian audit firms, including the likes of T R Chadha & Co., Lodha & Co., S S Kothari Mehta & Co. and Rakesh Nangia & Co., predates the entry of the Big Four in India. However, despite operating for decades, Indian chartered accountant firms haven’t been able to scale up to match the size of their global counterparts. This has resulted in the global Big Four cornering the lion’s share of the Indian audit services industry.

Seizing the Opportunity

Indian audit firms are firmly backing the government’s proposal. Rakesh Nangia, founder and managing partner of Nangia & Co LLP, told Outlook Business that the demand is largely fueled by the government’s “Atmanirbhar Bharat” push to reduce reliance on foreign firms.

“With Indian companies scaling both in size and operations, both at the national and international level, there’s also an inherent regulatory push to retain intellectual property and data on-shore,” Nangia explained.

The push comes at a time when businesses, led by Indian promoters, are expanding their presence. “Larger home-grown audit firms are needed especially as they understand the expectations and mindset of Indian promoters,” said Vaibhav Jain, Partner at Mehra Goel and Co.

“The need for Indian large audit firms has always been there. The idea should be inclusive and not limit the number to 4 or 10, but there should be a scheme where all firms are enabled to grow across the nation and even overseas,” Jain added.

An Eye on Challenges

Even as the Indian audit services industry eyes the opportunity emanating from the government’s push, experts point out that the journey for India to have its own Big Four will not be short of challenges.

Speaking to Outlook Business, Partner and CEO, T R Chadha & Co., Vikas Kumar said challenges like investor agreements and the preference given by multinational companies (MNCs) and listed Indian corporations to the Big Four limits a level playing field for domestic audit firms.

While the experts are hopeful about the government’s initiative this time, they feel that eight years of no groundwork and a lack of industry representation in the recently constituted committee doesn’t bode well. Consequently, the journey to realising the dream of creating the Indian Big Four remains a distant one.

“PM gave this clarion call to create Indian Big Firms first in 2017. Neither the government nor the ICAI has done enough as required for this goal. Both the government and ICAI need to earmark resources, both financial and human, from leadership teams on this project,” Jain said.

Further commenting on the issues faced by domestic audit firms, T R Chadha’s Vikas Kumar flagged investor agreements that put mandatory conditions like audits by the global audit giants. This restricts Indian CA firms' opportunities to get big clients, which eventually impacts their efforts to scale operations.

Moreover, in the case of multinational companies (MNCs), if their parent in America or abroad is audited by one of the audit majors, they naturally prefer their Indian arm to be audited by the same firm, Kumar explained. He also highlighted that most of the Indian companies with foreign investments prefer the Big Four for audit over domestic firms.

The challenges for Indian audit firms to go global aren’t just confined to a lack of scale and limited capital but extend to the difficulty in attracting and retaining top talent. While all international firms enjoy the benefits of branding and advertising, domestic CA firms are formally prohibited from doing so. This has severely impacted the brand awareness of Indian CA firms, both nationally and internationally, Jain said.

Besides this, many Indian audit firms are still at an evolving stage when it comes to areas such as developing a cohesive strategy and investing systematically in international leadership and talent.

In that backdrop, commenting on the trend of migration of Indian CAs overseas, Nangia & Co. LLP’s founder, Rakesh Nangia said an individual would only require a visa and a job offer, but taking a firm global would need significant capital, organisational scale and navigation of international regulatory challenges and permission to build an institutional presence.

“Global expansion by firms requires more than talent; it needs branding, capital, compliance infrastructure, and above all, scale,” Nangia said.

While the dream of building ‘Indian Big Four’ firms has fueled domestic audit services companies to step up, significant policy and regulatory measures and support from the government are required to progress on the proposal.